Weakened Indian crypto exchanges find alternatives to buttress their business

Hurt by risk averse market sentiment and crippling fall in trading volumes, crypto exchanges in India have become leaner and expanded beyond cryptocurrencies to sustain their business. The jury is still out on whether these measures will help avoid or accelerate their demise

After experiencing so many ups and downs in the sector, some Indian crypto exchanges are tapping into new revenue streams during the ongoing crypto winter. Illustration by: Chaitanya Surpur

After experiencing so many ups and downs in the sector, some Indian crypto exchanges are tapping into new revenue streams during the ongoing crypto winter. Illustration by: Chaitanya Surpur

It’s been over 365 days now since the dawn of the crypto winter. The industry has seen several such in the past decade. The previous one lasted over two years from January 2018 to December 2020. Most of 2021 was a steady growth period for the crypto market–it saw the creation of India’s two crypto-based unicorns–when Bitcoin (BTC) hit a 52-week high of $68,990 in November 2021 before a downward spiral. Bitcoin is currently priced at $27,200 at the time of writing, 60 percent off its peak.

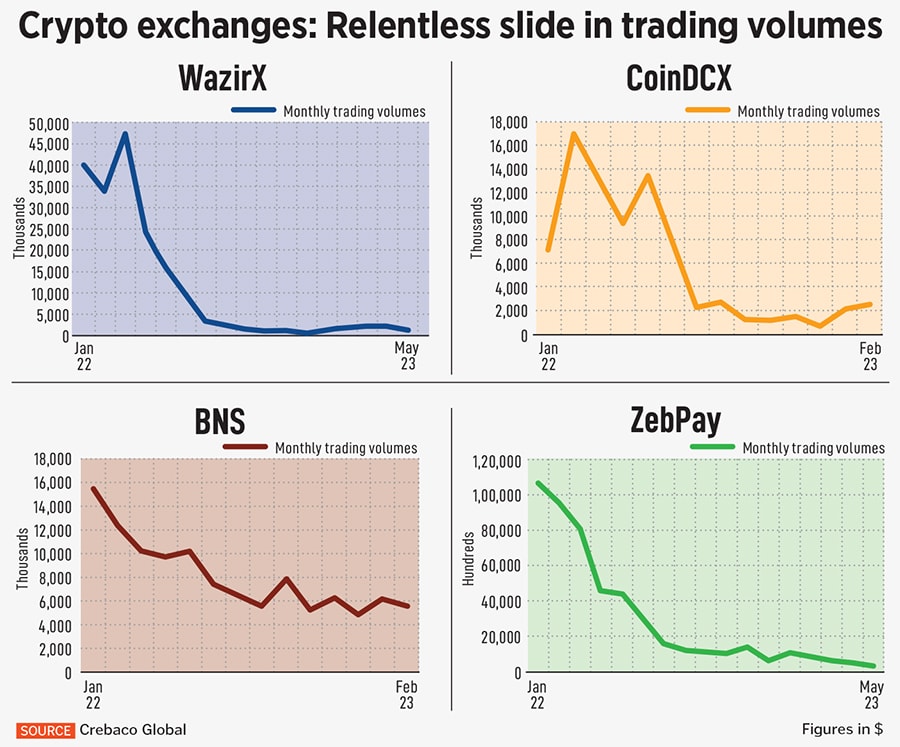

A series of events in 2022, like the Terra-Luna crash, the collapse of FTX, central banks tightening monetary policy to curb stubbornly high inflation and stringent domestic tax rules, have all led to the bear market. In this scenario, the small group of nearly ten crypto exchanges and platforms stand battered and weakened in this harsh winter where monthly trading volumes have collapsed by 75 percent on average and investors moved to trade at exchanges overseas.

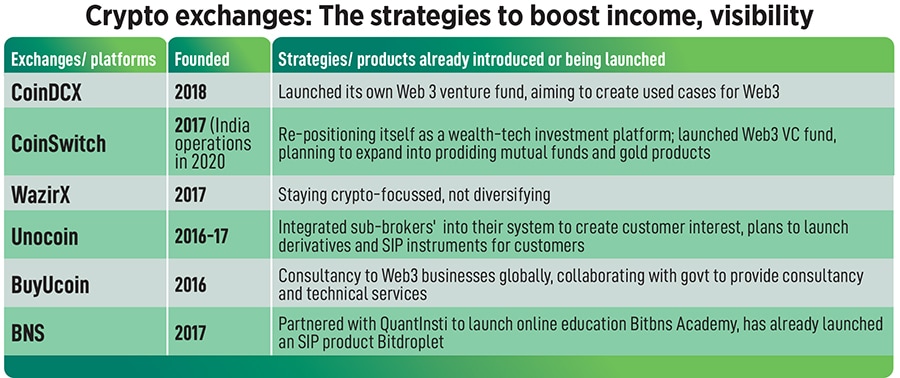

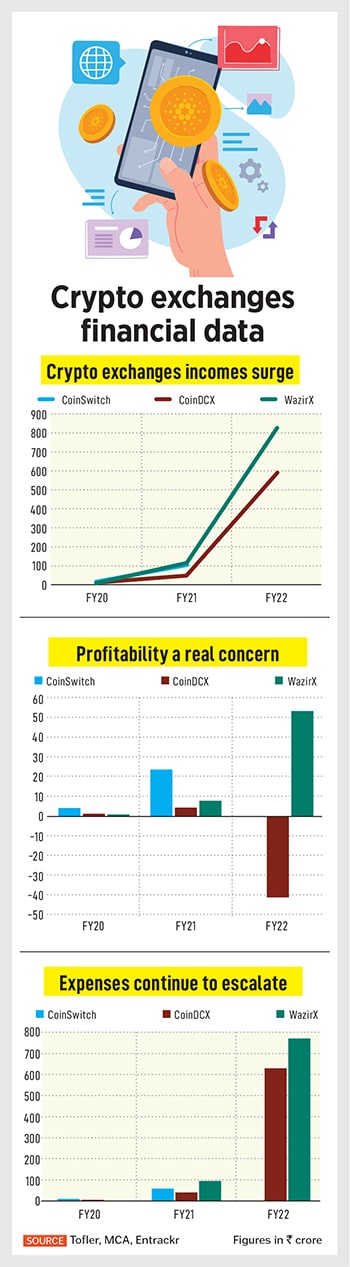

Profits have also been impacted (see tables) and several exchanges have been forced to find new avenues – beyond crypto transactions and listing fees – to try reviving their fortunes.

The crypto market lost over $2 trillion in 2022, according to CNBC. Top cryptocurrencies such as Bitcoin and Ethereum lost over 60 percent of their value, and consumer confidence in the sector fell drastically. However, 2023 started marginally more positive, showing an upside recovery, but little has managed to improve sentiment. The global cryptocurrency market cap is $1.2 trillion as of June 5.

Spot trading volumes at crypto exchanges have been acutely impacted globally. Binance, which is the largest cryptocurrency platform by trading volume, has seen its market share decline to its lowest level in eight months, according to CCData, a platform for digital asset data and indices. The cryptocurrency exchange’s market share has dipped consecutively over the past three months after reaching a yearly high of 57 percent in February this year. Its market share fell to 43 percent in May, while its spot trading volume dropped to $212 billion, recording the lowest monthly volume recorded since November 2020, when it traded $176 billion. In April, the exchange saw $287 billion worth of trading volume.