These 10 charts explain how Russia-Ukraine conflict will impact India

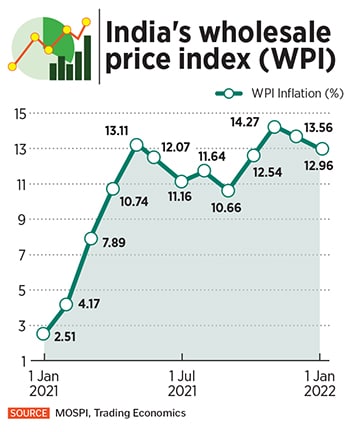

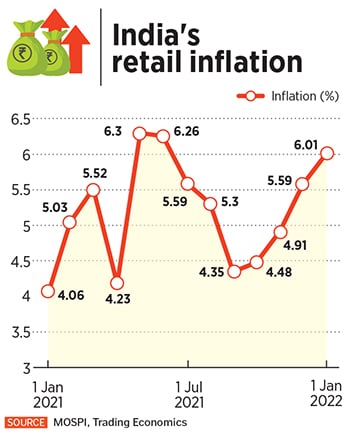

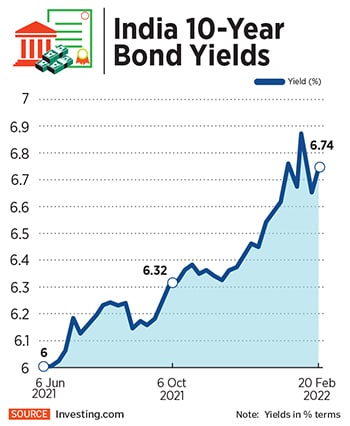

Global oil prices surged past $100 per barrel, increasing the possibility of a domestic fuel price hike. More local interest rate hikes also cannot be ruled out

Crude oil storage tanks at a refinery complex in Vadinar, Gujarat.

Image: Dhiraj Singh/Bloomberg via Getty Images

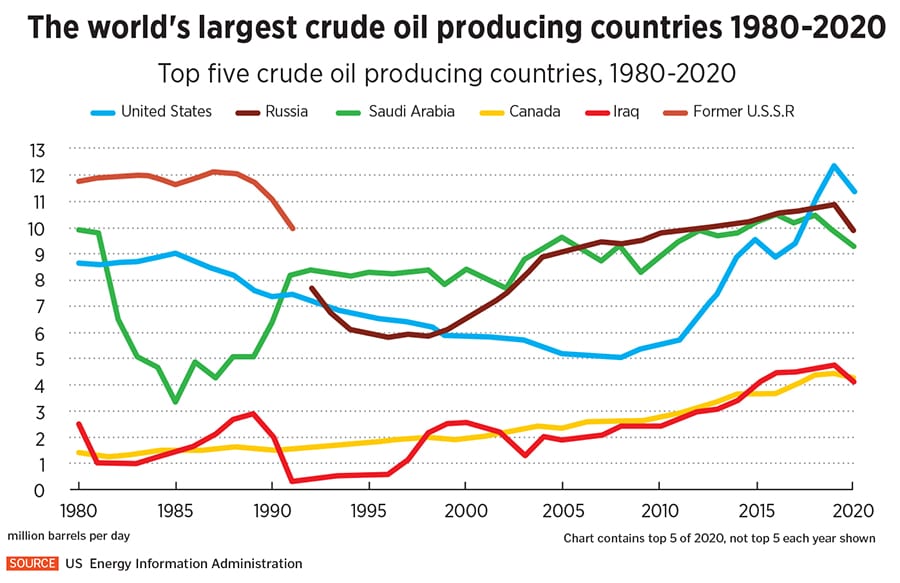

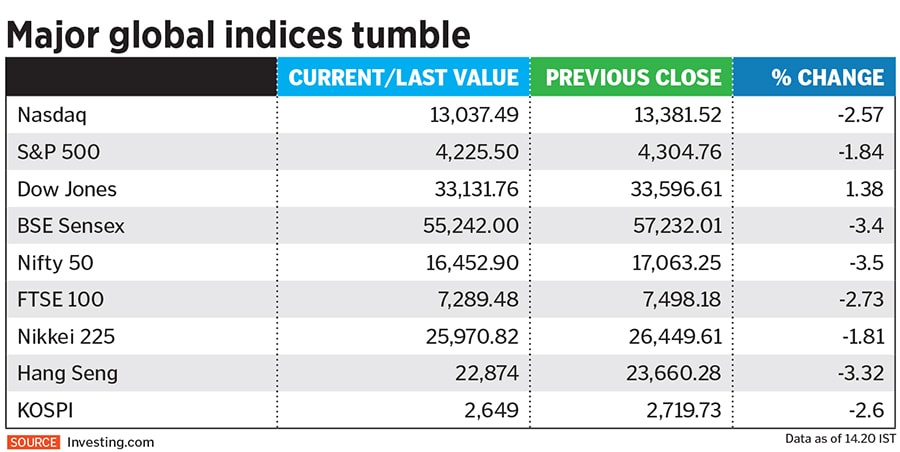

The global economy on Thursday moved into unchartered territory after Russian President Vladimir Putin announced a military operation, as Russian troops and tanks stormed into Ukraine, targeting military installations and airfields. The move to attack Ukraine resulted in oil prices breaching $100 per barrel (see chart) and sent global stocks tumbling by between 2 percent and 3 percent across Asia.

Russia is the world’s second largest oil exporter in the world after Saudi Arabia, selling crude to European refineries. Commodity prices are also likely to witness a resurgence in prices due to supply uncertainties from Russia and Ukraine.