Why are Indians ordering less pizzas, burgers and fried chicken

The slowdown in discretionary consumption, especially in the post-festive season, has dampened the strong demand sentiment that QSR players witnessed in the past few quarters

Overall, there has been a slowdown in consumption. That, however, hasn’t deterred the owners of QSR businesses in India in aggressively expanding their stores

Image: Shutterstock

Overall, there has been a slowdown in consumption. That, however, hasn’t deterred the owners of QSR businesses in India in aggressively expanding their stores

Image: Shutterstock

As prices of staples like milk, wheat, egg, cheese and vegetables escalated rapidly, households in India reduced dining out or ordering their favourite pizza or that chocolatey doughnut. In addition, there was a conscious decision by households to cut expenses, especially after the festive season in Diwali. The result: Indian Quick Service Restaurants (QSR) are feeling the brunt.

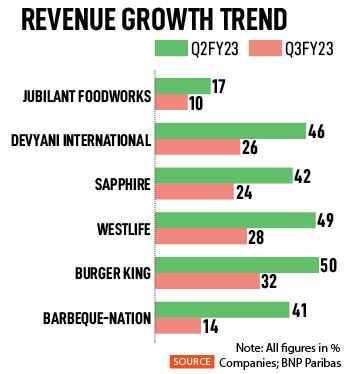

By attracting several international brands, the QSR segment in India achieved high growth even during the tough times of the pandemic-induced lockdown, but it is now gradually seeing a hit in business.

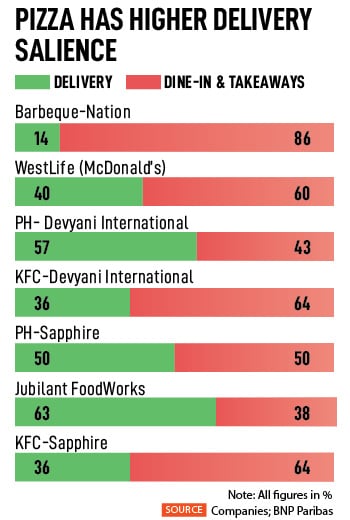

In the three months ended December, Pizza Hut reported a sequential decline in sales while rival Domino’s showed a flat growth. During the period, same-store-sales-growth (SSSG) of Sapphire Foods India declined by 4 percent and Devyani International's fell by 6 percent. The like-for-like growth for Domino's was 0.3 percent. KFC faced a decline in the average daily sales per store (ADS), both sequentially and yearly, due to weak consumer spending and incremental store additions in non-metro cities. Typically non-metro cities have a lower ADS. However, McDonald’s (run by Westlife) bucked the trend, reporting a 20 percent YoY SSSG, largely driven by higher guest count and average order value, due to its meals and omnichannel strategy.

Sapphire Foods India runs the franchisee business of KFC, Pizza Hut and Taco Bell restaurants. Devyani International run stores of KFC, Pizza Hut and Costa Coffee in India.

In January, food delivery company Zomato stopped services in 225 smaller cities, which contributed 0.3 percent of its gross order value (GOV) in the December quarter. It reasoned, “Performance of these cities was not very encouraging in the past few quarters, and we did not feel the payback period on our investments in these cities was acceptable.” The company reported losses of Rs 346.6 crore in the September-December period, but revenue from operations also leaped 75 percent.

According to Zomato, there is an industry-wide slowdown in the food delivery business since late October (post Diwali). “This trend has been seen across the country, but more so in the top eight cities. As a result, GOV growth in food delivery in Q3FY23 was only 0.7 percent QoQ in an otherwise-seasonally strong quarter,” Zomato said.

According to Zomato, there is an industry-wide slowdown in the food delivery business since late October (post Diwali). “This trend has been seen across the country, but more so in the top eight cities. As a result, GOV growth in food delivery in Q3FY23 was only 0.7 percent QoQ in an otherwise-seasonally strong quarter,” Zomato said.

Smilarly, Barbeque Nation bore a capex of Rs110 crore in the first nine months of FY23, out of which Rs90 crore was for opening new restaurants. “During the quarter, we noticed a subdued demand environment, which led to a marginal decline in same-store sales growth by 1.2 percent. November, specifically, was not that great. October 2022 was impacted by the festive season. Unfortunately, we are not seeing any uptick in the current quarter either. January 2023 was weaker than our expectations on the SSSG side,” said Barbeque-Nation Hospitality management.

Smilarly, Barbeque Nation bore a capex of Rs110 crore in the first nine months of FY23, out of which Rs90 crore was for opening new restaurants. “During the quarter, we noticed a subdued demand environment, which led to a marginal decline in same-store sales growth by 1.2 percent. November, specifically, was not that great. October 2022 was impacted by the festive season. Unfortunately, we are not seeing any uptick in the current quarter either. January 2023 was weaker than our expectations on the SSSG side,” said Barbeque-Nation Hospitality management.