IT services Q2 earnings and beyond: expect growth, but at a slower pace

India's top four IT companies report their earnings this week. Analysts expect continued growth, but the pace will most likely be slower

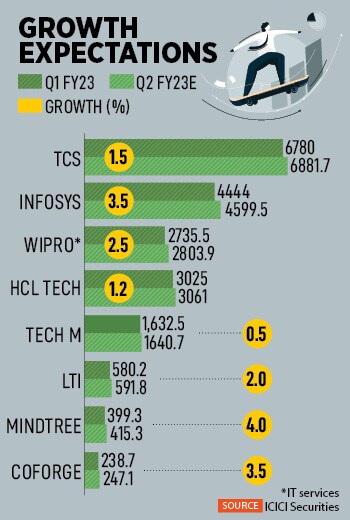

The revenue growth of Indian IT companies is expected to continue in Q2

The revenue growth of Indian IT companies is expected to continue in Q2

Tata Consultancy Services, India’s biggest IT services company, will be first off the block in reporting fiscal second-quarter earnings, when it reports its numbers after markets in Mumbai today.

While TCS offers no projections, the numbers and the top executives’ commentary should give an indication of the impact of the ongoing global economic slowdown. Analysts at brokerages in India expect growth to continue, as well as the high staff churn in the sector.

“The revenue growth of Indian IT companies is expected to continue in Q2,” research analysts Sameer Pardikar and Sujay Chavan write to clients in a note on October 4.

Concerns about the slowdown—and a possible slackening of the demand that had jumped because of the Covid pandemic—have already sent the shares of the top Indian IT companies lower by more than 25 percent this year, as part of a global tech-led selloff.

The S&P BSE Information Technology Index, which includes companies such as TCS, Infosys and Wipro as well as smaller companies such as Mindtree and KPIT Technologies, is down more than 26 percent since the beginning of 2022.

About 67 percent of 1,000 senior technology leaders at US companies across industries said they have yet to see a significant return on cloud investments, global accounting firm KPMG note in its latest annual technology survey, released last month, The Wall Street Journal

About 67 percent of 1,000 senior technology leaders at US companies across industries said they have yet to see a significant return on cloud investments, global accounting firm KPMG note in its latest annual technology survey, released last month, The Wall Street Journal  “The Indian IT sector benefitted from three secular tailwinds during the pandemic: outsourcing, offshoring and digitalization on the back of accelerated cloud migration,” the Goldman analysts wrote in a report to clients, seen by News 18.

“The Indian IT sector benefitted from three secular tailwinds during the pandemic: outsourcing, offshoring and digitalization on the back of accelerated cloud migration,” the Goldman analysts wrote in a report to clients, seen by News 18.