Ctrl+Alt+Del: Wipro's attempt to jump back into the game

New CEO Abidali Neemuchwala is creating a startup culture at the IT major to regain market leadership and, more importantly, keep up with the times

Leadership, especially when large teams are involved, is often about constructive confrontation. And that is the approach that Abidali Neemuchwala has embraced at India’s third-largest software services provider. The freshly-minted CEO wants to break down walls, knock heads together and get Wipro’s 170,000-strong workforce cracking on solutions clients will not be able to ignore. This translates to less rigidity in hierarchy and fewer silos, but a flat organisation where people are unafraid to step on each other’s toes. It also means the writing is on the wall for those who’re unable to adapt. After all, at stake is the company’s reputation. And it has some salvaging to do.

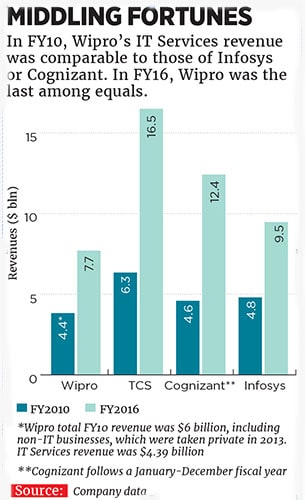

There is little doubting Wipro’s stature in India’s IT firmament. It has played its part in building the outsourcing sector into a multi-billion dollar industry that employs millions. However, it has lagged its peers for several years now: Tata Consultancy Services (TCS) has pulled away to become the clear leader by revenue and US-based Cognizant Technology Solutions, which has most of its delivery centres in India, has left Wipro behind as well. Also, rival Infosys is showing signs of handling its own troubles by embracing Artificial Intelligence and design thinking as the way forward.

Contrast this with Wipro’s string of middling to slightly-disappointing results which have continued in the quarter ended June 30, 2016 when the company saw its profits fall and, worse, forecast that it won’t grow in the following quarter either.

To appreciate the pecking order, and the shift in fortunes, consider this: For the fiscal year ended March 31, 2010, Wipro clocked revenues of about $6 billion; TCS was barely ahead at $6.34 billion and Infosys was behind at $4.8 billion. Cut to FY2016 and Wipro’s revenues were $7.7 billion, whereas Infosys had moved to $9.5 billion and TCS raced ahead to $16.5 billion.

Neemuchwala, 48, clearly has his job cut out. Having joined Wipro about 16 months ago from TCS as COO, he took over as CEO in February. He sees his task as not so much about technology —Wipro has historically always had deep engineering skills—but about reengineering mindsets.

For context of the nature of change required, in the past Wipro had emerged as an early leader in the labour-arbitrage model by recognising the demand for large-scale talent factories which could provide quality talent at scale, says Peter Bendor-Samuel, CEO of technology consultancy Everest Group, in an email to Forbes India.

Wipro was also one of the more acquisitive firms in Indian IT services with its ‘string of pearls’ strategy in the late 2000s. However, “when market dynamics started to favour industry vertical expertise, Wipro was late to recognise it and did not make the necessary organisational and talent shifts, putting them in a position where they were chasing the market and not leading it,” Bendor-Samuel says. “We are now at the next market inflection point, which on the bright side gives Abid and Wipro a chance to jump back into a leadership role.”

In particular, Bendor-Samuel adds, Neemuchwala will have to ensure a successful pivot to the new business and talent models in the digital arena and continue the ongoing M&A strategy at Wipro. “It has been encouraging to see some of the recent acquisitions by Wipro such as Designit and HealthPlan Services to attack these high-growth markets, but the company will need to step up its M&A programme,” he says, especially since competitors such as Accenture are far more aggressive on this front.

A single Wipro solution

“Cultural change”, as Neemuchwala calls it, though easy to comprehend, is never easy to implement. As he tells Forbes India, “Thought leadership, pro-activeness—that’s a cultural shift we’re undergoing in the overall Indian IT industry, and it’s true for Wipro as well. Historically, people have been shy of stepping on someone else’s toes.” Employees have always functioned within rigid silos, he points out. Now “we’re creating a boundary-less environment, where people shouldn’t feel they are offending somebody,” he adds. Technology is evolving and converging at the same time and integration holds the key. As a result, “collaborating across sub-organisations to create a single Wipro solution for the customer is becoming very important.”

He calls it a “startup”. Here, he says, “if you want tea, you just go and make it or anyone can go and make it. That’s a different mindset. There are no departments, no functional silos and it’s everybody sitting around the table and doing the work.” This will take time, he admits, because the existing culture is “deeply entrenched”.

“This industry has grown by managing supply,” says Saurabh Govil, Wipro’s HR head. “The biggest thing is for people to understand that what got them here won’t get them there [the future]. The world is changing and that change has to be understood. If we don’t break these silos, we won’t be able to make the customer successful [with our services] and that means we won’t be successful. The mindset shift is that it’s not about my business unit, my practice—it’s about the larger Wipro.”

This is because the market is tilting towards integrated services; customers want consultative solutions, so old ideas of service lines make little sense, Neemuchwala adds. “We fundamentally changed how service lines were held responsible, how they were structured and what skills they had, to focus more on the IP (intellectual property) creation side, and on the sales-support side of the house.” The delivery and operations were moved into strategic business units (SBUs), he says.

That means, a service line like, say, infrastructure management—managing large numbers of computer servers and storage units hooked up together—will be less about selling that specific service and more about becoming the most sophisticated offering in that space. The SBUs then, be it finance or health care, can call on one or all of these capabilities to sell a solution that is collectively exhaustive and mutually exclusive—providing both breadth of knowledge and depth of understanding. Also, sales was “hunting-driven” and the company didn’t focus as much as it should have on “mining” existing customer accounts, Neemuchwala says, and “cross-selling and up-selling” within them. This calls for a fresh approach on how the company provides incentives to sales people and training for the delivery staff—engineers, programmers and others who fulfil the orders—to handle incremental increases in sales from mining.

In cricketing parlance, “it [mining] is like scoring singles,” Neemuchwala likes to say. “Hunting is like scoring sixes and fours. So it’s a different kind of batsman that is required, and we need to train [people].”

The shapeshifting market

As customers accelerate the shift towards all things digital, they usher in further modifications to the market. For one, technology purchasing decisions start being influenced by the availability of cloud-based alternatives to on-premises and expensive options. “Clients are now competing with forces that they had not seen before,” says Rajan Kohli, head of Wipro’s newly-formed digital services unit. Kohli was previously running the company’s banking and finance business unit—its largest. It is also an area which is seeing constant evolution. He points to how fintech companies are making inroads into many areas that were traditionally the domain of banks— like transferring money, for instance —thereby eroding their profits. Also, in wealth management, robo-advisors are leaching away business from traditional financial institutions.

“The end consumers are now used to the Apple user interface and the Amazon customer experience,” Kohli explains. Banks, hospitals and insurance companies, car makers, FMCG sellers or entertainment businesses are similarly expected to step up and provide the same convenience, simplicity and elegance. If they don’t, then a host of startups are already courting the consumers with alternatives.

Wipro’s acquisition of Designit, a strategic design firm from Denmark, provides a beachhead in this expanding digital opportunity, Neemuchwala says. The acquisition brings Wipro more than 300 specialists capable of visualising and executing product design, focusing on user interface and experience from start to finish. Designit’s customers include Samsung, LG, Vodafone, Novo Nordisk and Audi. “That is seeing some very good traction,” Neemuchwala says, adding that they have already gained some contracts.

Typically, contracts in new digital areas tend to be small, and they still run on the traditional time-and-material model, CFO Jatin Dalal adds. Not surprisingly, this is an area where the maturity of the end goal is hazy, and involves a joint discovery. At the same time, today, digital services hold out the most promise and therefore “we are over-invested in it,” Dalal says. That involves not only money, he adds, but also moving the company’s best and brightest, including people like Kohli, into these streams, even though the traditional outsourcing business still accounts for more than 80 percent of the company’s revenues, as is the case with rivals TCS and Infosys.

Artificial Intelligence (AI) is a major theme too, given how it is anticipated to change how work is done across industries and even in personal lives. Wipro has built an AI platform called HOLMES and the company is running pilots with 35 customers, with specific uses for banks, telecom companies, retailers, infrastructure services and related processes.

Robotic automation is another area that is changing productivity dramatically. “Commoditisation of services means we must have new cost structures to provide those services and robotic automation will have a bearing on it. We’ve had some good early successes in being able to improve productivity and releasing people,” Neemuchwala says, “to do more creative work”. Automation doesn’t necessarily mean higher revenues straight away: Dalal recognises it and is comfortable with it. “If you run an inefficient project, the client will come back and ask for reductions or, worse, go to someone else,” he says. And that’s the reality.

On the other hand, if automation reduces costs for the client, and frees up people to do more creative work for the same customer, “they [the clients] like that” and it will eventually expand the scope of work and therefore the revenue from that account. At least, that is what Dalal is betting on.

Getting change ready

The goals are lofty and Neemuchwala has been clear about acquiring from outside those skills and technologies that aren’t already found within the company, but are urgently needed. “We acquired a [IT consulting] company called Cellent in Germany so that we can be local players there; we acquired Designit... we’ve done a few other acquisitions too.”

The company is also looking at tools and incentives to facilitate the new approach. Some of this includes non-sexy changes like simplifying processes to make it easier for people to tap each other. Predictive analysis is being used to model scenarios which can help decide what more can be done for the same customer.

Wipro has created digital pods—dedicated centres of excellence that can showcase the best of what the company has to offer in the new areas of digital technologies—that customers are invited to; their product managers look at it, give feedback and then, the applications are piloted very quickly with the barebones requirements and built out into full-fledged products. “The company has established these digital pods in London, New York, Tokyo and parts of Europe, and is setting up a few more,” Neemuchwala says.

Another aspect of working in the biggest markets is having a more robust presence in those locations. Therefore, localisation, to which the industry has paid only lip service for several years, will have to become a lot more serious. “The need for being a much more local player is increasing. Localisation is a huge focus,” Neemuchwala says. It means investing in building strong teams locally. These teams won’t be large in numbers and will often comprise experts with years of experience in specific domains—say, finance or machine learning—and in how Wipro’s biggest customers buy technology. They will play a growing role in demonstrating that Wipro is a provider of consulting and technology, and not just IT services.

New markets are being staked out as well, such as Latin America, mainland Europe, Australia, Asia Pacific, Japan, Canada and South Africa. “We have strengthened our team to broad base our entire approach to the portfolio,” says Neemuchwala.

All of these efforts are meant to converge into the larger plan of making Wipro a far more global company. It is looking at development centres in the US, and preparing to hire young MBAs under a programme called Global 100. These recruits are meant to work in customer-facing roles in their own geographies, from America to Australia. They will typically be in their late twenties, and join as assistant managers to undergo an 18-month intensive training that will see them rotate across departments and business units. They will then be fast-tracked to become the next generation of rainmakers for Wipro, Govil says.

Historically, clients would have stipulated their people requirements with requisite skills, and the warm bodies would be provided by the IT vendor. “Now, we have domain experts, cyber security experts, data scientists, designers and solution architects sitting at the table and helping the client re-imagine the business process and map the customer journey,” says Neemuchwala. This is then followed up by pulling technologies together into appropriate applications. “In the near future, I do see Wipro as a company that is quite consultative in nature; a company focussed not only on engineering but also design and digital,” he points out.

Kohli also expects that customers will increasingly come to view Wipro as a technology solutions provider rather than an IT services provider. This is not to say that the role of people will diminish, but will morph to bring technology-based original solutions to the fore. “Today, it’s a smaller part of Wipro, being this (new) way with our customers,” says Kohli. In three years, a large part of the organisation, especially that part which wants to tap the “change-the-business” aspects of its clients’ technology purchases, would have embraced this new way of life. The share of Wipro’s revenues from these efforts will be “significantly higher,” than the 17 percent it is today, he says.

Neemuchwala also anticipates greater efficiency in delivering the run-the-business part and the bread-and-butter work, “with hyper automation, Artificial Intelligence, and looking at business processes differently.” And it will have a huge impact on productivity and user experience. If people are doing work that can be automated, they will need to move up the skills chain. As a result, over the next two to three years, reskilling is a huge priority at Wipro. The rate of hiring of freshers may not change dramatically overnight, but the changes will show in the “qualities we expect, the training we give,” he says.

For the more experienced people, “for people who are learnable, want to do new things, and get out of their comfort zones, there is enough work”. A startup, after all, never stops working.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)