Hold on, my wallet's in my phone: Fintech firms are a blessing for small entrepreneurs

Powered by technologies that harness big data, fintech companies are positioning themselves as viable lenders and payment solutions providers with mobile wallets and insta-loans. Not surprisingly, this is compelling traditional banks to evolve too

Pankaj Garg, 33, founded DailyObjects, a company that designs, manufactures and sells customised smartphone cases and laptop sleeves, in 2012 because he loved seeing people’s emotions captured in the graphic designs. Like most entrepreneurs, he too faced working capital needs in the initial stages and approached banks for loans. However, they weren’t convinced about the company’s business model. Back then, “we were a startup and growing fast but had not broken even,” he says. “Banks just didn’t understand us then.”

It was Bengaluru-based Capital Float that saw the startup’s potential. The new-age lender, aided by proprietary algorithms that scrutinise reams of data and measure a potential borrower’s creditworthiness, offered a small working capital loan to Garg in 2013. That helped him pay his freelance artists for their designs and also bear the expenses for the just-in-time manufacturing of cases and sleeves.

“They are just as tough as banks in their due diligence,” Garg says about Capital Float. The difference is, they are fast, automated and flexible. For the right customers, loans are disbursed in a day, and for durations as short as 60-90 days. Garg, a repeat customer, typically repays his debts within a year to 18 months through equated monthly installments (EMIs).

Gaurav Hinduja, 33, and Sashank Rishyasringa, 32, both MBAs from Stanford, who started Capital Float about three years ago, have by now disbursed loans worth Rs 400 crore to over 1,000 small businesses across 40 cities in India. Venture capital firms SAIF Partners, Sequoia Capital and Aspada recently returned to hand Capital Float another $25 million (around Rs 170 crore) in funding led by Creation Investments Capital Management. The startup had previously raised $17 million in two rounds from its existing investors.

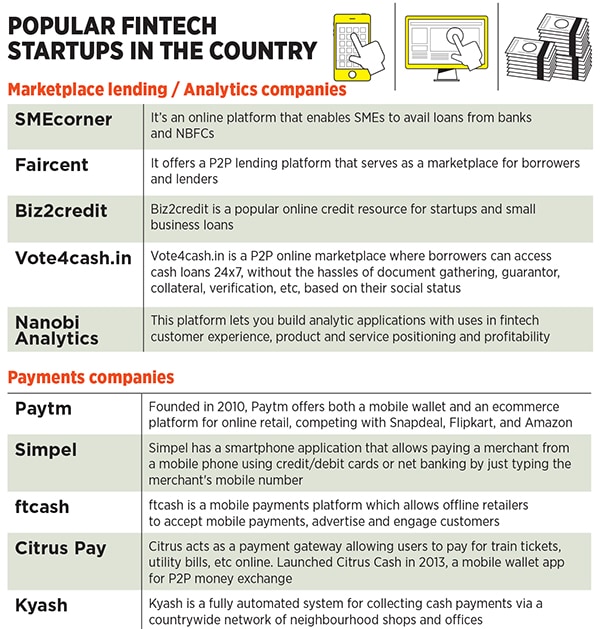

Capital Float isn’t the only player to have grown in this space. Bengaluru-based Loanzen, Ahmedabad-based Lendingkart and Gurgaon-based Indifi Technologies are also in the game. They see opportunities on multiple fronts—lending to new economy ventures, where traditional banks fear to tread; and quicker, cheaper and hassle-free lending. The emphasis is on fast, internet-based processing. Applications are mostly online and some parts of the process can be done on smartphones too. Loanzen, for instance, will eventually go “app-only”, its founder Madhu Sudhan tells Forbes India. “Our goal is to make it [getting loans] convenient for an entrepreneur so that he or she won’t have to run from branch to branch,” he says. Like Capital Float, Loanzen is also building a proprietary platform to automate lending.

Unlike Capital Float and Loanzen, which are themselves lenders, Indifi operates as a marketplace, connecting banks and non-banking financial companies (NBFCs) with small and medium enterprises (SMEs). The company caters to businesses as diverse as travel agents and manufacturers, all of whom have the same underlying need—short-term capital.

These modern-day financiers are opening up credit to SMEs at roughly the same interest rates (16-18 percent) as banks. Demand for debt within India’s 29.8 million micro, small and medium enterprises (MSMEs) stood at $520 billion (around Rs 35 lakh crore at current exchange rates), the International Finance Corporation estimated in a November 2012 report. Formal sources of lending, however, cater to only $140 billion, of the total MSME debt financing, according to the report. That leaves a $380 billion opportunity—currently including everything from self-financing to loan sharks—for companies such as Capital Float to target.

A common thread running through these companies is the sophisticated technology they are employing, including big-data analytics and machine learning, to make lending practices more competitive, earning them the name ‘financial technology’, or fintech, companies. The numbers bear out the opportunity: The Indian fintech sector is projected to rise from an estimated $33 billion in 2016, by volume of transactions, to $73 billion in 2020, growing at a five-year CAGR of 22 percent, accounting firm KPMG and technology lobby Nasscom said in a report in June.

Lending apart, another class of fintech firms is employing technology to take over a task traditionally done by banks: Payments. Mobile wallets—digital repositories of money accessible through smartphones—like Paytm, MobiKwik and Freecharge are being used by millions of urban Indians today for a host of services from ordering food to hailing a cab.

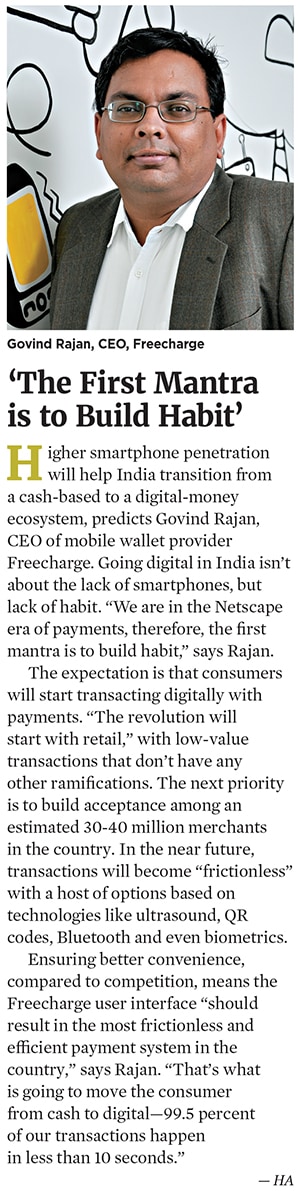

“What is evident is that banks are not the only players who are going to operate in this space,” says Bipin Singh, co-founder and CEO of MobiKwik. “Technology has a role to play and technology companies, independent of banks, also have a significant role to play.” Mobile wallets have garnered the trust of millions of users, by offering convenience, superior user experience and trustworthiness. Ecommerce marketplace Snapdeal’s Freecharge mobile wallet, newer than rivals MobiKwik and Paytm, was processing a million transactions a day within the first six months following its September 2015 launch, says CEO Govind Rajan.

This high rate of adoption in turn gives fintech firms access to the real gold in their business—data. On that data will be built innovative money models never seen before in this country, envisions MobiKwik’s Singh. “The next logical step is, if people have money in their [mobile] wallets, they should be able to invest it. Or, if they’re short, they should be able to borrow. So basically, it is going to be a seamless movement of money from banks to wallets to lenders or multiple lenders.”

The Reserve Bank of India (RBI) has said it is watching peer-to-peer lending, which is not directly regulated in the country, says Singh. Lending to businesses through NBFCs is, on the other hand, well-established.

The ability of fintech firms to trawl the internet and accumulate enough data on potential borrowers represents “a real promise of getting a breakthrough in lending to SMEs,” says Ravi Venkatesan, chairman of Bank of Baroda (BoB), one of India’s largest state-owned banks. On the one hand, SMEs, which have reasonably sound business models, find it tough to get credit; on the other hand, traditional banks find it extremely hard to meet lending targets—a perplexing scenario, he adds. Venkatesan, a former head of Microsoft’s India unit, points out that the traditional ways of banking are increasingly becoming rigidities, rather than processes that enable businesses to thrive with timely credit (see interview on last page). The traditional banks have very little time, because the shift towards new-age alternatives is gathering pace. And even as banks grapple with their large pile of bad loans, they must somehow find the wherewithal to urgently prepare for the digital era. “The shift won’t happen bit by bit. When it happens, it will be a tsunami,” he says.

One bank has taken serious note of these trends. In March this year, the State Bank of India (SBI), the nation’s biggest lender, placed front-page ads in India’s leading dailies tom-tomming the 5 million ‘likes’ that its Facebook page had garnered at the time. The ads underscore the earnestness with which SBI wants to cater to the digital aspirations of its new-age customers.

‘State Bank’, as it’s called in the industry, has taken steps to tap the same lending opportunity that Capital Float and its peers are pursuing. It has become one of the first public sector banks to tie up with Snapdeal to offer loans to merchants that sell on the ecommerce platform. “With Snapdeal, we have introduced a fully-automated credit assessment and sanction model,” says Manju Agarwal, the bank’s deputy managing director for corporate strategy and new business. If a merchant selling on Snapdeal requests a loan, Snapdeal will share the data for his or her trading activity in the preceding six months, which is then fed to a fully-automated engine. “Based on the algorithm, we will get to know how much money can be lent. We then ask the customer to submit know-your-customer (KYC) documents… it’s as simple as that,” explains Agarwal.

This applies to individual borrowers as well. “Once these customers start using digital transactions, a transaction history is created. If a customer is seen spending say Rs 20,000 a month, I can straight away give him around Rs 1 lakh as a personal loan… where is the risk?” asks Agarwal.

In May, SBI joined a group of banks that rolled out the mVisa smartphone app to merchants and customers in Bengaluru. mVisa is aimed at enlisting millions of small merchants and their customers on the digital payments ecosystem and uses a QR code-based solution developed by payments services provider Visa Inc. Unlike with point-of-sale machines, like the ones used to swipe credit or debit cards, mVisa places no upfront costs on merchants, but charges a commission on transactions. If the bank can bring on board the 30 million merchants in the country and its 280 million customers to mVisa, so that all their transactions are digital, it would be an important milestone, says Agarwal.

For fintech firms, the importance of the digital footprint these transactions generate cannot be overemphasised. One reason why algorithm-based automated lending is possible today—and was not five years ago—is the reliable data available on potential borrowers. India’s growing ecommerce and other internet- and smartphone-based services ecosystem is generating a wealth of data on individuals and businesses interacting with many of these digital platforms.

Nandan Nilekani, former chairman of the Unique Identification Authority of India (UIDAI) responsible for the Aadhaar project, likes to call this the “digital exhaust” that people leave behind, much of which is out there on the internet. More sensitive components of this digital exhaust, such as bank transaction details, can also be accessed. This, however, requires the consent of the customer.

This is where the “consent architecture” component of the India Stack comes into play. India Stack refers to the various layers of applications—the foundations of which are now in place in the country—that enable a growing number of transactions to happen online. These could be financial, like money transfer, or government-to-citizen services, like applying for a marriage certificate, say, or government-to-business services such as registering a startup. Eventually, the India Stack will also facilitate and catalyse a host of business-to-consumer and business-to-business transactions as well.

As more and more payments become digital, they create a digital footprint of your [financial] activity and you can give consent to a bank to use your digital footprint to sanction a loan,” Nilekani said in February. He was speaking at a workshop organised by the National Payments Corporation of India (NPCI) on the Unified Payments Interface (UPI), a round-the-clock funds transfer service that is set to enable cashless payments through smartphones. “I, as a user, can authorise my digital footprint to go to a lender, who can use it to check my activities and based on that, give me a loan,” he said. “It’s a layer on top of UPI, which we hope will be developed in the coming months.”

The NPCI has built a massive backbone on which low-ticket, high-volume retail payments transactions can happen quite literally at the click of a button—or the tap of a smartphone. An Uber cab driver in Bengaluru, for instance, can send money to his far-flung village, within minutes of the taxi aggregator paying him his weekly dues. This dis-intermediation of payments—industry-speak for eliminating the middleman (read traditional bank)—is another aspect of the fintech revolution sweeping India.

“SMEs have started to interact with digital payments platforms and have begun generating a lot of formal data, which now makes them easier to under-write than if they just had some traditional financial information,” Capital Float’s Rishyasringa points out. “The biggest paradigm change in this business has been that we are going from a world where decisions were based on human bias and judgement to one where they are based on data. Literally, our model is, give us your data and we will tell you whether we can give you a loan or not, and within minutes,” he adds. “So what we have built internally is a proprietary way of looking at the data footprint of an SME and arriving at an assessment about whether the business will be able to adequately service and pay back our loan.”

Capital Float’s proprietary software application crunches data on “over 2,000 variables” before throwing up information, based on which a decision on sanctioning a loan is made. As more businesses buy loans from Capital Float, the more data there is to test and make the underwriting model more robust.

The RBI sets strong KYC requirements, which still need some manual processes. Barring those processes, “we are pretty much able to do everything else in an automated fashion,” says Rishyasringa. “With the whole India Stack going live, you will have Aadhaar to do KYC, e-sign to sign documents, and UPI for payments, so I think we are already heavily engaging with the India Stack. In the next one year, a lot of this will become paperless.”

Almost all the loans are for working capital, he adds. “We were the first ones to lend to merchants who sell on Snapdeal, based on their transactions. We do a lot of invoice lending to the more traditional segments. We interact with Uber as well, via a partnership, to finance car purchases for drivers—again a very interesting segment and very interesting data set,” points out Rishyasringa. They have also tied up with Alibaba to allow merchants in India to buy goods on credit from suppliers in China.

All this validates the

premise that smaller businesses are responsible and credit-worthy borrowers, even though traditionally they have been viewed as risky. On the other hand, the bad loans at India’s biggest banks are largely on account of defaults by mid- to large-size corporates, says Rishyasringa. The microfinance institutions and other NBFCs that have lent money to the SME sector and managed it in a “focussed and disciplined manner, have portfolios with a stellar track record”. Ten years ago, there was no credit bureau score, one didn’t have much net banking activity and there was no Facebook. Today all of Capital Float’s borrowers have very heavy digital footprints across multiple platforms and services, he says.

Hinduja adds to this: In the last 18 months to two years, large private sector banks and NBFCs have been thinking seriously about going more digital; India will start seeing the evolution of this whole digital economy ecosystem, “perhaps spurred by people like us but also as larger players join in and build it out”.

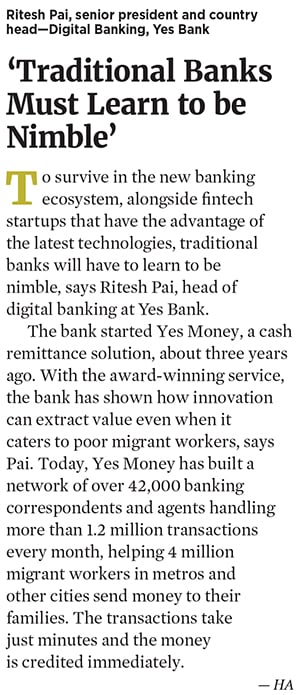

Different banks are evolving in different ways and are also at different stages of that evolution, says Nitin Chugh, head of digital banking at HDFC Bank. However, “specific to digital, the view is very clear: Banks that are not offering new technology will obviously see leakages happening.” “It’s possible that some banks will go down the tube by not doing anything to improve their customer relationships,” Chugh adds. “It is also equally important to change your own internal processes and mindset, and internal structures. This is what we have done with a strong hand and a strong will. Now we are confidently saying that digital is in our DNA.”

The private bank has taken a lead in engaging hackathons and short-listing promising startups to work with, specific to banking technologies. Chugh is also studying, in a very time-bound manner, Blockchain technologies and related applications. Blockchain, in an over-simplified manner, is a sort of a ledger in which everyone knows what everyone else is doing. Chugh and his team are close to deciding on its applications at HDFC Bank, he says, although the decision could well be to wait a tad longer before taking the plunge.

BoB’s Venkatesan echoes the sentiment on the need for a digital mindset: “The heart of the challenge for all banks, whether it is a private- or a public sector bank, is culture and capabilities. It takes a completely different mindset to really build a new digital bank.”

Say Hinduja and Rishyasringa: “Our first aha moment was when we realised firms were giving loans in the US within hours, and we asked ‘Why can’t we do this in India?’” This was in 2012 and they were inspired by companies like Lending Club, OnDeck and Kabbage. Capital Float was started the following year. Today India already has smartphone users hailing an Uber or booking a movie ticket, so “why should something as important as getting a loan be an antiquated brick-and-mortar experience?”

(Additional reporting by Shruti Venkatesh)

‘The Shift to a Digital Economy Will be Like a Tsunami’

Indian fintech companies are boldly going where no bank has dared to tread. Ravi Venkatesan, chairman of state-owned Bank of Baroda (BoB), says traditional banks must urgently find ways to shed their cultural rigidities and adapt to the evolving banking landscape.

On what beleaguers public sector banks:

The issue with most public sector banks, except the State Bank of India (SBI), is that they are focussed on the issue of non-performing assets and cleaning up their balance sheets. The process of recoveries tends to be a very time-consuming activity. This comes at a rather dangerous time, when you have the [digital] disruption happening. There is very little bandwidth or intellectual horsepower being focussed on this, which is seen as slightly long term. That’s the big issue. Financial technology doesn’t figure in the list of priorities for most state-owned banks. SBI is different because Arundhati Bhattacharya, to her credit, has focussed reasonably on the issue. At BoB, too, [Managing Director and CEO] PS Jayakumar and I are quite focussed on it. I don’t think this can wait till the current problems are resolved. This needs to be a vital board-level issue at all the major PSU banks.

The heart of the challenge:

It takes a completely different mindset to build a new-age digital bank. The challenge for all of us is: How do you bring in the kind of talent that is needed? How do you create an environment where such talent can innovate and be agile? In the new space, you have to take a lot of risk. At the end of the day, fundamentally, it is an organisational challenge for all of us.

At BoB, the vast majority of our business is corporate lending. So BoB must be a challenger and a disruptor, and not the disrupted. We have to see this as an opportunity and not a threat.

On the opportunity to leapfrog, just as in mobile:

[Former chairman of the Unique Identification Authority of India] Nandan Nilekani and his team, and networks such as Indian Software Products Industry Round Table (iSPIRT), are catalysing the fintech revolution in India. They are determined to build all the layers of the stack [a combination of four digital layers—biometric authentication, paperless records, cashless transactions and consent for data use—that India is building] and make it available to everyone; unlike in developed markets where commercial interests will build this one component at a time. It’s an open stack [anyone can offer services on it] that they call the India Stack.

The conditions for leapfrogging from a cash-based economy to a digital economy are far riper in India as a result. The shift won’t happen bit by bit; when it happens, it will be like a tsunami. We will likely see viral adoption like with WhatsApp.

On the new advisory council at BoB:

One of the challenges is how to tap expertise on a global basis, and it is hard for a public sector bank like ours to do so in traditional ways. At the end of the day, the board is nominated by the government and our ability to induct the expertise that we need is quite limited. We’re trying to bring advisors to the board in a few critical areas—fintech, risk management, HR and financial inclusion. For instance, we are working with a global leader in risk management in banking, with a seasoned venture capitalist who is making significant investments in fintech. It’s not a large number of people—it will be a handful of people, who will meet three or four times a year and make sure that our thinking and speed of execution are appropriate to these kinds of challenges.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)