Ajit Isaac's string-of-pearls strategy for Quess

Ajit Isaac, CEO & CMD of Quess Corp, is a master at buying companies and scaling them, thus building two of India's largest HR firms

In early 2000, Ajit Isaac was happily riding the dotcom wave. Although he was one of the first few employees to be hired by IDFC, being set up as an infrastructure development financing institution in the early-’90s, Isaac chucked the job in 1999 and logged on to the dotcom boom with Go4Careers.com. The portal, which he was heading, was an online jobs site that was part of Go4i.com, which offered a variety of digital content and services, and was bankrolled by JP Morgan.

In March 2000, the global dotcom bubble burst. Stocks sunk and companies that were marked as high-flyers crashlanded. As internet-based firms began to fold up, Go4i, too, stared at an uncertain future. Gaurav Mathur, founder and MD at InVent Capital, then a principal at JP Morgan, says, “We didn’t know if the portal would work, but we felt the staffing business [Go4Careers] should make money. So we moved it out and built it as an offline business.”

It’s a path that Isaac hasn’t ditched till now. Even in an age when going online has become fashionable again, Isaac’s latest venture, Quess Corp, has a veritable offline model. Life has turned a full circle for the 48-year-old who’s gone against the tide and stood out in India’s online-centric startup ecosystem. That he has built two of the country’s largest human resource companies—Peopleone Consulting, which was later acquired by Swiss staffing company Adecco, and Ikya—along the way is perhaps incidental. (When Go4Careers was taken offline, it was rechristened Peopleone Consulting and new lines of services, such as temporary staffing, were added to the business.)

Established in 2009, Quess is a business services provider that operates across four verticals—global technology solutions, people services (including general and IT staffing) and logistics, integrated facilities management and industrial asset management. With a string-of-pearls strategy, Isaac has built a business services supermarket to cater to back-office needs of Indian companies.

The company closed the 15-month period ending March 2016 with revenues of Rs 2,573 crore and a net profit of Rs 68 crore, becoming the most profitable company in the Indian portfolio of Fairfax Financial Holdings, the investment firm led by Indian-origin Canadian investor Prem Watsa.

Between fiscals 2011 and 2015, Quess’s revenues have grown at a compound annual growth rate (CAGR) of 74.69 percent, with net profits at nearly 153 percent. In the fiscal year 2016, the company has so far clocked a turnover of Rs 1,535 crore and a net profit of Rs 35 crore. With over 1,300 clients across eight countries and 43 offices in India, it is also the country’s largest player in IT staffing.

After it went offline, Peopleone’s business grew handsomely, says Mathur. In 2004, it was acquired by Swiss HR solutions firm Adecco. At present, Adecco India is the largest HR services company in the country.

Isaac, an alumnus of Loyola College, Chennai, and a Chevening Scholar from University of Leeds, UK, has been a key component in this journey, first as the chief executive at Peopleone and then as part of Adecco India’s board of directors till 2007. He imbibed as much from Adecco India as the company did from him. “Isaac learnt the art of integrating acquired companies and scaling up operations during his time with Adecco, which itself has grown on the back of acquisitions globally,” says Mathur. He is good at identifying common areas that can be integrated between his company and those he acquires. The process of selling Peopleone to Adecco, including the financial due diligence, helped make him a more “numbers-driven person”, adds Mathur.

One of the key strategies that Isaac has adopted is to build relationships that would propel not just growth, but long-term friendships too. Take his relationship with Mathur, for instance. Isaac has been a permanent fixture in Mathur’s ventures, not only during their association during Peopleone, but later as well.

In 2005, Mathur quit JP Morgan to co-found India Equity Partners (IEP). Consequently, IEP funded another HR solutions startup, Ikya Human Capital Solutions, and brought in Isaac to lead the company. Isaac joined the new company in 2009 and got a 33 percent stake in it.

In 2013, IEP was looking at an exit from Ikya and Isaac was looking for a like-minded and long-term investor to replace IEP. One of Mathur’s connections from his JP Morgan days was Harsha Raghavan, MD and CEO at Fairbridge Capital, the Indian investment advisory arm of Fairfax. Through Raghavan, Isaac came in touch with Watsa, considered to be one of the foremost value investors in the world. The same year, Fairfax invested around Rs 256 crore for a 74 percent stake in Ikya through Thomas Cook (India), another Indian company controlled by Fairfax. And Quess was born. (Following a rights issue by Quess in December 2015, Fairfax’s shareholding in the company has come down to 69.55 percent, while Isaac and other entities controlled by him owned the rest.)

Quess’s business logic is simple: All its lines of services are directly related to economic growth. Take the staffing and facilities management business, for instance. As the Indian economy grows, Indian firms will need more office space and employees. Quess helps companies reduce fixed costs by providing skilled workers on contracts, and as an outsourcing partner for non-core functions including housekeeping, security, and pantry services.

To fund growth in existing and new businesses, Quess has now decided to go public. It filed a draft red herring prospectus with the Securities and Exchange Board of India (Sebi) in February 2016. Though a date for the initial public offering (IPO) hasn’t been fixed, road shows have begun in India and abroad.

But neither Isaac nor Fairfax have any intention to offload any portion of their shareholding in the company via the IPO. “In a way, we have built India’s largest business services platform. We have achieved this faster than we thought we would,” says Isaac, Quess’s chairman, MD and CEO. “If you give me a lot of money and ask me to put it all back together again, I don’t think I’ll be able to do it.”

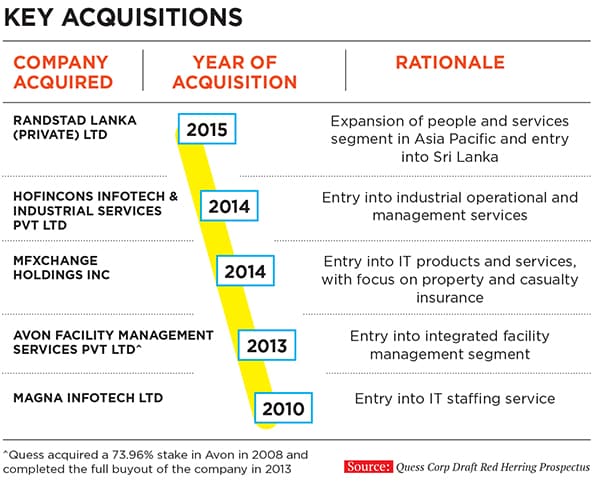

Quess’s search for acquisitions began in 2009 with Avon, a facility management company. Many of the businesses that Quess has acquired were either struggling with losses or low profitability. Isaac managed to make these businesses operationally efficient and turn them around.

The acquisitions continued with Magna Infotech, an IT staffing company, in 2010. Isaac’s company has acquired at least seven other ventures in fields as diverse as staffing, IT solutions and industrial asset management at a cost of around Rs 160 crore. In 2015, the corporate structure was simplified and the acquired companies, which existed as Ikya’s subsidiaries, were merged into the parent entity and renamed as Quess.

That Isaac and his team of professionals have mastered the art of nursing fledgling companies and growing them is evident in the financial performance of two of Ikya’s earliest buys. Since their acquisition, Avon’s revenues have grown 26 times to Rs 302 crore in FY2015. Its operating profit jumped tenfold in the same period to Rs 20.7 crore. Magna’s turnover has tripled since it was bought by Ikya to Rs 545 crore and its operating profit has grown sixfold to Rs 63.7 crore.

“Magna and Infotech emboldened us to do further acquisitions,” says Isaac. “We knew we had a model in place to spot opportunities for operating cost reduction, good integration skills and people culture.”

Mathur says that Isaac doesn’t shy away from taking tough decisions. “One of the ways an acquisition can create value is by figuring out which clients and segments make money and focus on those. Isaac is good at introducing systems and processes in the companies he acquires to identify these,” he says.

One of his biggest plus points, according to people who know him, is that Isaac never overpays for an acquisition, something that has been the bane for many Indian promoters. “He will not overpay [for an acquisition] and stretch himself just because he wants something,” says Chandran Ratnaswamy, CEO of Fairfax India Holdings Corp, Watsa’s trusted aide and a director on Quess’s board.

Speaking from Toronto, Watsa agrees with Ratnaswamy. “Isaac is price conscious and that means he is conscious about the fact that he needs to make returns for shareholders,” Watsa says.

For Watsa and Fairfax, Quess is a trophy investment. It is the most profitable company in its Indian portfolio till date; and as Watsa patiently waits for his other investment in India, Thomas Cook, to find its feet, Quess is providing support. For the 15-month period ending March 31, 2015, around 79 percent of Thomas Cook’s consolidated revenues and 75 percent of pre-tax profits came from its subsidiary Quess.

Clearly, the partnerships between Quess and Fairfax, and Isaac and Watsa, have worked very well for all stakeholders. The relationship between the investor and the investee contrasts sharply with instances of acrimony that early-stage investors and their portfolio firms have shared in some Indian ecommerce startups.

While Isaac identifies and leads the acquisitions that Quess makes, the Fairfax team comprising Watsa, Ratnaswamy and Raghavan function as a sounding board, often throwing its weight behind the company when it comes to securing debt financing for the transactions. “We aren’t in touch with him 24x7, checking what he is doing all the time,” Watsa says. “When we own a business we repose complete faith in the person running it. If we would have interfered too much, a guy like Ajit may well have left.”

So what’s next for Quess? A lot apparently.

The company wants to raise around Rs 400 crore through the IPO, and sources indicate that the promoters may dilute a 10 percent stake in the company. If this happens, it will value Quess at Rs 4,000 crore. This implies more than an 11-fold jump in the company’s value since Fairfax first invested in it.

Isaac wants to use part of the money to retire some working capital debt and to create a war-chest for further acquisitions.

Besides, Quess has largely operated in the business-to-business space till now. Isaac wants to explore if its capabilities can be extended to the business-to-consumer segment. For instance, Quess’s facility management arm cleans 150 million sq ft of commercial space, including parts of Delhi and Kochi airports, 10 hospitals, and a few hotels. The company is now partnering with Helpr, an app-based domestic jobs company, to extend this service to residential premises. Quess also manages the pantry operations at a number of offices and has a centralised kitchen in Bengaluru. It wants to utilise excess capacity at the facility to deliver food to individual consumers.

Of late, Quess has also entered new businesses such as logistics, through which it does the last-mile delivery of goods for ecommerce players like Amazon and Pepperfry, and installation and maintenance of telecom tower equipment for companies like Huawei, Nokia, ZTE, and Reliance Jio (Reliance Jio is owned by Reliance Industries Ltd, which also owns Network 18, publisher of Forbes India). Expansion of these businesses is also on the cards.

Isaac is tight-lipped when it comes to pegging a number on expected growth. But, in 2011, he had prepared a mission statement for his company. It was called 1-800-5000, resembling a toll-free number. The idea was that in 2018, the year in which Quess would complete a decade of existence, the company should achieve Rs 5,000 crore in sales and an operating profit margin of 800 basis points, or 8 percent. It is still only halfway there but growth, so far, has not proved a problem for Quess.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)