Motilal Oswal: The value miners

Within a short span, Motilal Oswal's mutual fund schemes have become category toppers. Co-founder Raamdeo Agrawal credits this to their philosophy of value investing that has worked for all the businesses of the group

It is late afternoon when Forbes India meets Raamdeo Agrawal, 59, at his corner office at Motilal Oswal Tower in Mumbai’s Lower Parel. The joint managing director (MD) of Motilal Oswal Financial Services Ltd (MOFSL) has a Moscow-bound, red-eye flight to catch in a few hours and he has made time for this conversation in between a bunch of office meetings.

The eighth-floor office provides a peek into Agrawal’s personality and also the investing style of his company. There is a cabinet packed with books on topics ranging from investment to management; among them, Eric Ries’s The Lean Startup and Clayton Christensen’s The Innovator’s Dilemma. There are hardly any books on stock markets or short-term trading.

Also on his desk is John Kay’s Other People’s Money, a book he has been recommending to his team lately, and four other books he plans to read on his flight. All of them deal with how to build and sustain businesses. “We have a culture of reading in this office. It helps us work on new ideas,” says Agrawal.

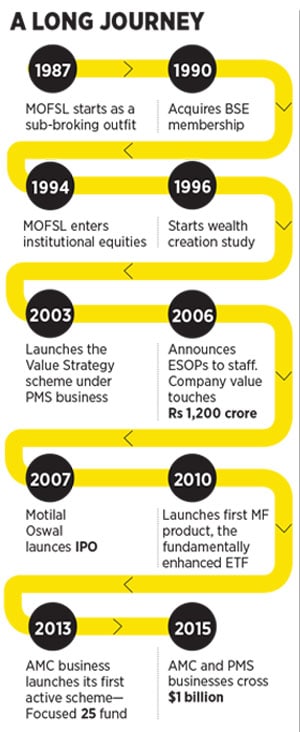

He is proof of that. Agrawal has used his bookish knowledge practically. It helped him start MOFSL, with close friend Motilal Oswal, in 1987 as a sub-broking firm and grow it into a financial conglomerate with interests in broking, private equity, home loans, portfolio management services (PMS) for HNIs and most recently mutual funds. In FY16, the group garnered revenues of Rs 1,055 crore and a net profit of Rs 163.32 crore.

But it was building the mutual fund business that tested the patience of Agrawal and Oswal. Motilal Oswal Mutual Asset Management Company was a late entrant in the market. It began in 2010 by selling exchange traded funds (ETFs), which were not successful and Agrawal had to revisit the idea. In 2013, in a change of strategy, the mutual fund business launched actively-managed funds, which turned out to be a key decision of his professional life.

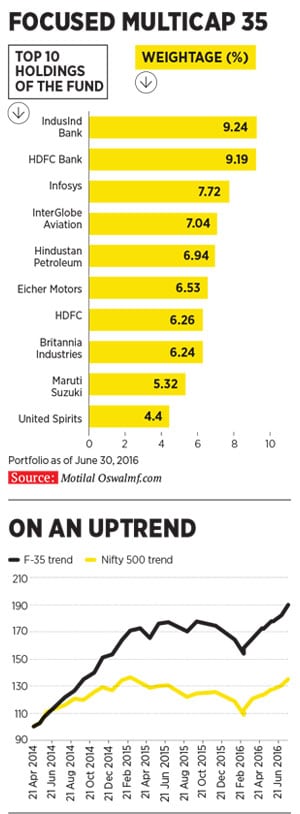

That year, Motilal Oswal Mutual Fund launched three schemes in the large-, mid- and multi-cap segments, which have outperformed their respective categories. The flagship fund, Focused Multicap 35, has delivered an annualised return of 26 percent over the last two years, compared with 9 percent for the BSE 500. The Focused Largecap 25 has returned 14.62 percent against the Nifty’s 5.76 percent in the same period. The Focused Midcap 30 has delivered returns similar to the Multicap 35. MOFSL currently manages equities to the tune of Rs 10,000 crore, of which Rs 5,420.52 crore is in the mutual funds business and the rest in the PMS business.

“Building the mutual fund business was tough. We were the outsiders. It took us time to crack the code but we finally did it. We never hired any of our fund managers from the mutual fund industry; all our talent is homegrown,” says Motilal Oswal, 54, chairman and MD, who has oversight of the overall business while Agrawal manages the investment piece.

The mutual fund had to go through a lot of pain in its initial years, before active funds were launched. The firm hired Nitin Rakesh as the CEO and MD of the business in 2008. The maiden mutual fund offering, in 2010, was known as India’s first ‘fundamentally-enhanced’ ETF, popularly called active ETFs. ETFs are products that track an index by investing in a fixed portfolio of stocks and can be traded on the bourses. ETFs had been around in India since 2001. But the idea of an enhanced, or active, ETF was new. In an active ETF, the fund manager tries to enhance returns by actively changing the weightages of the stocks in the portfolio. Agrawal gave Rakesh the go-ahead to test the waters for the product in India.

Rakesh had led the India operations of State Street Syntel Services, a joint venture between State Street Bank and Syntel, for six years till 2008. He had focussed more on product development and risk management in his career than investment management. Rakesh felt India was ETF-ready.

Inevitably, the fund’s ETFs did not meet investor expectations and by 2012, Rakesh moved out of the Motilal Oswal group. The fund house then converted their one active ETF into a passive ETF, and also shut down their gold ETF and gilt fund.

Next, Agrawal started to look for a new CEO and met Aashish Sommaiyaa who was working with ICICI Prudential AMC at the time. This was in September 2012. Agrawal told him that he wanted Motilal Oswal Mutual Fund to become a product manufacturer and that Sommaiyaa would have the mandate to launch new products there, apart from reviving the struggling ETF business.

Sommaiyaa knew Agrawal was one of the best value investors in India. To him, it made more sense for Motilal Oswal Mutual Fund to embrace the same value investing principles of the group’s other businesses than pursue ETFs. Agrawal was already running a proprietary book (his and partner Motilal Oswal’s personal wealth) of around $100 million. He had made some spectacular bets that had garnered sky-high returns. His investments in companies like Hero Honda, Bosch, Bharti Airtel, Gruh Finance and Infosys had earned him a fan following among long-term investors.

“All I had to do was nudge Agrawal and tell him that the investment philosophy that he followed for his personal wealth would work for the mutual funds business as well. He had a good track record managing the group’s PMS business too,” recalls Sommaiyaa.

At MOFSL, Agrawal had ensured that every employee had imbibed the philosophy of fundamental investing and holding stocks for the long term. In 2003, he started the Value Strategy scheme—which emphasised long-term investing—under the PMS business of the group. The scheme has given returns of 26 percent over the last 13 years against the Nifty’s 17 percent.

“When it comes to investing, Agrawal believes a lot in research. He starts with growth and then looks at value. He is a very disciplined investor and pays attention to the quality of management. There are times when he doesn’t mind paying a higher price for a stock when he is convinced about the business,” says Nirmal Jain, founder and chairman, India Infoline Finance Ltd (IIFL). He helped set up Enquire, the equity research division of Motilal Oswal in 1994. Recently, IIFL Wealth, the private wealth management arm of IIFL raised Rs 600 crore for the PMS business of Motilal Oswal.

In 2010, Agrawal gave Manish Sonthalia, an old hand at Motilal Oswal, the mandate to run the Value Strategy scheme. He then took a back seat and became the group’s investment philosopher and guide. The stocks comprising the Value Strategy scheme were few in number and were chosen on the basis of their fundamentals. Agrawal stipulated that the stocks in the scheme pass through the QGLP filter—Quality (of management), Growth (in earnings and sustained return on equity), Longevity (of competitive advantage) and Price (paying a fair price for a good business).

“Agrawal has a deep knowledge of the competitive advantages of companies. In 2004, he told me that holding companies in India do not get good valuations. He has been so right about it,” says Sonthalia. He adds that Agrawal’s attention to research has worked wonders for the PMS business.

Agrawal’s initiation into value investing began in 1995. Sanjoy Bhattacharya, who runs the investment firm Fortuna Capital, gave Agrawal a copy of The Warren Buffett Way by Robert G Hagstrom. Since then, Agrawal has followed the Oracle of Omaha’s investment philosophy of identifying value stocks and holding them for the long term.

For instance, Agrawal’s bet on Hero MotoCorp (then Hero Honda) is market legend. In 1995, he invested around Rs 10 lakh in the shares of the two-wheeler manufacturer at Rs 30 apiece, and held on to them for the next 20 years, till the share price rose to Rs 2,600 apiece. When he sold out in 2015, his holding in Hero MotoCorp was earning him Rs 3-4 crore annually in dividend income alone. What makes this all the more noteworthy is that the rise was peppered with many dull periods.

Between March 2000 and March 2001, for instance, the stock traded around Rs 170. It was the dotcom boom era and non-IT stocks were undervalued. Agrawal stayed invested because of his faith in the Munjals, the promoters of Hero MotoCorp. In March 2002, the stock was at Rs 365 apiece.

Again, in March 2011, many investors saw little value in the Hero stock after it parted ways with Honda Motor Company, ending a 20-year joint venture with the Japanese company. Agrawal was the contrarian. He knew Hero MotoCorp would lose its market share a tad, but he was sure the company would remain the leader in the two-wheeler segment. His confidence was validated: Between 2011 and 2015, the stock moved up by 13 percent annually. Though he has sold Hero MotoCorp from his personal portfolio, it is still a part of Motilal Oswal’s PMS schemes.

“What is really unique about Agrawal is that he has the ability to stay with a stock with full conviction even when it plateaus. In the case of Hero MotoCorp, there was a time when the share price simply did not budge for years. Very few investors have the patience to go through the business cycle with a company. Raamdeo has displayed the conviction and the patience to do,” says Kenneth Andrade, founder and CIO, Old Bridge Capital, and a mutual fund industry veteran and former CIO (equities) at IDFC AMC.

Thus, when Sommaiyaa accepted Agrawal’s offer to captain Motilal Oswal Mutual Fund in January 2013, it already had the right ingredients to market high-quality products. There was the track record of the PMS schemes and then there was Agrawal, the seasoned value investor.

While Agrawal felt that the market was crowded with too many active funds and there was a need to differentiate his company’s mutual funds with active ETFs, Sommaiyaa believed otherwise. He was of the opinion that there was enough space for a product that followed value investing to the core by taking concentrated bets. Most asset management companies claimed to be long-term value investors but the pressure to grow their assets and manage volatile equity funds was taking its toll. They were not able to meet investor expectations. He felt that Motilal Oswal Mutual Fund should launch classic active products that will invest in few stocks, like with the PMS business. Agrawal liked the idea and they filed with the Securities and Exchange Board of India (Sebi) for their first classic active fund.

Meanwhile, his partner Motilal Oswal was asking Agrawal to collapse the proprietary book and move that money into the mutual fund business. The idea was to align the company’s interests with that of the investors. Agrawal was initially averse to the idea. He had built a portfolio of $100 million over the last 20 years and it was a difficult decision to shut this down. But Oswal convinced him. “Moving our proprietary money into the mutual fund was the best way to tell the customers about our conviction in the product,” Oswal tells Forbes India.

The mutual fund had already filed for the large-cap Focused 25 fund in May 2013 and Agrawal felt that it made sense to move the proprietary book into the mutual fund business. In 2014, the mutual fund launched the Focused Midcap 30 fund and the Focused Multicap 35 fund. By April 2015, Agrawal moved around $100 million into the three, but predominantly the Focused 35 scheme. Similarly, Agrawal also collapsed the corporate treasury and invested the money into the same schemes. As of May 31 this year, the Focused 35 has a corpus of Rs 3,765 crore. The funds have a high exposure to InterGlobe Aviation that runs Indigo Airlines. “This is a company that perfectly fits into our QGLP matrix. The headroom for growth is there in the aviation business. Here is a company that has made an asset light business with low debt. It is basically a service offering. The market is growing and Indigo has a 38 percent market share. The business throws out cash. It is sustainable,” says Taher Badshah, chief investment officer of the mutual fund business.

In essence, everything fell in place when Agrawal decided to look at mutual funds the way he would manage his personal wealth—through the value investing philosophy of Buffett. In fact, Agrawal travels to Omaha every year to attend the Berkshire Hathaway shareholders’ meet and hear Buffett speak.

Critics argue that Motilal Oswal’s mutual fund schemes succeeded because they were launched when Narendra Modi was declared the BJP’s prime ministerial candidate in September 2013. The market went up by 40 percent in the next one year. Many analysts say it was prudent timing that helped these schemes top the charts and growth may not be sustainable. They also say the investment business at Motilal Oswal is a one-man show and Agrawal doesn’t have a succession plan.

But Agrawal counters this: “Our investing business is based on processes that everyone in the company follows. I’m more of a philosopher-guide. The entire business is looked after by professionals that worked through the ranks.” Sommaiyaa concurs. He says that the business of Motilal Oswal is based on solid ideas and they have the ability to destroy the ideas that don’t work. He recalls his first day in office. Agrawal called him for a meeting and gave him Joan Magretta’s Understanding Michael Porter: The Essential Guide to Competition and Strategy, and told him, “These are my views on how a business should be built.”

The book summed up the core idea in the first few pages: ‘Aim to be unique and not the best’. Creating value is more important, not beating competition, Agrawal told Sommaiyaa. And, as with other businesses, value investing has worked for Motilal Oswal’s mutual funds too.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)