Why climate adaptation in India is a VC opportunity: Five areas to focus on

The latest State of Climate Finance in India report by Climake argues comprehensively that the adaptation landscape is ready for private money

An aerial view shows the site of a landslide on July 31, 2024 in Chooralmala village, India. Heavy monsoon rains triggered massive landslides in Wayanad, Kerala.

Image: Abhishek Chinnappa/Getty Images

An aerial view shows the site of a landslide on July 31, 2024 in Chooralmala village, India. Heavy monsoon rains triggered massive landslides in Wayanad, Kerala.

Image: Abhishek Chinnappa/Getty Images

The lives lost and the ongoing devastation in Wayanad in Kerala—just the latest in climate change related disasters in the country—is one more stark reminder that action is needed, urgently.

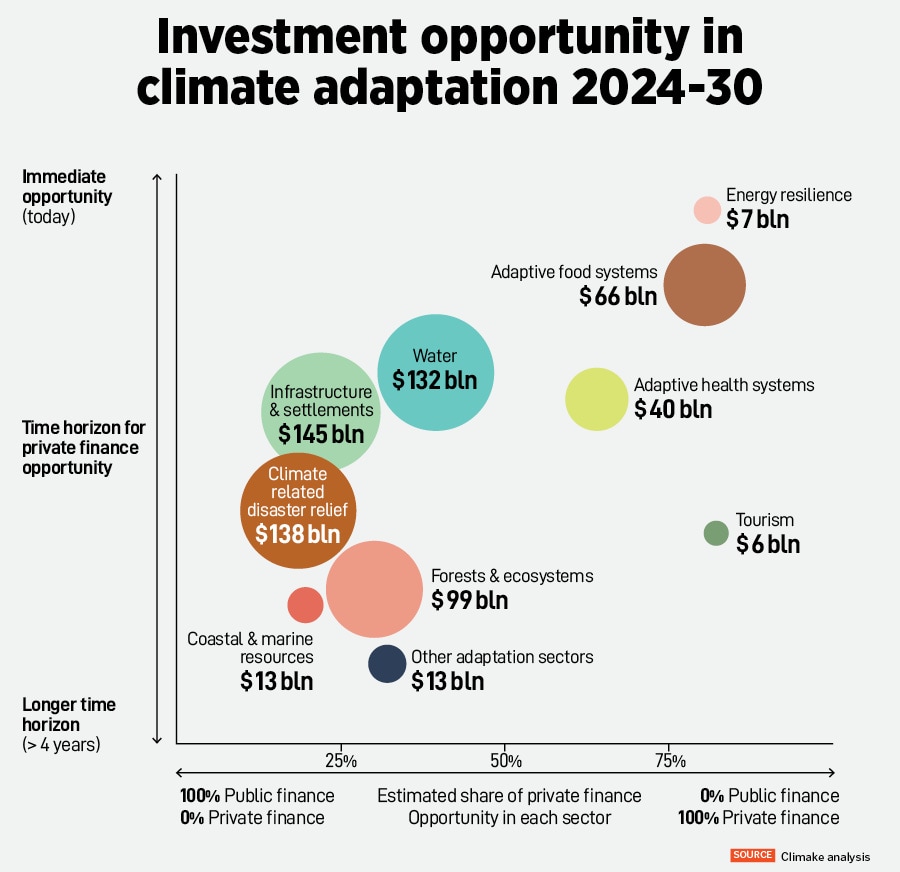

Unsurprising then, that within the yawning gap between current private funding of climate action and what is actually needed, the focus on climate adaptation in India is further under-represented in policy, finance, and innovation. The latest annual report by Climake, an organization working to develop India’s private climate finance ecosystem, makes this point.

The report, The State of Climate Finance in India 2024, is out today.

The contrast is clear when it comes to investor interest in the segment, the report notes: Lifetime investments in all adaptation sectors add up to only $899 million, in India. Climate mitigation, on the other hand, received $4.7 billion in private investments in 2023 alone, according to Climake’s estimates.

Climake is a four-year-old organisation founded by Simmi Sareen and Shravan Shankar to help develop a private finance ecosystem in for climate action in India. As part of their work, Sareen and Shankar compile an annual report on climate finance in India.