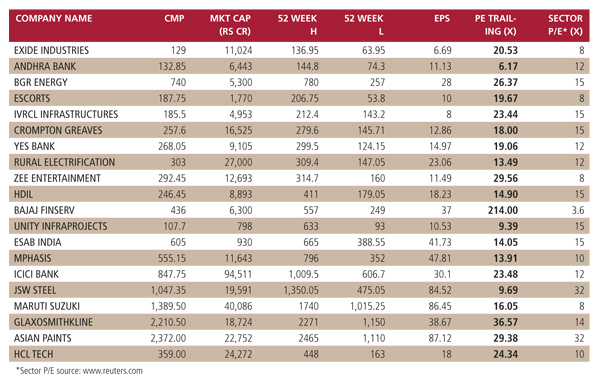

20 Stocks You Must Own

Last year, we suggested a portfolio to take advantage of fallen valuations. This year our theme is capital conservation for decent returns

Around this time last year, Mumbai was still impatiently waiting for the arrival of the monsoons. It would have been the season’s best reprieve for anxious investors who were till then reeling under the heat of a global market meltdown. In retrospect though, it may have been the ideal starting point for Indian investors.

Exactly a year before now, in our first cover story on the markets, we had recommended that investors resume buying. We had recommended a portfolio of 20 stocks that would mirror an array of opportunities the Indian economy presented.

A year later, barring two companies, the portfolio has ended with positive returns. Three companies P&G, Page Industries and Pidilite have returned 100 percent. Five other stocks gained 70 percent.

On the whole, the Forbes India 20 portfolio was up 54 percent, compared to 45 percent of the mid-cap index (most of our recommendation was from this category). The broad market went up by 15 percent during the same time.

To be honest, there were enough easy pickings. Many companies were powering ahead before the global bust and yet, their valuations had fallen off the cliff. Almost all our stock picks had a strong domestic story that helped insulate them from the global instability.

But that was last year. Many Indian companies are now quickly reaching their pre-slump level in sales. Having scaled back expansion plans, they will soon churn out their full capacities, leaving little headroom for volume growth.

Investors have already guessed that Indian companies will continue to perform well, and lapped up stocks at prices that have already discounted the current financial year’s earnings.

Our considered opinion is that any investments in the stock market may not yield above-average returns in the next one year.

High net-worth individuals (HNIs) have already moved from equities to structured debt products to signal the flight to safety. The fog of global uncertainty hasn’t quite lifted. On the contrary, economist Paul Krugman has predicted the makings of the third Depression. To cut a long story short, it will, therefore, be more difficult to construct a portfolio that will return as much as the one we chose last year.

In a fast growing economy, there are bound to businesses that will deliver better than average returns. We tend to lean towards the views of experts who reckon that the valuations of Indian markets at a P/E ratio of 18 times 2010-11 earnings cannot be considered as expensive. The historic average tends to be 20, while a ratio of 24 could well enter the danger zone.

Last year, we had five themes in our recommendations. We included ones that captured very risky bets (Suzlon and Wockhardt, two stocks in that category failed to deliver). We also included smaller cap companies like Page Industries among those that run ahead of the broad market in good times. The aim was to maximise gains rather than stay conservative.

There is a fundamental difference in the theme this year. Our immediate focus is to preserve capital, while aiming for decent returns (the long term returns from equities in India is 15 percent). So we’ve left out the relatively small companies, which typically fall harder in a downswing. Some of the other parameters have not changed. “This market is above fair value and investors should not overpay for growth,” says Rajeev Thakker, CEO of Parag Parikh Financial Advisory. We’ve retained our focus on picking stocks that have a large domestic play. We’ve also focussed on sectors that have shown dramatic consumption trends: Real estate, auto, banks and financial services. We’ve added the fast-growing infrastructure sector too.

Here’s a sense of why we selected some of the stocks and themes.

In the auto segment, we picked India’s largest car maker Maruti, tractor firm Escorts and battery maker Exide Industries. These stocks have run up in the recent past and seem fully valued. But the demand for small cars has continued to surge forcing Maruti to set up another plant. Trading at a P/E of 16, the stock still has a lot of steam.

Exide rides indirectly on the growing automobile sales – it makes nearly two-thirds of the batteries that go into cars and trucks. Exide’s core return on capital employed (ROCE) is at 85 percent and its management believes electric vehicles and hybrid vehicles could well be its next big opportunity.

The banking sector at the moment is valued on the higher side. But ICICI Bank is a good buy at 1.85 times the book value. Under CEO Chanda Kochhar, it has signaled a clear return to profitable growth. Yes Bank, on the other hand, plans to foray into the high-return micro-finance business. It is trying to improve its public deposits too. For the long term investor, this is one bank to catch at an early stage.

Bajaj Finserv is a good insurance play. The stock has performed well over the past three months, up 28 percent, after benefitting from RBI’s circular on revised norms for transfer of shares to overseas entities.

There are some unusual names in the portfolio. BGR Energy is one. BGR Energy is engaged in power equipment and construction and it is expected that the power generation capacities are expected to peak in India. Based on a recent Goldman Sachs report, BGR is expected to add $4.7 billion in orders and report 43 percent sales growth CAGR and 33 percent ROE over the next two years. Over the next year, analysts expect BCG’s share price to move up by about 25 percent.

Then there is IVRCL, the integrated infrastructure player, which gave a guidance of Rs 7,000 crore for its top line in 2010-11. It has a huge order book of Rs. 32,000 crore. On 2010-11 numbers, the company trades at a P/E of 12.2 times.

Indian IT firms may have lost a bit of their margins, but of late, they’ve gained at the expense of global tech majors Accenture and Oracle. We sense value in HCL Tech, which is fast improving its standing among the top four and has registered the strongest revenue growth in three of the last four quarters. Aggressive bidding during the slowdown gave HCL entry into marquee client accounts. Discretionary spending is returning sooner than expected, and we expect HCL to be a key beneficiary from the revival in ERP consulting projects. Besides, its valuation is cheap compared to its peers.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)