Should you really take that home loan?

While falling home loan interest rates have steered on many prospective home buyers, experts warn that repo rates have nearly bottomed out and could only go up in the coming year

Labourers work at the construction site of a residential complex in Kolkata.

(Photo by Debajyoti Chakraborty/NurPhoto via Getty Images)

Sreejit Nair (name changed), a 34-year-old information technology (IT) employee with an Indian conglomerate, spent the past few months of the pandemic shopping around for the perfect house to move into. He sold his existing home for a loss of nearly Rs 4 lakh during the pandemic and has now bought a ready-to-move-in 865 square foot apartment, for Rs 1.07 crore in Thane. The price is inclusive of all charges.

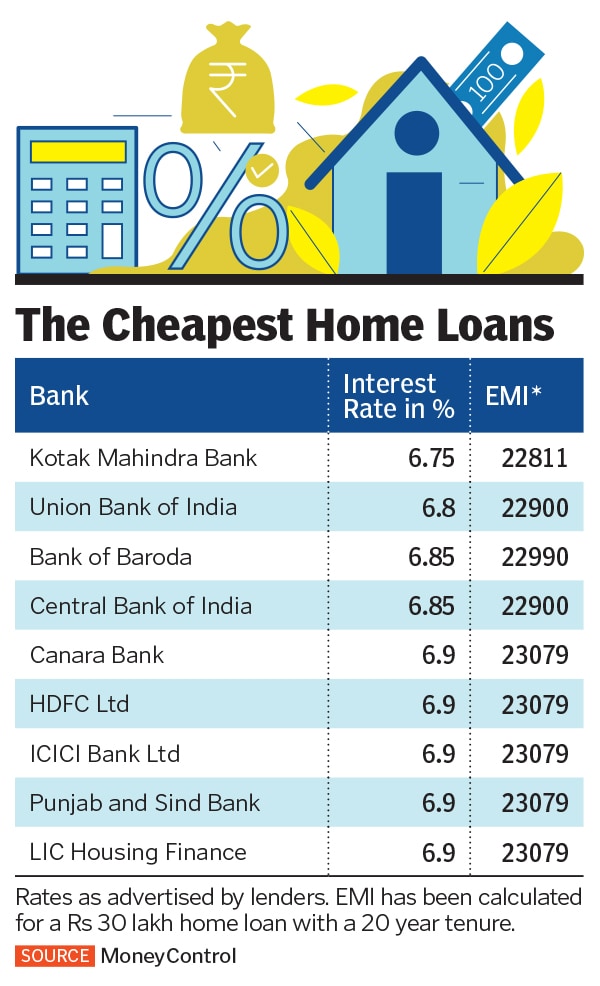

Of course, he has topped the buy with a home loan, which are attractive these days. With his credit score, he has managed to borrow at 7.10 percent from state lender SBI.

He isn’t alone in this home buying frenzy, visible in certain pockets of the country. According to data from CRE Matrix Research, a real estate research firm, sales in Thane and in Mumbai’s central suburbs had dipped to zero in April this year, but managed to recover to 5,839 units in September.

While this is still far from the January peak of 8,259 home sales, a recovery on a monthly basis is visible. Does this mean you should go after that home purchase?