How TPG helps companies make a turnaround

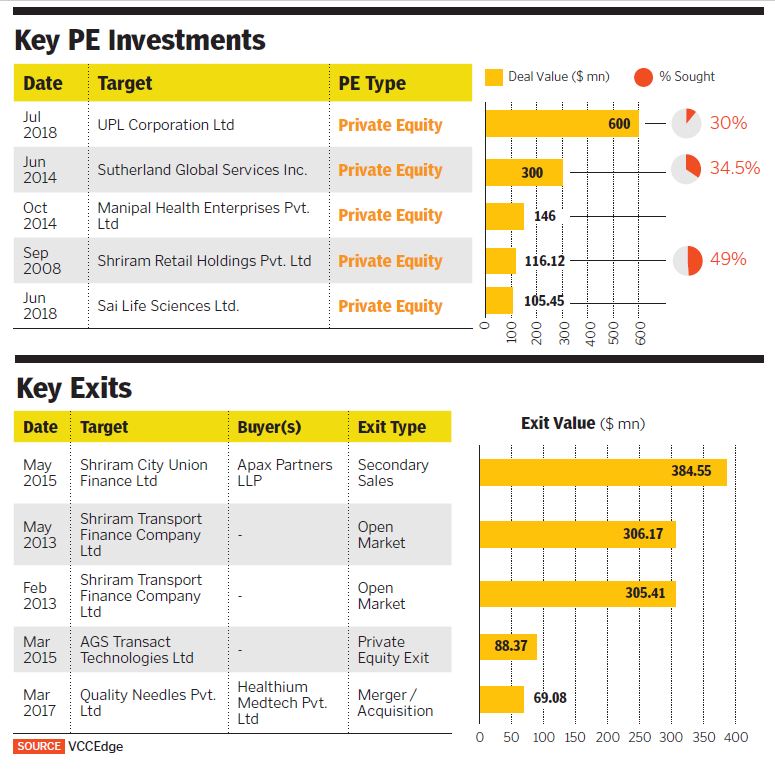

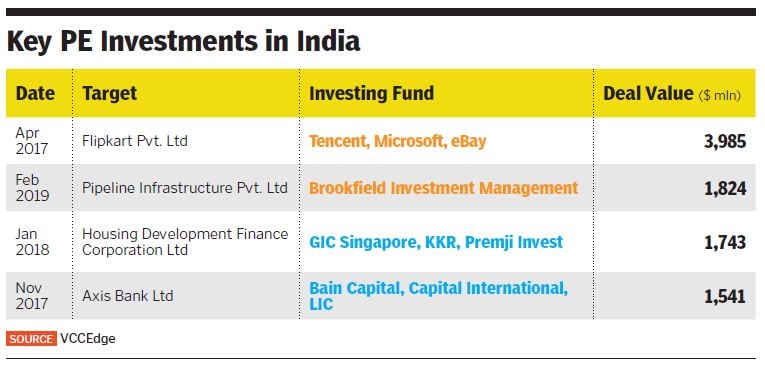

TPG has deployed nearly $2 billion in India, in a deal spree across verticals

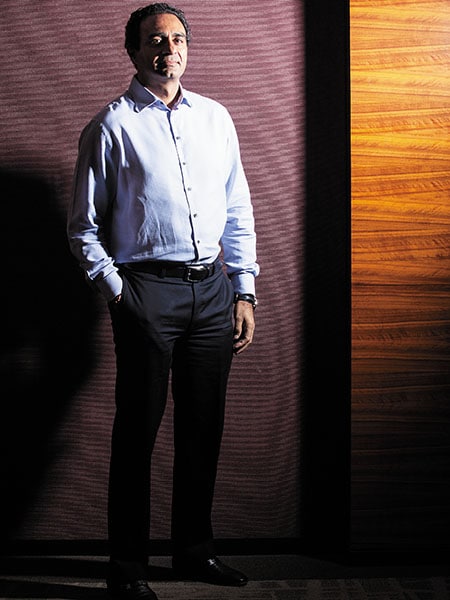

Puneet Bhatia, MD and country head of TPG Capital in India

Puneet Bhatia, MD and country head of TPG Capital in IndiaImage: Aditi Tailang

Jet Airways is operationally dead following a spate of unsurmountable problems. One person had seen the writing on the wall before the airline was grounded. “Sometime it’s not a good thing when you have more knowledge and understanding [of the situation]. An airline dies slowly, but when the decline starts, it nosedives. We could almost foresee frame by frame how this [Jet] movie will play out and that is exactly how it happened,” says Puneet Bhatia, co-managing partner and country head of TPG, a global private equity (PE) firm.

Bhatia is no stranger to how airline bankruptcies happen, having seen over a dozen across the world in two decades. In fact, TPG’s first ever deal was buying out the then-bankrupt Continental Airlines in 1993. It sold it for 10 times its investment value in 1998.

TPG’s India team met the stakeholders at Jet Airways last September to warn them of the airline’s precarious future. They offered pre-conditions to buy it and said if Jet did not move fast, things would go downhill. Bhatia and team spent a considerable time on the transaction, but the deal did not materialise. The lenders choked after committing nearly ₹200 crore in the now-defunct airline. Parking slots were given away and lessors started giving the planes to other airlines.

Jet was on the verge of shutting down, but the lenders believed otherwise. The airline met with a painful end in March.

Resurgence Man

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)