SPACs: The hottest party in investment town

A current rage on Nasdaq, they offer a quicker way for new-age Indian companies to list in the US markets, tap fresh investors, and raise capital

Illustration: Chaitanya Surpur

Illustration: Chaitanya Surpur

In July 2018, India’s largest renewable energy company ReNew Power received the market regulator’s approval to raise money from Indian capital markets. The much anticipated share sale never took off, as the company’s ask of nearly $4 billion valuation is something that public investors did not warm up to.

After all, two months before filing its draft prospectus with Securities and Exchange Board of India (Sebi) in May 2018, ReNew had raised Rs 1,608 crore from Canada Pension Plan Investment Board at Rs 415 per share at a valuation of nearly $2.3 billion, a significant premium to what Goldman Sachs had paid in 2016 when it did a follow-up round at Rs 205 per share. ReNew’s largest shareholder is Goldman Sachs, which owns 48.6 percent in the company. Japanese power company Jera had paid Rs 375.28 per share in March 2017.

Things have changed since then.

In February 2021, ReNew Power announced that it is listing on the Nasdaq by reverse merging with a special purpose acquisition company (SPAC). A SPAC is a blank-cheque company or a shell company that lists through an initial public offering (IPO) and is registered with the US Securities and Exchange Commission (SEC).

In this case, RMG Acquisition Corp II (RMGB), which listed on Nasdaq in December 2020 by raising $345 million, has offered to acquire ReNew Power. During this process, ReNew Power will merge with RMGB and create a combined entity called ReNew Energy Global Plc, which will be listed and traded under a new symbol, RNW. When a combined business transaction is finally completed, which includes shareholder approval and financing among other things, it is called a de-SPAC transaction.

In this case, RMG Acquisition Corp II (RMGB), which listed on Nasdaq in December 2020 by raising $345 million, has offered to acquire ReNew Power. During this process, ReNew Power will merge with RMGB and create a combined entity called ReNew Energy Global Plc, which will be listed and traded under a new symbol, RNW. When a combined business transaction is finally completed, which includes shareholder approval and financing among other things, it is called a de-SPAC transaction.

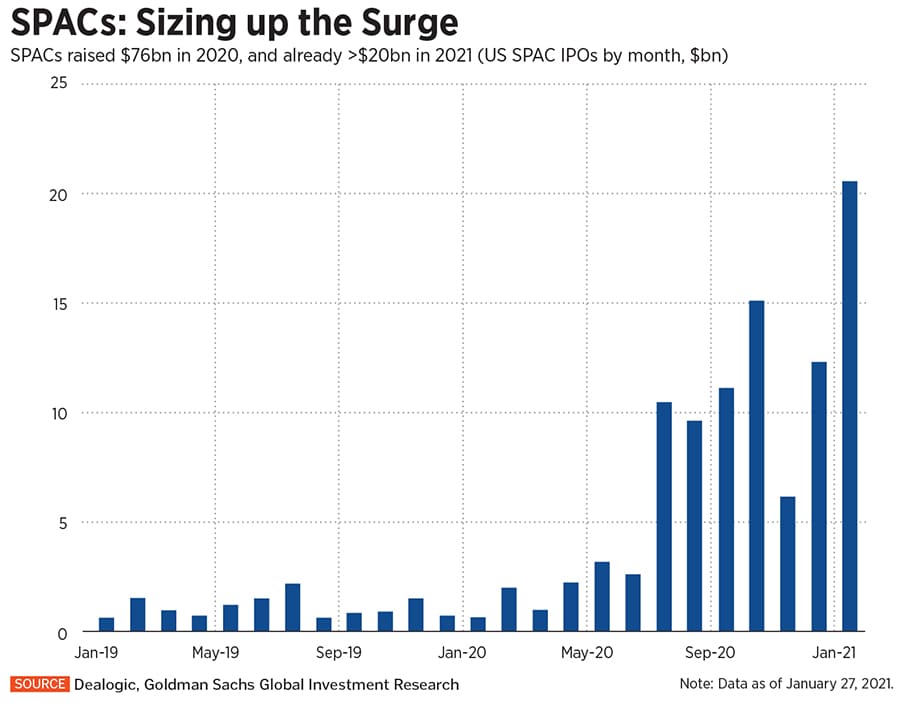

“Companies that are seeking to list through SPACs are of very high quality,” says Raj Balakrishnan, head of India investment banking at Bank of America. Over the last decade, SPACs were dominated by traditional sectors like industries, BFSI and energy, but over the last three years, sectors that are ‘hot’ include electric vehicles and allied services firms, technology-backed companies, fintech, insure-tech, space and environmentally sustainable companies.

“Companies that are seeking to list through SPACs are of very high quality,” says Raj Balakrishnan, head of India investment banking at Bank of America. Over the last decade, SPACs were dominated by traditional sectors like industries, BFSI and energy, but over the last three years, sectors that are ‘hot’ include electric vehicles and allied services firms, technology-backed companies, fintech, insure-tech, space and environmentally sustainable companies.