The good. The okay. And the ugly

With LIC preparing for a public listing, here's a look at its portfolio of investments

According to LIC’s September documents, over 90 percent of its policyholders’ equity investments in India are held in stocks that are part of the Nifty 200 and BSE 200 indices

According to LIC’s September documents, over 90 percent of its policyholders’ equity investments in India are held in stocks that are part of the Nifty 200 and BSE 200 indices

Image: Nasir Kachroo/NurPhoto via Getty Images

It is no surprise that India’s largest insurer, Life Insurance Corp of India (LIC), invests in capital markets to make money for its policy holders. In fact, a year and a half ago or so, its total asset under management (AUM) was bigger than all mutual funds put together. According to LIC’s draft red herring prospectus (DRHP), as on September 30, 2021, its policyholders had total investments of Rs 39,49,516 crore on a standalone basis, which includes investments of more than Rs 9,78,493.81 crore in equities, representing 24.78 percent of its investments.

According to LIC’s September documents, over 90 percent of its policyholders’ equity investments in India are held in stocks that are part of the Nifty 200 and BSE 200 indices. According to a Crisil Report dated September 30, 2021, LIC’s investments in listed equity represented approximately 4 percent of the total market capitalisation of NSE as at that date.

Forbes India decided to pull out the entire list of LIC’s investments in Indian equities, with data being provided by PrimeInfobase.com.

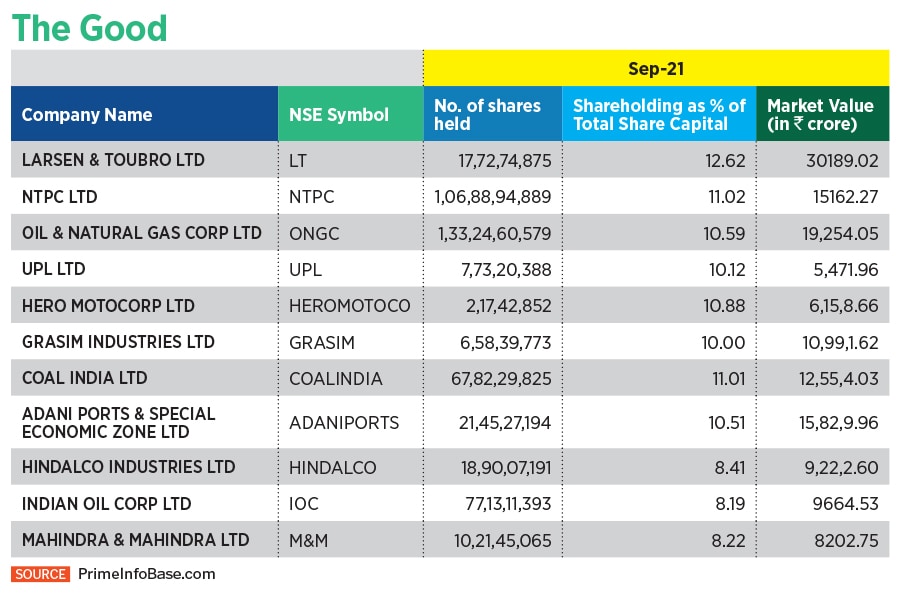

The good

According to PrimeInfobase.com, a capital markets data provider, LIC owns 48 of Nifty Top 50 stocks, which includes the likes of Larsen & Toubro Ltd, where it holds 12.62 percent worth Rs 30,189 crore. Other stocks where it owns more than 10 percent holding includes Adani Ports & Special Economic Zone worth Rs 15,829 crore, Coal India Ltd worth Rs 12,554 crore, Grasim Industries and others. It completely offloaded 5.93 percent stake in Power Grid Corporation of India in the September quarter; the value of its shares was worth Rs 7,211 crore.