Rise of fintech 2.0- building a future-ready fintech

The next chapter of the Mavericks reveals how promising fintech founders in India are changing the game with their innovative thinking

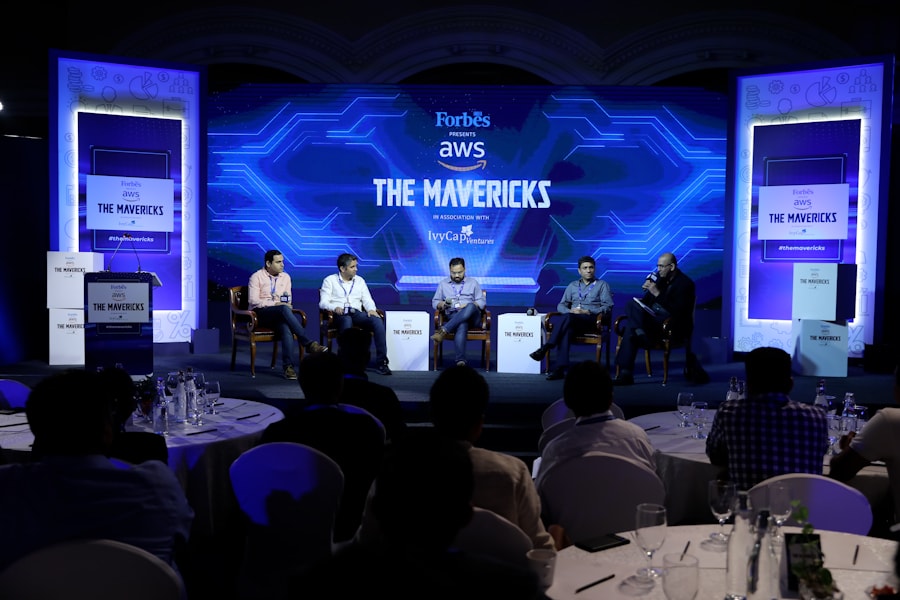

Forbes India, AWS, in association with IvyCap Ventures hosted an event ‘The Mavericks’ focused on the theme: 'Rise of Fintech 2.0' at the ITC Windsor in Bengaluru to dive deeper into the evolving Fintech ecosystem in India and the development of innovation in this sector. Numerous panel talks and founders conversations enlightened the audience on how to develop a Fintech organization that is focused on the future.

Forbes India, AWS, in association with IvyCap Ventures hosted an event ‘The Mavericks’ focused on the theme: 'Rise of Fintech 2.0' at the ITC Windsor in Bengaluru to dive deeper into the evolving Fintech ecosystem in India and the development of innovation in this sector. Numerous panel talks and founders conversations enlightened the audience on how to develop a Fintech organization that is focused on the future.

The event’s theme- Rise of Fintech 2.0 aimed towards educating the audience on the various aspects of building a Fintech organisation as well as adapting to technological innovations. Apart from this, business and leadership aspects were touched upon to provide an all-encompassing overview of the industry.

Welcome note by Manu Balachandran, Associate Editor, Forbes India

In his welcome note- Manu Balachandran, Associate Editor at Forbes India, discussed how India is home to over 6000 Fintechs and its Fintech industry is estimated at over $30 billion. With it being recognized as the largest Fintech ecosystem globally, Indian fintech players have tapped into this lucrative opportunity.

The most promising fintech giants are changing the landscape and shaping the industry with their innovative solutions and plans to make it future-ready.

Founders Panel: Building A Future-Ready Fintech