Rural demand still lagging, but signs of recovery visible

A healthy harvest season, better MSPs for crops and expected spending by the government in upcoming Budget are a few factors that may lead growth in the rural consumer segment

Rural grocery store in Nimeda village of Jaipur district in Rajasthan.

Image: Amit Verma

Rural grocery store in Nimeda village of Jaipur district in Rajasthan.

Image: Amit Verma

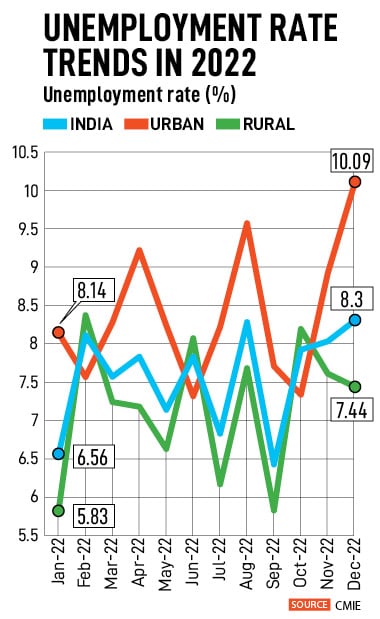

The slowdown in rural demand is expected to gradually recover but the pain is likely to persist somewhat, with consumers still cautious before buying a staple or a discretionary item. As consumer demand in the urban sector continued to grow despite inflationary pressures and price rise of products, while rural took a drastic hit, analysts expect the growth divergence to start narrowing. A full recovery in rural demand may still be a far cry, but there are visible green shoots. A healthy harvest season, better minimum support prices (MSPs) for crops and expected spending by the government in Union Budget ahead of general elections next year are a few factors that may lead growth in the rural consumer segment.

“As per our rural channel checks, the slump in rural demand is gradually ebbing as cashflows improve with the sale of Kharif crops and the impact of erratic, unseasonal rains is not as threatening as initially perceived. The Covid-19 hangover on consumer sentiment is progressively easing, with expectations of a good Rabi crop and elevated crop prices propping outlook,” says Garima Kapoor, economist-institutional equities, Elara Capital. Kharif crops, also referred to as monsoon or autumn crops, are cultivated during rains and harvested latest by January.

Cashflow improvement in rural economy, post-Kharif harvest and the revival of unfettered celebration of marriage season after two years of Covid restriction are likely to aid nascent recovery in rural demand. “Expect the Rabi crop to be buoyant amid good water reservoir level and high soil moisture content. We anticipate the relative outperformance of urban India to pare in the coming quarters amid steady improvement in rural demand. Expect this trend to gather traction in FY24,” Kapoor adds. Rabi crops, also known as winter crops, are typically sown in winter and harvested in May.

The government is also estimated to increase spending towards rural India as a run-up to the general elections in mid-2024 , bolstering growth in consumer demand.

The harsh second wave of Covid-19 and the sharp rise of product prices even in staples like biscuits and milk led to a massive decline in demand in rural areas—the demand remained tepid due to continued inflationary pressures on consumers’ wallets, resulting in downtrading to smaller packs/brands (especially in discretionary categories).

The harsh second wave of Covid-19 and the sharp rise of product prices even in staples like biscuits and milk led to a massive decline in demand in rural areas—the demand remained tepid due to continued inflationary pressures on consumers’ wallets, resulting in downtrading to smaller packs/brands (especially in discretionary categories).

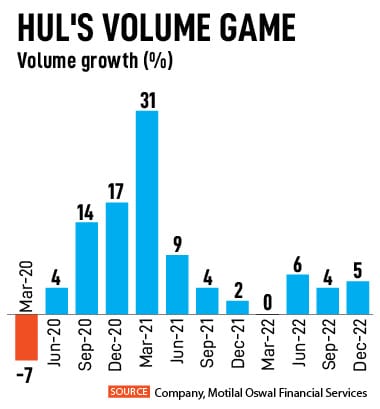

HUL reported a growth of 16.2 percent in net sales, 7.9 percent gain in Ebitda and 12.6 percent rise in adjusted net profit in the December quarter. Overall, the volume growth of HUL was 5 percent in the third quarter of FY23. “The management alluded to rural slowdown likely bottoming out but didn’t sound too convincing about growth acceleration being around the corner, in our view. A lot of the hopes are still pinned more on government actions and macro rather than on factors that HUL would drive on its own,” said analysts at JM Financial. Though raw material inflation has eased a bit, prices of key input products like soda ash, barley and skimmed milk powder are still high.

HUL reported a growth of 16.2 percent in net sales, 7.9 percent gain in Ebitda and 12.6 percent rise in adjusted net profit in the December quarter. Overall, the volume growth of HUL was 5 percent in the third quarter of FY23. “The management alluded to rural slowdown likely bottoming out but didn’t sound too convincing about growth acceleration being around the corner, in our view. A lot of the hopes are still pinned more on government actions and macro rather than on factors that HUL would drive on its own,” said analysts at JM Financial. Though raw material inflation has eased a bit, prices of key input products like soda ash, barley and skimmed milk powder are still high.