How a musician CEO struck the right note with Himalaya Drug

Himalaya Drug Company reinvented itself to gain the first-mover advantage in the rapidly growing herbal-based drugs and personal care products segments

In December 1992, music channel MTV aired a music video titled ‘Hitting It Harder’, sung by Ahmedabad-based rock band Hammersmith. It had taken the band 10 years to get such a big break, with guitarist Philipe Haydon, 31, spending Rs 2 lakh of his savings to get the music video produced. That was not the only high point for Hammersmith. “We had a recording contract with Sony,” says Haydon. “We were about to sign on the dotted line and that’s when my dad [stepfather Hoshang Firoze] said that I had to figure out what I wanted to do because it would be tough to have a job and be a working musician.” And Haydon did have a job: He was a senior sales executive with Bengaluru-based Himalaya Drug Company, and had been promoted to zonal manager (in charge of two big markets, Karnataka and Kerala) from his previous role as regional manager of Gujarat.

“I never wanted to be a pharmaceutical guy,” says Haydon, now the president and CEO of the company for which he quit his band. “Fortunately, I listened to my dad and chose Himalaya, and it has been good.” Starting out as the company’s youngest medical representative, he has spent 37 years with the company, becoming the youngest regional manager, zonal manager, sales manager, general manager and CEO. “I’m now gunning to be the oldest guy on campus and the oldest serving [employee],” laughs the 53-year-old.

Haydon, however, did manage to get his own way with music as well: He is the vocalist and guitarist of the well-known blues-rock band Ministry of Blues since it was formed in 2006, and claims to be on a sabbatical for the last four months; up until last year, he managed to do around three gigs (performed on weekends) a month. But his alter ego had largely remained a secret to the company’s 7,000 employees, with only six people aware of it. His chairman, Meraj Manal, 70, has given him close to half the 20-odd guitars he owns as birthday gifts. “I have always had a bit of a split personality—a musician and a very serious business person. I believe in taking my work seriously and not myself,” says Haydon. He dedicates his personal time to practise music, which involves “discipline” and “sacrifice”, but adds, “It’s the same with my job at Himalaya. We cannot dream of perfection unless we work hard for it.”

In December 1979, Haydon, who was then a science student at St Xavier’s College, Ahmedabad, had got a job with Himalaya Drug Company as a medical representative, with some help from his stepfather, who was a senior manager in the company. The company’s then national sales head, who had trained his stepfather, would go on to train Haydon. He took up the job only to earn money and pursue his passion—playing the guitar.

At that time, Himalaya sold around 25 drugs in India; it’s most notable one being (and continuing to be) Liv.52, which was launched in 1955 for treating liver disorders. However, the company was better known for its other drug Serpina, believed to be the world’s first antihypertensive drug, launched in 1934, four years after the company was founded by Mohammed Manal, Meraj’s father.

A few months into his job, Haydon began to feel the pressure of being the representative of an ayurvedic drug maker that was trying to make its mark in the world of allopathic medicines. In early 1980, he went to meet a senior urologist at Vadilal Sarabhai Hospital, Ahmedabad, to promote Cystone, which helps dissolve kidney stones. The urologist had agreed to meet Haydon because he mistook him to be British.

“The doctor had one question for me: ‘If this product actually dissolves a stone, then why does it not dissolve the kidney?’” recalls Haydon. The question left Haydon tongue-tied and embarrassed as a group of “young foreign-educated doctors” burst out laughing at his plight. “I went home and told my dad that I wanted to quit.” But Haydon’s stepfather, who eventually retired from the company as general manager in 2000-01, said: “Ask the urologist what he prescribes to a patient with indigestion? He will, most definitely, say, ‘I give enzymes’. Tell him that enzymes aid in the digestion of food and not the stomach wall itself.” This answer, says Haydon, “left me armed with a new-found enthusiasm.” The next 27 years saw him steadily rise in rank within the company.

In 2007, Haydon became the CEO of pharmaceuticals, then the company’s largest business division. He went about launching new products and business verticals, such as prescription-based oral care. He is also credited by the company for revitalising its ayurveda medicine brands Liv.52 and Cystone. “Philipe is super at challenging the status quo,” says Manal. “He thrives on David-versus-Goliath scenarios. His passion, belief and contribution to Himalaya cannot be measured, and is highly infectious.”

He took over as the company CEO in 2012 and has since played a key role in transitioning Himalaya Drug Company from a herbal drug maker to an overarching wellness company that now boasts of more than 300 products across categories such as toothpastes, body lotions, face washes, shampoos, soaps, lip balms, pain-relief balms, nutrition products as well as ayurveda drugs for humans and animals.

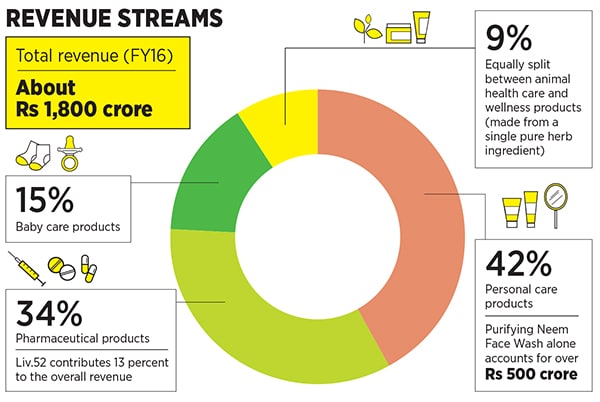

Till about 2004, Himalaya Drug Company had revenues of around Rs 200 crore, with 97 percent of revenue coming from ayurveda medicines. As of fiscal 2015-16, it had revenues of about Rs 1,800 crore (see chart), with only 34 percent of it coming from the pharmaceutical business (it has more than 60 ayurveda medicines).

About 42 percent of its turnover comes from personal care products, while nearly 15 percent comes from baby care products (launched in 2004) and the remaining 9 percent equally split between animal health care and the wellness categories.

Citing AC Nielsen’s market data, Haydon says Himalaya has a dominating 23.8 percent market share in the face wash category, well ahead of multinational companies such as Hindustan Unilever and P&G; its Purifying Neem Face Wash is its single largest revenue earner.

“Himalaya Drug Company has become an iconic wellness company,” says Vishal Bali, chairman, Medwell Ventures, a health care services provider. “From branded ayurveda therapeutics, the company has made a very impressive transition to broad-base itself into India’s first multinational wellness company.”

As per the latest IPM (Indian Pharmaceutical Market) data prepared by market research company AIOCD Pharmasofttech AWACS Pvt Ltd, Himalaya’s pharmaceutical business ranks at No 30 in a list of the top 150 pharma companies in India. Liv.52 ranks at No 9 among the top 300 pharma products. “Liv.52 is a classic example of having the highest brand value and volume compared to many other pharmaceutical products [allopathic] that have struggled to achieve sales of more than Rs 150 crore,” says Dr Anantha Narayana, former head of herbals research at Hindustan Unilever Research Centre and former director of Dabur Research Foundation. Liv.52 contributes approximately 13 percent to the company’s revenue.

Deepesh Garg, managing director of investment banking firm o3 Capital assesses Himalaya Drug Company as being “very profitable” and having a “very high cash flow” generating business.

While the company does not disclose its profits, Haydon admits it has been on a high growth trajectory over the last decade.

“We have been growing at a steady clip of more than 22 percent,” he says. While the company’s pharmaceutical business has been growing at 15 to 16 percent, its personal care division has been reporting growth figures “in the late 30s”. No wonder it is perpetually being courted by investors and larger multinationals. “I would say, on an average, about one serious offer each year,” says Manal. “One with cash plus an island and a yacht of my own!” The answer, adds Haydon, is always: “Guys, thank you, We are not for sale!”

In 1987, Manal effected a corporate restructuring and set up a parent company Himalaya Global Holdings Ltd, headquartered in the Cayman Islands, where the company’s first retail store was set up in 1996.

The parent entity has four subsidiaries with head offices in Dubai, Singapore, Houston and Bengaluru. Each hub has a CEO, and each region has its own manufacturing set-up. Haydon says the India entity is the largest of the four subsidiaries. “I dream of several Indias for Himalaya, each with its own localised R&D, manufacturing and marketing. Dubai has gotten there. The rest are on their way,” says Manal, who joined the company in 1964 and relocated to Dubai in 1999.

In 2002, the Himalaya Drug Company underwent a major rebranding exercise—it moved away from its yellow-brown packaging to a teal-and-orange colour scheme. The company’s logo changed from ‘HD’ to ‘Himalaya Since 1930’.

In 1999, the company had launched a brand called Ayurvedic Concepts to tap into the personal care market. However, consumers were not able to associate Himalaya with Ayurvedic Concepts. “The launch of Ayurvedic Concepts is what triggered the umbrella branding under which there would be many business verticals,” says Haydon. This decision gave the company a first-mover advantage in a sector that is fast gaining traction.

Today, the concept of ayurveda is present across different product categories, following a clear shift among consumers towards it. “These products typically command a premium over traditional FMCG products,” explains Garg of o3 Capital. “It’s a high-margin niche segment that is being created in almost every FMCG category.” Anil Talreja, partner, Deloitte Haskins & Sells, believes there is a positive perception about herbal products. “This is one reason why companies that manufacture or trade in these products are on a positive growth trajectory,” he says.

Gaurav Narang, co-founder of Medybiz Pharma, a specialty pharmaceutical distributor, says well-educated people are also willing to experiment with ayurveda. “However, it is for specific types of ailments,” he says. He adds that people mostly prefer allopathic medicines for quick relief or life-threatening ailments and estimates that for every 100 people taking allopathic medicines, 10 are moving towards ayurveda.

But despite its achievements, Himalaya faces several challenges. For one, allopathic doctors are still not comfortable with non-allopathic medicines. Dr M Udaya Kumar Maiya, medical director of home health care service provider Portea Medical, says, “Personally, my experience with Liv.52 is that I don’t know if it works. But, whenever a patient asks me if they can take it, I say go ahead. I know in the best of cases it does nothing, and in the worst of cases it does nothing.” Maiya, however, admits that most allopathic doctors are not conversant with ayurveda medicines. That said, today, more than 4 lakh doctors across India recommend or prescribe Himalaya Drug Company products, which are in fact not prescription-based, according to the company.

“Their greatest challenge now would be the emerging ayurvedic industry driven by Patanjali Ayurved of Baba Ramdev and other ashrams, including Sri Sri Ravi Shankar’s group,” says Dr Ranjan R Pai, MD and CEO, Manipal Education and Medical Group.

Hayden believes the entry of new players would help grow the market, but says, “Our core differentiator is our focus on research.” The company has over 290 multidisciplinary research scientists working on product formulations, combining the traditional wisdom of ayurveda with modern scientific research. On an average, it takes the company three to four years to launch a personal care product.

Over the next three to four years, Himalaya plans to evolve into a multi-specialty company that targets the entire wellness spectrum, using ayurveda. Currently, the wellness market in India is estimated to be worth Rs 1 lakh crore, growing at 15 to 17 percent per annum; at least half of this market caters to personal care products. In recent months, Himalaya has expanded its personal care offerings with a new range of premium lip balms and moisturising creams. Haydon claims they have a robust pipeline of “more than 60” in the wellness category. “We are defining the wellness space through head-to-heel products that will touch every life stage of a consumer,” says Manal.

The company is also planning to expand its reach—offline and online. It has 169 exclusive Himalaya stores, which have grown by 20 percent in five years. After having launched its own ecommerce portal in 2008, Himalaya launched a mobile app in May this year. Already 25 percent of online sales are coming through the app. The company is working towards its ecommerce vertical clocking Rs 100 crore in sales by 2018.

For the musician-cum-C-suite executive, taking Himalaya Drug Company to the next level is an “obsession” now. He wants to be around when the company becomes a billion-dollar entity, which he is hopeful about in the next five years. On a more philosophical note, he says, “Music has taught me to be more empathetic and has given me the patience to manage different temperaments.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)