PVR-INOX: How the big screen will get bigger, better

The merger of the two giants of the exhibition sector might help them recover from the pandemic. But things could also get better for other stakeholders—including distributors, producers, smaller exhibitors and consumers

(left) INOX director Siddharth Jain, and Ajay Bijli, chairman and managing director, PVR

(left) INOX director Siddharth Jain, and Ajay Bijli, chairman and managing director, PVR

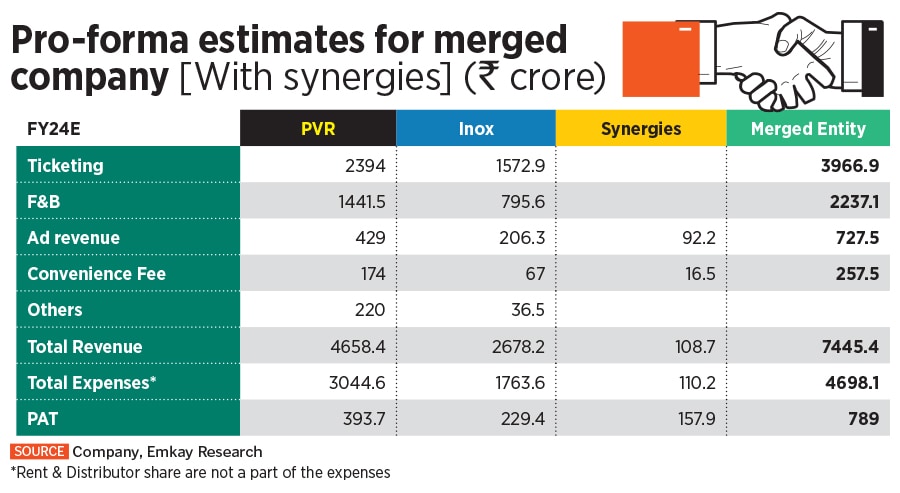

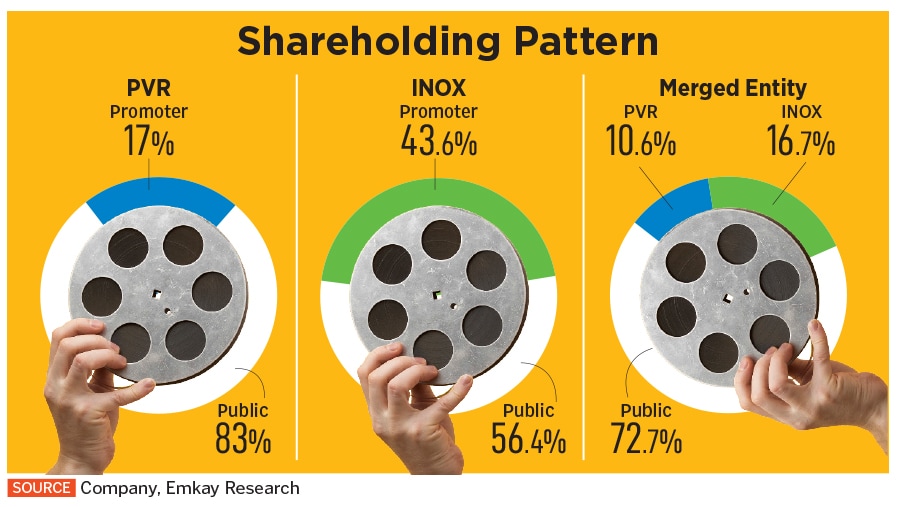

From competition to cooperation. India has seen its share of top players in various sectors coming together to benefit from size, scale and synergies. HDFC-HDFC Bank and Zee Entertainment-Sony India are two recent merger announcements of formidable players in their respective industries. Add to that PVR and INOX Leisure, where the No. 1 and No. 2 entities in film exhibition have decided to meld their operations to exploit synergies and prove that one plus one equals more than two.

On March 27, when the two announced a merger deal, they created the largest multiplex chain in the country. Currently, out of the 9,500 screens across India, PVR and INOX have a network of almost 1,500 screens. Of these, PVR operates close to 871 screens at 181 properties in 73 cities, whereas INOX runs 675 screens at 160 properties in 72 cities. Carnival Cinemas and Cinepolis India follow with 450 and 417 screens, respectively.

But why now, after all these years? “The pandemic,” INOX director Siddharth Jain says simply. “We were shut down for almost 12-18 months. We were interacting very closely on industry-related issues and it’s during this period of time that it dawned upon us that it really makes sense to come together.” Nevertheless, the move came as a surprise. According to sources, PVR was reportedly in advanced talks with the local unit of Mexican company Cinépolis for a possible merger. When asked about this, Cinépolis said, “We are not commenting on this.”

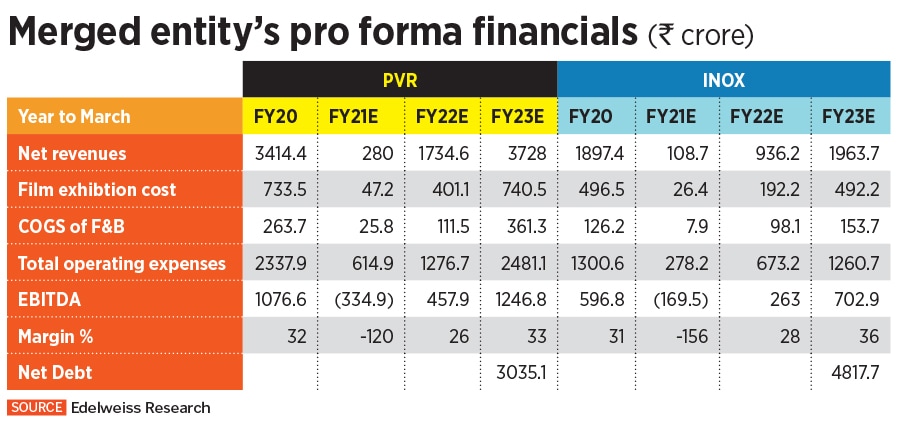

According to a report published by Media consulting firm Ormax Media, compared to a gross box office of almost Rs 11,000 crore in 2019, the cumulative revenue across 2020 and 2021 put together stood at only Rs 5,757 crore—a loss of almost Rs 15,000 crore.

The film exhibition sector saw no growth at all in the last two years and many single screens and multiplexes shut down entirely, but larger players like PVR and INOX managed to survive. “However,” adds Ajay Bijli, chairman and managing director, PVR, “both of us [PVR and INOX] saw massive burn rates. There were no revenues whatsoever. This merger is not just about the survival of our companies, but also the survival of the whole sector, which can get revived.”