Silver lining in each crypto cloud

Retail cryptocurrency investors, entrepreneurs and backers of these startups in India have seen the toughest two months yet, with low trading volumes, steep tax laws, and poaching of Web3 and crypto talent outside India. Experts, however, have not lost hope. First of a two-part series

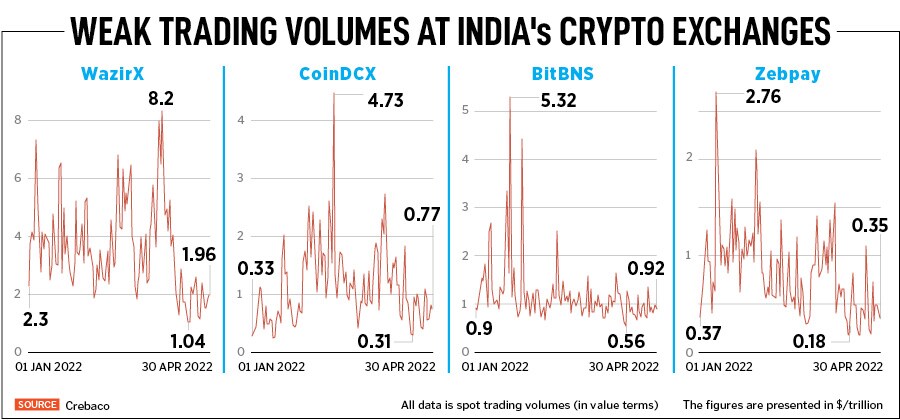

Spot trading volumes for most cryptocurrency exchanges in India continue to be sluggish, and in most cases about 70-80 percent off their peak levels seen earlier in 2022

Illustration: Sameer Pawar

Spot trading volumes for most cryptocurrency exchanges in India continue to be sluggish, and in most cases about 70-80 percent off their peak levels seen earlier in 2022

Illustration: Sameer Pawar

Conrad Dias, 30, has been investing in cryptocurrency for the past one year. Initially, he started trading on Indian exchanges WazirX and CoinSwitch Kuber but after facing constant glitches, Dias switched to Binance, a Cayman Islands-registered international cryptocurrency exchange. “Indian exchanges used to crash ever so often when there was increased market volatility. I opened an account with Binance Pro and it has been much better since,” says the media professional.

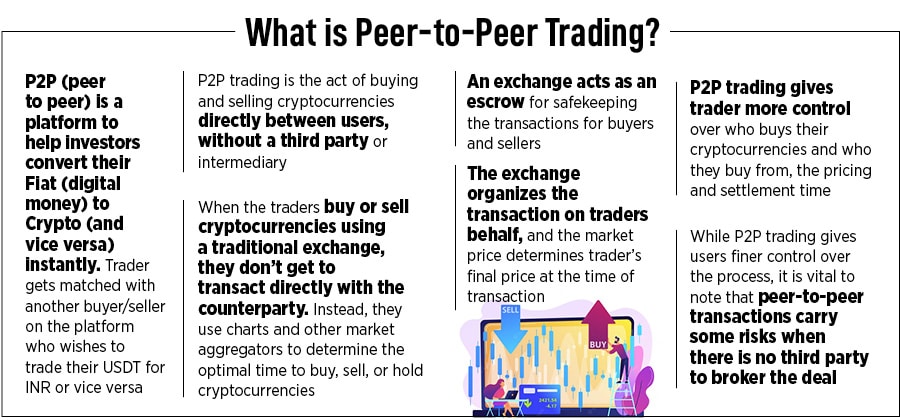

Dias, a regular investor into mutual funds and equities, opted to be riskier and “see if cryptos were really profitable”. With 20 percent of his portfolio invested in cryptocurrency, Dias is currently trading through the peer-to-peer (P2P) route at the exchange.

Bitter Tax Pills

Dias will need to be resilient if he wants to continue to trade and emerge profitable in virtual digital assets (VDA). Regulations are still to be ironed out and the taxation is steep. The start of the new financial year has only caused discomfort for retail investors in India, with the implementation of a 30 percent capital gains tax on income from cryptos, since April.Add to this another controversial provision, a one percent tax deducted at source (TDS), which will be implemented from July this year. The government, in March-end, has also clarified that investors cannot set off losses incurred from one VDA with the profits from another VDA transaction while computing taxes. But the same is allowed for investments in other assets such as stocks and commodities. The government has thus sent the signal that a crypto investor cannot dodge paying the 30 percent tax, if they have made a profit.

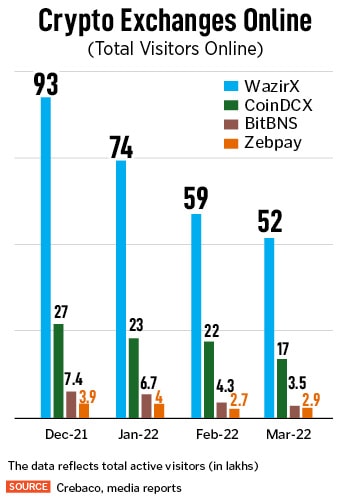

Spot trading volumes for most cryptocurrency exchanges in India continue to be sluggish, and in most cases about 70-80 percent off their peak levels seen earlier in 2022, as per data from Crebaco Global, a crypto and blockchain market research and ratings firm. This trend is further corroborated by a sharp fall in total online visitors to several domestic cryptocurrency websites.

Cryptocurrency exchange, ZebPay CEO, Avinash Shekhar says: “While we have seen a reduction in overall trade volumes due to the adverse impact of the new tax laws on day-trading, we continue to see investors buying into

Cryptocurrency exchange, ZebPay CEO, Avinash Shekhar says: “While we have seen a reduction in overall trade volumes due to the adverse impact of the new tax laws on day-trading, we continue to see investors buying into