India's gaming sector is spawning unicorns. But the future is uncertain

Regulatory challenges and tax uncertainties are casting a long shadow on India's gaming startups

Since August 2020, the Indian gaming market has seen an additional funding of $1.5 billion and approximately 450 million gamers in India, indicating that gamers, investors and companies are bullish about this sector

Since August 2020, the Indian gaming market has seen an additional funding of $1.5 billion and approximately 450 million gamers in India, indicating that gamers, investors and companies are bullish about this sector

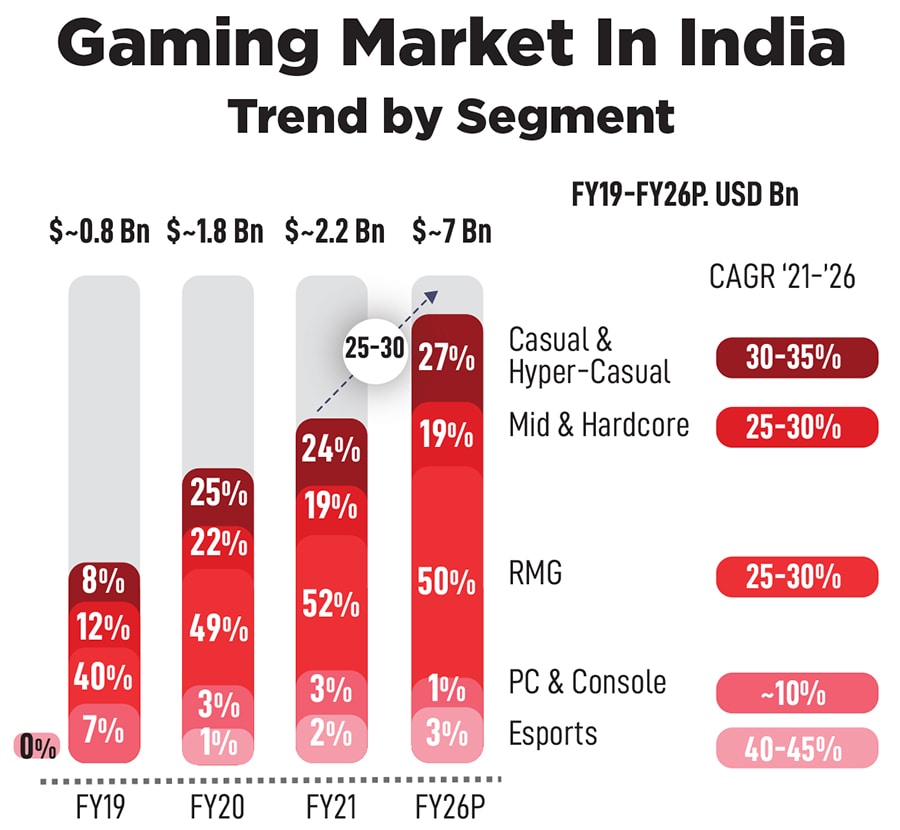

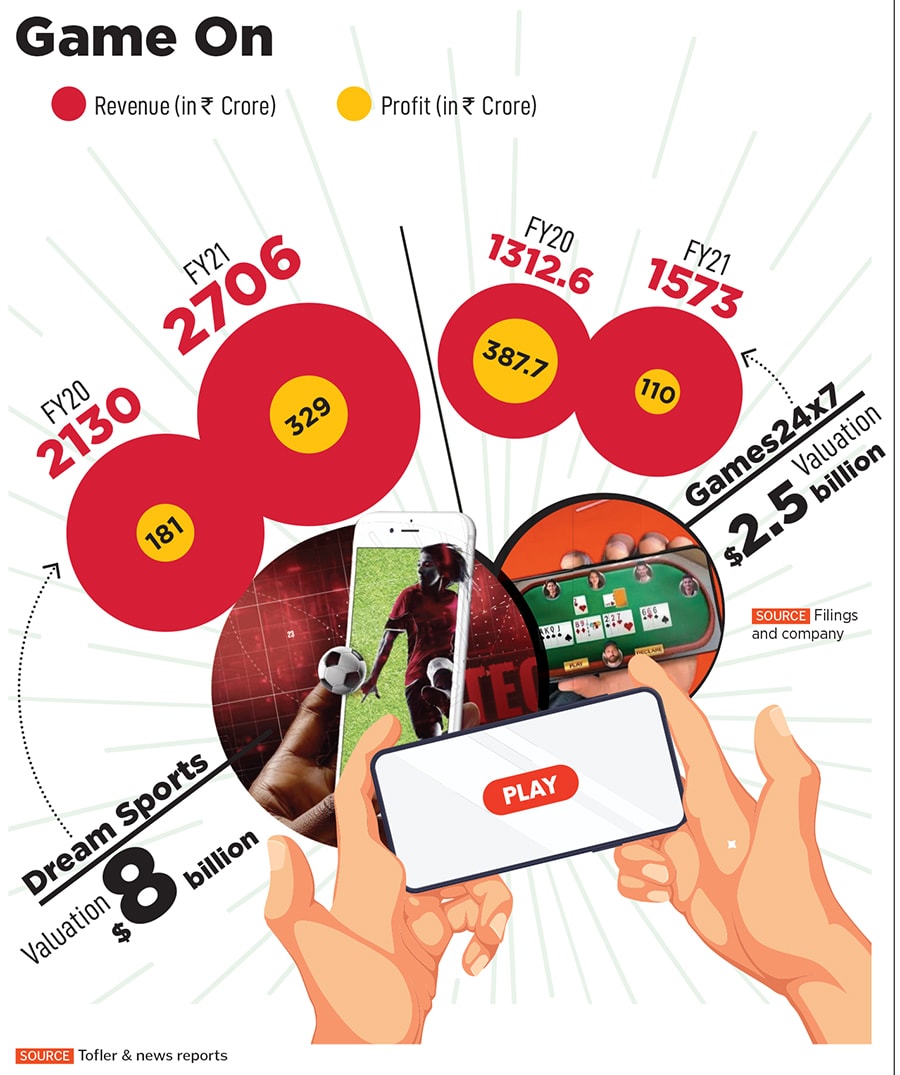

The gaming industry in India was estimated at $2.2 billion in 2021 and is expected to hit $7 billion by 2026—more than 3x in the next 5 years, says Lumikai, a gaming-focused VC fund. According to Inc42, at present, the industry has three gaming unicorns—Dream Sports, Games24x7 and MPL.

Since August 2020, the Indian gaming market has seen an additional funding of $1.5 billion and approximately 450 million gamers in India, indicating that gamers, investors and companies are bullish about this sector. However, with regulatory uncertainties still dogging the sector, how long will the dream run continue for these profitable unicorns? Experts feel gaming startups are here to stay, and a lot more profitable unicorns are likely to join the bandwagon soon.

A dream run

While the gaming sector can be sub-divided into multiple categories, only two of the three unicorns are profitable—Dream Sports and Games24x7—as per FY21 financials. While Dream Sports has its fantasy gaming platform, Dream11, as its cash cow, it has also expanded to various other segments. In 2019, once the company turned unicorn, they launched personalised sports content and commerce platform FanCode, one-stop payment platform DreamPay, and sports travel and experiences platform DreamSetGo.With the regulatory uncertainty surrounding the online fantasy sports segment, is the group diversifying to hedge the risks? “Yes and no,” Harsh Jain, co-founder and CEO of Dream Sports, had said in a recent conversation with Forbes India. “Yes, it helps de-risk, but no that’s not why we are doing it. We are just solving the problem for sports fans in India.”

A stronger regulatory framework from the government is welcome by stakeholders, but, says Mitesh Gangar, co-founder & director, PlayerzPot, “As a progressive gaming brand, we would like to propose to continue with the current tax slab of 18 percent GST, which will stabilise our operations and services without hampering profits. A tax hike might disturb the current economy of the industry at present, and slow down its growth momentum.” The super gaming app which caters to fantasy sports, casual gaming, and card games hopes to turn unicorn in the coming two to three years.

A stronger regulatory framework from the government is welcome by stakeholders, but, says Mitesh Gangar, co-founder & director, PlayerzPot, “As a progressive gaming brand, we would like to propose to continue with the current tax slab of 18 percent GST, which will stabilise our operations and services without hampering profits. A tax hike might disturb the current economy of the industry at present, and slow down its growth momentum.” The super gaming app which caters to fantasy sports, casual gaming, and card games hopes to turn unicorn in the coming two to three years.