Will state election results reprice risks, give wings to stock markets?

State election outcomes can differ greatly from national elections. So, is the exuberance in the markets rational or misplaced?

Bhartiya Janta Party (BJP) workers and supporters celebrate the victory of Madhya Pradesh, Rajasthan, Chhattisgarh assembly state elections outside BJP headquarter, on December 3, 2023 in New Delhi, India.

Image: Salman Ali/Hindustan Times via Getty Images

Bhartiya Janta Party (BJP) workers and supporters celebrate the victory of Madhya Pradesh, Rajasthan, Chhattisgarh assembly state elections outside BJP headquarter, on December 3, 2023 in New Delhi, India.

Image: Salman Ali/Hindustan Times via Getty Images

Nothing works as much magic for stock markets’ exuberance as the playing out of a highly anticipated event just as expected. The reverse too, holds good. The state election results—the Bharatiya Janta Party (BJP) has won three large states—are likely to provide that adrenaline rush to markets, setting the stage for the general election next year.

The results may boost the stock markets’ confidence in multiple ways. First, abate political risks for the next five months; second, increase expectations of political continuity in 2024 to bolster sentiments; third, reduce risks or chances of government policies turning populist next year.

However, Rahul Bajoria, MD and head of EM Asia (ex-China) Economics, Barclays feels that the results may add to the perception of political stability in the medium term, but state election outcomes can differ greatly from national elections. He agrees, although, that the state election results are an early boost for BJP.

Elections in five states are the last state polls before the 18th general election in 2024, which will determine whether Prime Minister Narendra Modi's BJP gets to serve a third consecutive term. “BJP’s win speaks to Modi’s continued mass appeal, but also reflects the popularity of state-level leaders, the poor showing of the Congress and the ongoing trend of competitive populism,” say Sonal Varma and Aurodeep Nandi, economists, Nomura.

Elections in five states are the last state polls before the 18th general election in 2024, which will determine whether Prime Minister Narendra Modi's BJP gets to serve a third consecutive term. “BJP’s win speaks to Modi’s continued mass appeal, but also reflects the popularity of state-level leaders, the poor showing of the Congress and the ongoing trend of competitive populism,” say Sonal Varma and Aurodeep Nandi, economists, Nomura.

Of the five state election results, the ruling BJP has outpaced its national rival, the Indian National Congress (INC), in three big states (Madhya Pradesh, Rajasthan and Chhattisgarh). Five states held polls in November: The bellwether Hindi heartland states of Madhya Pradesh, Rajasthan, Chhattisgarh, the southern state of Telangana, and the smaller northeastern state of Mizoram. Among these MP, Rajasthan and Chhattisgarh are bipolar contests between BJP and Congress.

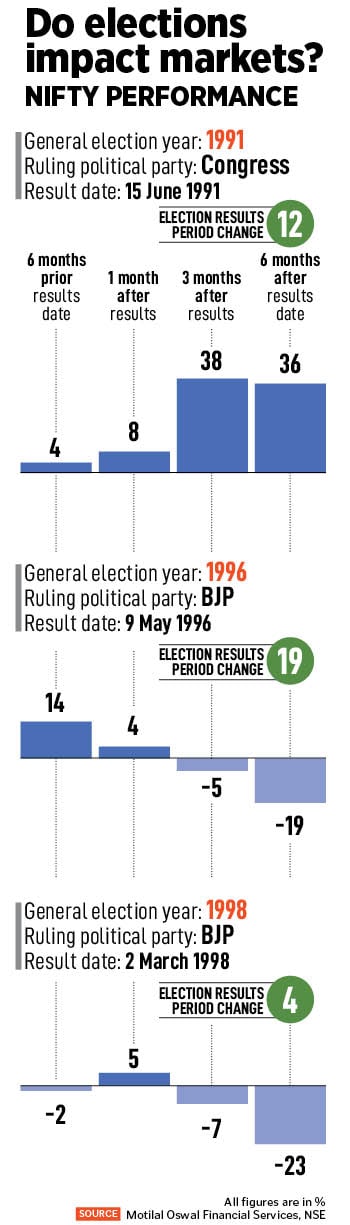

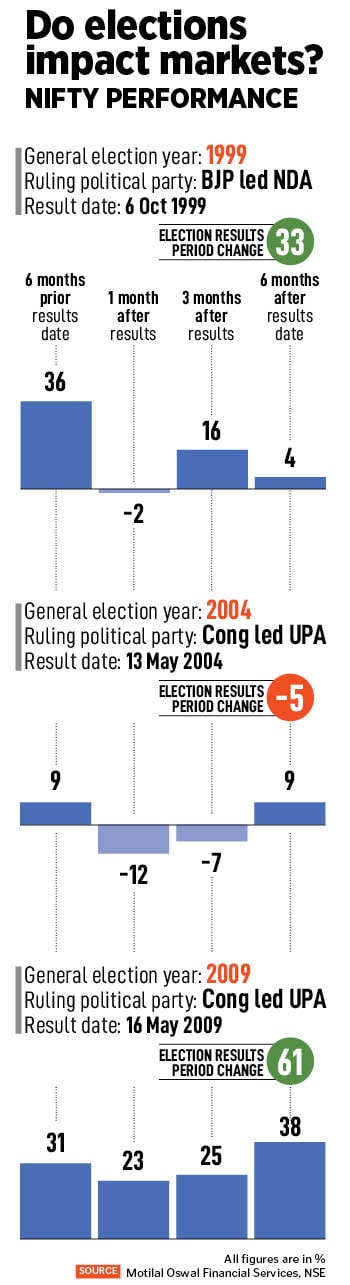

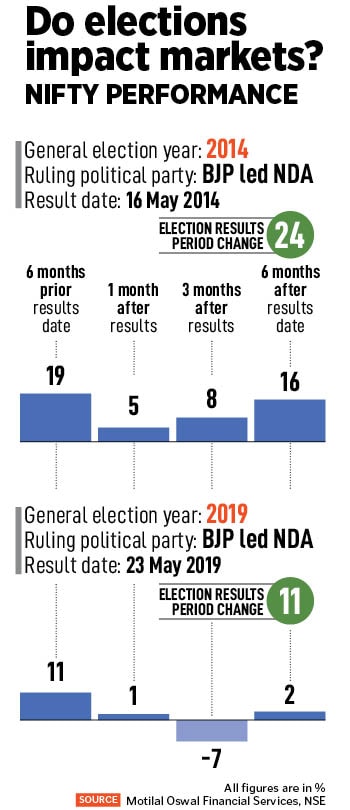

Following severe volatility, the markets gained over 5 percent in November, with the benchmark index Nifty rising over 11 percent this year. Midcaps and smallcaps outperformed by gaining 5 to 6.5 percent in November; they have surged 36 to 46 percent since January.

Following severe volatility, the markets gained over 5 percent in November, with the benchmark index Nifty rising over 11 percent this year. Midcaps and smallcaps outperformed by gaining 5 to 6.5 percent in November; they have surged 36 to 46 percent since January. “This naturally turns the attention to the upcoming general elections in May 2024. In our view, the key risk would be the emergence of a weak coalition government, which could result in a pivot back to redistributive policies at the expense of the focus on boosting capex and implementing supply-side reforms,” he elaborates.

“This naturally turns the attention to the upcoming general elections in May 2024. In our view, the key risk would be the emergence of a weak coalition government, which could result in a pivot back to redistributive policies at the expense of the focus on boosting capex and implementing supply-side reforms,” he elaborates.