Sensex at 50k: The sun is out, but don't ignore the dark clouds yet

Earnings growth and liquidity have helped improve investor sentiments, say experts, but will the momentum sustain?

Image: Himanshu Bhatt/NurPhoto via Getty Images

Image: Himanshu Bhatt/NurPhoto via Getty Images

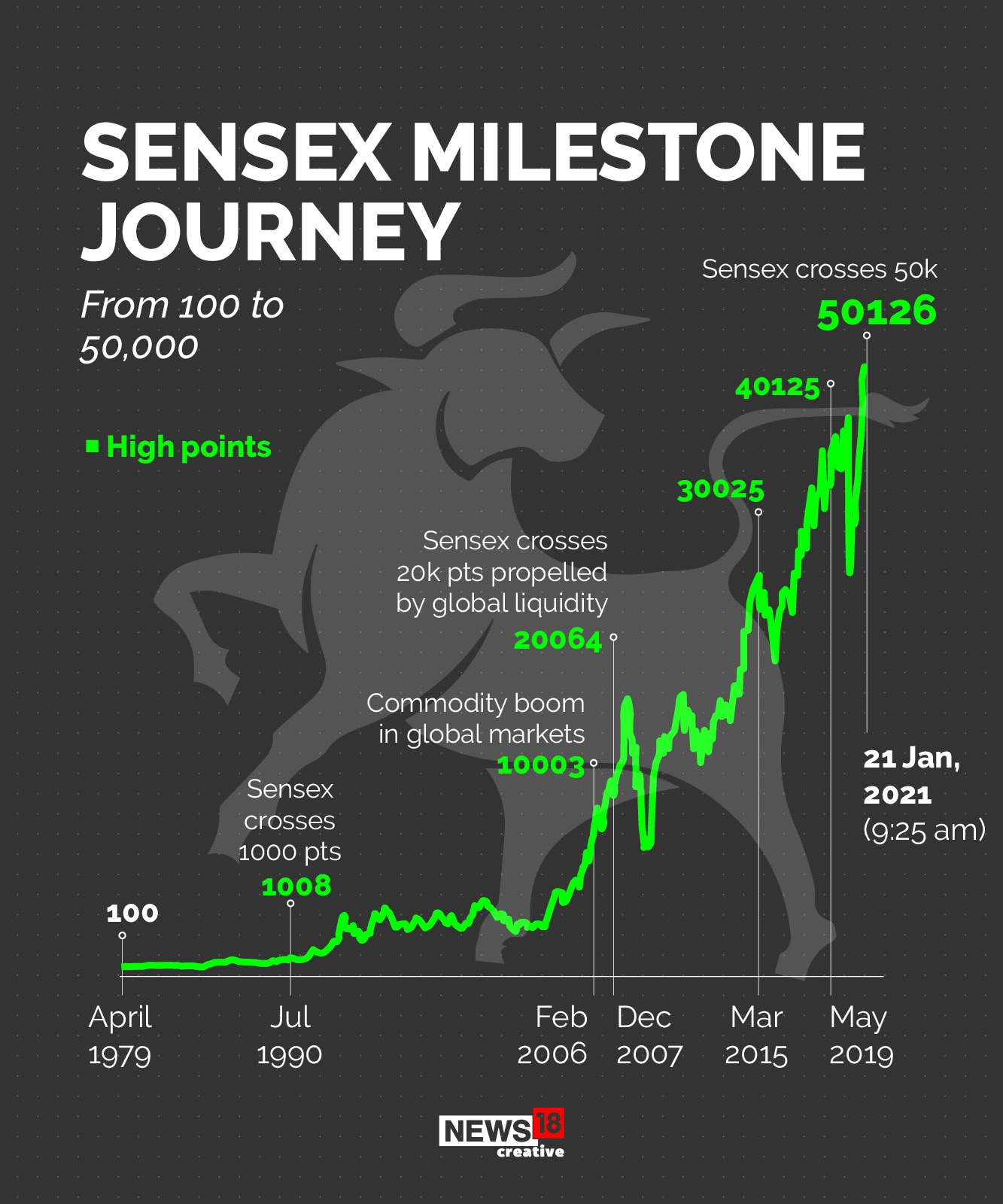

The benchmark 30-share Sensex index scaled the 50,000-points level early on Monday to its lifetime high, and nearly doubled from its low in March last year when corporate India was deeply concerned over business activity that came to a standstill due to the Covid-induced lockdowns.

The Sensex retraced on profit booking to close down 167.36 points at 49,624.76. But at this closing, the Sensex has risen 91 percent from its March 23 low of 25981.24 points.

The good news in 2021 has not stopped. Most large nations appear to have solutions— through the rollout of vaccines—for the pandemic; foreign investors continue to pour in money into emerging markets; liquidity from global central banks is high and the Reserve Bank of India in 2020 was benign on inflationary concerns.

So if you have made profits from equities in 2020, is it time to pour in more funds at the expense of other asset classes? Experts think not. The sun may be out for now, but there are dark clouds which loom.

Though corporate earnings improved sequentially from Q1FY21 TO Q2FY21—and they look encouraging in the December-ended quarter—some concerns remain. “Valuations are stretched, whether you look at PE ratios or GDP to market capitalisation. Yes sure, right now there is good news and it can continue for some time. But a bubble can become larger before it bursts,” says independent market expert Ambareesh Baliga.