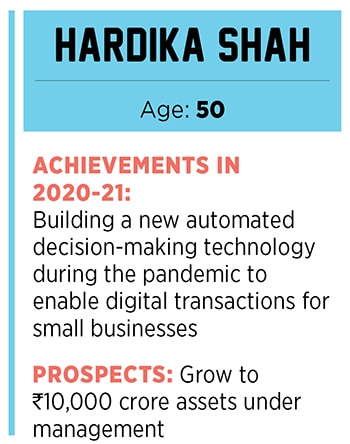

Hardika Shah: Helping small businesses grow

Shah's Kinara Capital works on financial inclusion and has led to an incremental income generation of Rs 700 crore for small business entrepreneurs, and led to more than 250,000 jobs created or sustained

Hardika Shah, founder and CEO, Kinara Capital

Hardika Shah, founder and CEO, Kinara Capital

Image: Selvaprakash Lakshmanan for Forbes India

In 2014, Iswarya and Mohan Babu set up Mukund Automats, an automobile parts manufacturing business, but the first-generation entrepreneurs struggled to run it without a loan. The Bengaluru-based couple poured in their savings into buying some machines and hiring three workers. After struggling for a few years, they came across Kinara Capital, a fintech non-banking financial company (NBFC).

In January 2016, they secured a loan of ₹7.25 lakh from Kinara Capital. “After that, we grew and grew. We now employ 50 people. Our monthly turnover is ₹30 to 40 lakh,” says Iswarya. When the business expanded suddenly, they needed some more capital. Mohan adds, “Even with a running loan, Kinara Capital was willing to provide us with a second loan.”

This is only one of the many small businesses Kinara has helped grow. The social impact of the NBFC’s financial inclusion work has led to an incremental income generation of ₹700 crore for small business entrepreneurs, and led to more than 250,000 jobs created or sustained, says the company. “This,” says Hardika Shah, founder and CEO, “was our mission from the very beginning and, over the last 10 years, we haven’t wavered from it.”

Growing up in a middle-class Gujarati family in Mumbai, Shah saw her mother struggle to raise capital for her small business. At 17, she left to pursue her undergraduation in computer science from Knox College in Illinois, USA. After completing an MBA from a joint programme between Columbia Business School and UC Berkeley’s Haas School of Business, she joined Accenture. She was also working as a pro-bono mentor at top social entrepreneurship programmes, including at Santa Clara and Stanford University, where she was often reminded of the challenges her mom faced in raising capital.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

While gauging the trust of SMEs was relatively easier, finding lenders and investors to trust her business model was a task. She recalls, “They would question ‘how can unsecured business lending work?’ The second was getting them to take that leap of faith on Hardika the promoter, who had moved to India after 23 years with no direct

While gauging the trust of SMEs was relatively easier, finding lenders and investors to trust her business model was a task. She recalls, “They would question ‘how can unsecured business lending work?’ The second was getting them to take that leap of faith on Hardika the promoter, who had moved to India after 23 years with no direct