Kenneth Andrade - The Mid-Cap Mogul

When most savvy investors are shunning mid-cap companies, fund manager Kenneth Andrade has just begun a buying spree

Every morning around 8:30, Kenneth Andrade is usually among the first employees to walk into the plush IDFC Mutual Fund office at Indiabulls Centre in Mumbai’s Lower Parel. The 42-year-old chief investment officer tends to be a loner, who keeps to himself and prefers not to interfere with other people’s work.

Of late though, his colleagues say Andrade has become a bit more aloof, choosing to retreat inside his cabin on the sixth floor. There, he stays put for hours, poring over a set of historical charts. For casual observers, it would seem as if Andrade is on a new secret mission.

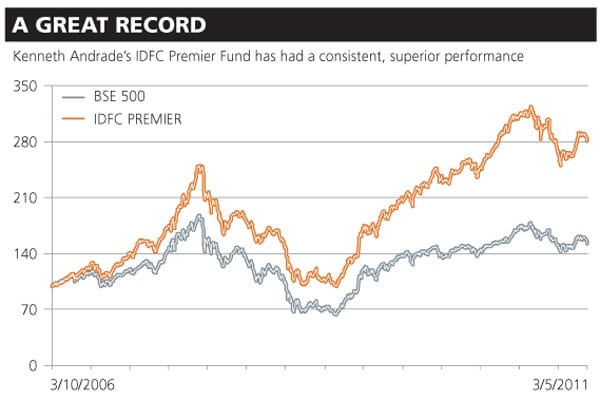

And they wouldn’t be far off the mark. The crack fund manager is entering an intensely critical phase in his career — one that could determine the future of the IDFC Premier Fund, the country’s most successful mid-cap fund. With a corpus of Rs. 2,000 crore, IDFC Premier is the second biggest in its genre. At 16 percent annually for the past three years, its returns have been more consistent and better than the Goliath in the space, Reliance Growth Fund, and significantly more than the measly five percent which the BSE 500 has generated.

Over the past five years, the consistent superior performance of the IDFC Premier Fund has also built a formidable reputation for Andrade as a mid-cap specialist. He manages around Rs. 5,000 crore of equity for IDFC Mutual Fund which has a size of Rs. 21,000 crore.

With mid-cap stocks under severe pressure in the last six months, Andrade’s fund has struggled to keep up his performance record. And then he made his contrarian move: In April this year, he opened his fund for subscription for a period of six weeks.

Now, IDFC Premier has a unique structure: It allows new investors into the fund only when Andrade senses an opportunity. Investors are allowed to exit any time.

Since 2005, Andrade has opened the fund only four times and has ended up collecting big monies from investors when the markets were down. The last time he opened the fund in February 2010, it collected Rs. 100 crore. At that time too, the stock markets had gone into a similar funk.

His latest drive has delivered spectacular results: By May 16, when subscriptions closed, the fund had collected a whopping Rs. 250 crore, the highest ever collections earned by any exit-only fund in this market.

So what’s prompted Andrade to remain ensconced in his office and put off the celebrations? Most of his peers in the fund business have either shifted their focus to large-caps or sold off parts of their portfolios to sit on cash to meet redemption pressures. Andrade, on the other hand, is plotting to buy more mid-cap stocks in a falling market. This is exactly how he’s operated in the past too. Over the next few weeks, Andrade’s new shopping list of stocks will be gradually revealed, as he figures out the contours of his new buying strategy.

Yet, the falling market is already beginning to test Andrade’s courage of conviction. His reputation was built on an uncanny ability to spot high-growth companies well ahead of the rest — and then stay invested in them for years. Yet, the bear phase has tested some of his best picks of the past.

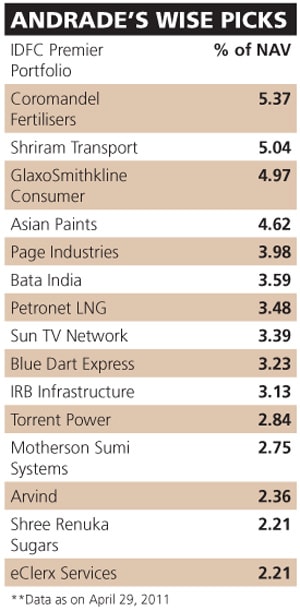

Take for instance, Shriram Transport Finance, which is IDFC Premier’s second biggest holding at five percent. The stock has fallen by 16 percent over the last six months. During the same period, the mid-cap index has dropped 15 percent. Andrade has to now decide whether the fundamentals on which he picked the stock are still intact. “When you see a stock fall, you need to go back to the (original) premise to check if anything has changed in the positioning of the company when you took a call on that stock. So far, I have not found any fundamental change in the company,” says Andrade.

Unlike other fund managers, Andrade not only relies heavily on his set of stocks picks, he also has the ability to benefit from big investing themes. At this point, he’s bet a whopping 45 percent of IDFC Premier’s assets under management (AUM) on stocks that are a part of India’s burgeoning consumption story. Yet, he will not be buying any new companies in this segment. But he expects the existing companies in this segment to grow and account for around 70 percent of the portfolio in the coming years.

Given the high degree of concentration risk, most seasoned market players are following his moves very closely to see if his winning streak will sustain. “Kenneth is probably the best example of the rational contrarian in the Indian mutual fund industry. His methods are typified by keen attention to details. He has a highly disciplined approach to stock selection and the belief that risk adjusted value triumphs in the long run,” says Sanjoy Bhattacharya, Partner, Fortuna Capital and a Forbes India columnist.

On a risk adjusted return score, measured in terms of the Sharpe ratio (returns divided by the standard deviation), Andrade’s Premier score is at 0.45, the best in the industry. The ratio basically looks at volatility to help understand how the fund gets steady returns.

So here’s the moot point: Can Andrade find the next set of picks and build a winning portfolio in a market that’s spooked most fund managers? The answers are no different from what Andrade has done to build his portfolio in the past.

All Eggs in the Basket

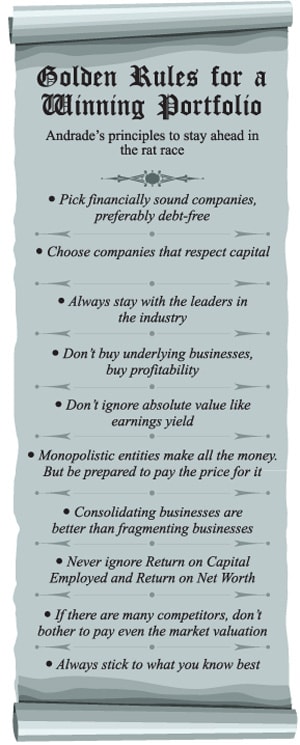

Andrade follows simple thumb rules of investing. While planning his portfolio, Andrade has a disciplined approach. When he enters a new space, he prefers to buy all the leading stocks in that space. Then he keeps a watch on their performance. He uses the data put out by all the companies in that segment to evaluate how to fine-tune his holdings. When it becomes clear that one company is likely to race ahead, he gradually moves out of the other stocks and focuses entirely on that company.

Then again, in cyclical industries, Andrade believes that smart capital allocation makes all the difference between a successful company and an also-ran. And that debt is an albatross on a company’s growth margin. So, irrespective of their market capitalisation, he chooses companies that are debt-free.

“I like companies that respect capital. Equities are about buying efficient capital delivered by underlying businesses,” he says. For instance, in 2006, Shree Renuka Sugars had a market capitalisation of Rs. 3,600 crore compared to the market leader Bajaj Hindusthan at Rs. 7,058 crore. The promoters of Renuka Sugars were baffled by Bajaj Hindusthan’s higher market capitalisation. They felt that they should be on par as the company was strong on all financial parameters. Investors were making a beeline for Bajaj Hindusthan. But Andrade liked Renuka Sugars because it had set up capacities at low costs and had a scalable model for bigger capacities at half the capital cost. Bajaj Hindusthan had a capital-intensive model.

When the sugar industry hit a low point immediately after the downturn in 2009, things changed. Bajaj Hindusthan borrowed heavily to survive. It was saddled with a Rs. 4,500 crore debt and its market capitalisation fell to Rs. 1,500 crore. Renuka Sugars emerged from the downcycle with a market capitalisation of Rs. 4,000 crore — and an opportunity to go on a big acquisition drive to de-risk its portfolio.

And finally, he has a fondness for companies that operate in virtual monopolies, even if it means paying a premium. For instance, VST Industries has a clean run as a maker of mini-cigarettes in the Re. 1 and Rs. 2 price band. There are no big players in this segment. Andrade says that companies in this segment will cater to the users of chewing tobacco who want to smoke. And this is a huge market in India.

There’s another rule that he says he religiously sticks to: “I like to stick to what I know”. For a long while, he bet on Pantaloon Retail, till it became apparent that the cash flows were simply not coming through as anticipated and the debt was still large. He got out of the stock last year. On the other hand, even though the infrastructure space is being beaten down by the markets, Andrade remains bullish on a player like IRB. He says the company operates in the 561 km Ahmedabad-Baroda stretch and traffic on this stretch is expected to grow tremendously, thanks to the country’s GDP growth. Back-of-the-envelope calculations suggest that IRB could collect Rs. 20,000 crore in toll by the end of 2020. These are the types of businesses that Andrade believes will outlive any recession.

Patience Has Its Rewards

Despite his obvious success, Andrade may have been a late bloomer. Before he moved to IDFC, Andrade was managing the Kotak MNC and Kotak Midcap Fund of the Kotak Mahindra Group. Vetri Subramaniam, the then head of equities at Kotak Mutual Fund, feels that Andrade is disciplined and has the ability to nurture a stock and allow it to grow. This is a rare ability in fund managers.

Subramaniam was head of equities at Sharekhan when he first hired Andrade in 1998. A friend of Subramaniam’s had referred Andrade to him as a young fund manager who was looking for a break. Subramaniam, on the other hand, was looking for a stock picker who would think differently from him. After four months of negotiation and four interviews, Andrade joined Sharekhan in September 1998.

“I was convinced about him from the beginning. I wanted someone to complement me. I have a very top down approach to stock investment and he is completely bottoms up. He is an excellent stock picker and his ability to understand and simplify balance sheets is very good,” says Subramaniam who now heads equity at Religare Mutual Fund.

When Rajiv Lall, MD and CEO of IDFC, decided to buy the Standard Chartered Asset Management Company (AMC), Andrade, who was responsible for managing the equity portfolio at Standard Chartered AMC, came as part of the asset. IDFC needed someone like him to kick-start

their AMC business.

At IDFC, Andrade is now brimming with optimism in spite of the drubbing that the mid-cap market has taken. He is hinging on India’s consumption cycle to bail out mid-cap companies. “We are hardly 25 percent into this (consumption) cycle. One of the biggest drivers for this change is the fact that you have migration happening from rural to urban areas which will help consumerism,” he says.

In the last 10 years, India’s per capita income has crossed $1,600, but is still 60 percent lower than China’s. In another 15 years, he asserts, India and China will account for 30 percent of the market capitalisation and 40 percent of the world population. And when that happens we can expect the market to go up by four times from its present position.

“What outsourcing was to the ’90s and infrastructure in the last decade, globally, consumers can dictate the next decade,” he says. No wonder that India has followed in the footsteps of other countries to boost consumerism — lowering interest rates and increasing salaries. The increase in salaries has also put three public sector undertakings (PSUs) in the top five paymasters’ bracket in the Index. And this is the group that Andrade is pinning his hopes on as they account for 17 percent of the population. He believes that these are the people who will not downtrade in any kind of economic scenario.

“These are not the people who will be affected by a rise in interest rate. They will go and buy their favourite bike cash down,” he says. When people begin to uptrade, they will move to costly brands. And that’s precisely the reason why Andrade is betting on companies like Page Industries which owns the Jockey brand.

Brand was also on Andrade’s mind when he chose Asian Paints. In 2008, profits of Asian Paints were flat though the topline growth was 20 percent. During the same time, other companies saw sales as well as profits fall. Asian Paints gained market share by holding its pricing.

Today, Asian Paints has twice the profitability of the entire sector and thrice the distribution strength. “I don’t like to buy underlying businesses, but I like to buy profitability,” smiles Andrade. He knows that Asian Paints will maintain its number one position for a long time.

Andrade has been picking winning stocks through the infrastructure and IT boom. He is now eyeing infrastructure and outsourcing stocks to bring his tally of stocks to 45. After watching the trends, he will consolidate it back to 30.

He knows that the market can topple him any time, so he keeps his cards close to his heart even as his favourite Beatles song, “It’s been a hard day’s night,” fills his office on a Saturday evening.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)