Taking Stock Of the Market

Given where the stock markets are, it is difficult for an average investor to decide whether to buy or sell. Here's making it easier

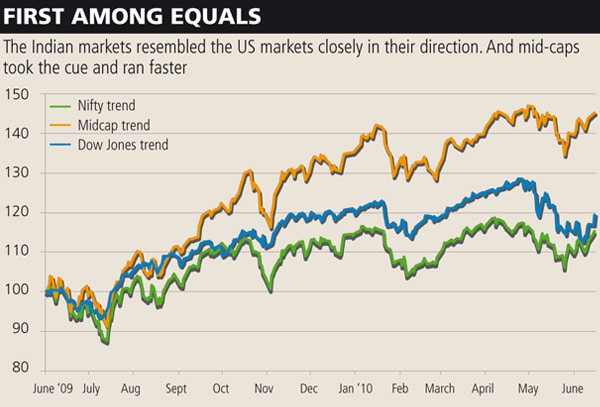

In the best of times, Shankar Sharma is the kind of man who can piss the eternal optimist off with his grim, almost Taleb-esque predictions. Over the last one year, the Nifty has moved up 15 percent while stocks of medium-sized companies rose three times as much. These are the kind of returns that have left investors in every other part of the world beady-eyed and glazed over with envy. Add to this the facts coming from the manufacturing economy: Automobile sales are robust and truck operators are back in the market looking to expand their fleets. These are indications of an economy on the trot.

But the chief strategist at broking firm First Global sounds resolute in his forecast: The markets will fall 20 percent. That’s 3,500 points waiting to be lopped off the BSE Sensex. “The correction will happen when you least expect it to happen,” he says. “We need to understand the world economy is not in the best of health and expecting Indian equities to do well is misplaced hope,” he adds with gravitas.

The problem with Sharma is he’s the kind of grim Oracle you can’t wish away. He’s the man who called the debacle that was 2008 much earlier than anybody else did.

Now, Ridham Desai works two kilometres away from where Sharma operates out of. The head of equities business at Morgan Stanley looks every part a man who believes the market will gain 10 percent over the next couple of months. He says Indian stocks are valued just about right — in fact, there’s some steam left in prices — and that the Sensex will breach 19,000 by the end of the year.

Why? Because, while the recovery so far from the economic slowdown has been led by consumption surge, growth is now coming on the back of investments that add capacities. Not just that, capacity utilisation in India’s manufacturing and services companies is going up sharply. There are gains to be had from that as well. He doesn’t care much for the fires burning in Europe and other parts of the world. The problem is, like Sharma, Desai cannot be ignored at all. Last year, he argued the Sensex would move from 14,000 to 19,000. It almost, almost got there.

But the bigger problem is for regular investing folks. Do you align with the Sharma camp and simply focus on protecting your backside? Or do you go with Desai’s world view and hitch your wagon to the stars?

Portfolio Players

Let us face it. It is not easy taking a call on the markets today. This is one of those extraordinary times when even the professional investors go numb with paralysis. In the web of complex variables that dictate the day-to-day movement of the stock market, there is no one who can see beyond current volatility.

The markets have surprised all classes of investors too often in the last couple of years. Fund managers repeatedly failed to outperform broad-market indices and old correlation theories between risky assets and safe havens turned to dust. Investors who sold off and went into cash hopelessly watched as the market suddenly turned course and gave 50 percent returns in less than a year. Most people who made money did so serendipitously. But the sort of punishment that the actively bullish and bearish investors got for their decisions has made most of them wary of taking a decision again.

But given that inertia isn’t a legitimate investing strategy, we must look for intelligent clues from the domestic and foreign markets and try to decode what the volatility and the rigorous imprisonment of the stock market in a 10 percent range tell us.