Can Infosys Move Out Of Murthy’s Shadow?

N.R. Narayana Murthy’s successor will have to be a bold risk-taker, open to radically new ideas. And some voices on the board think K.V. Kamath is the man for the job

Sometime last year, N.R. Narayana Murthy, chairman and chief mentor at Infosys Technologies, asked Jeffrey Lehman, chairman of the nominations committee at the company, if he could take time out to meet with M.S. ‘Vindi’ Banga over dinner in New York City. Lehman is entrusted with the task of finding Murthy’s successor by July next year. Banga, one of the front runners to take over as chief executive from Patrick Cescau at Unilever, the world’s largest consumer goods company, had just been beaten to the post by Paul Polman of Nestle. Murthy was keen for Banga to take over from him after his term ended. Not much is known how the conversation progressed that night.

Later in the year, Murthy invited Banga to Infosys’ headquarters in Bangalore to meet the others on the board. He’d pitched Banga to the others as a strong contender to his chair. At the meeting, Banga made a presentation on corporate governance, which he delivered with much élan. “I have enormous respect for Vindi. Yes, I’d like to see him on the board,” Murthy told Forbes India.

Soon after Banga left though, Lehman informally told Murthy the board would much rather back K.V. Kamath, non-executive chairman at ICICI Bank and an independent director on Infosys’ board. Kamath’s formidable reputation precedes him. Credited with building the largest private sector bank in the country, he’s got a lot going for him.

The younger leaders on the executive council (EC) at the company like him because they see him as the guy who asks all the tough questions at board meetings. To his credit though, he hasn’t shaken things up too much, perhaps in deference to Murthy’s presence. That said, fact remains, his tough guy image has spooked the founders a bit.

He’s popular with the second line of leaders at the company as well. They appreciate his incredible ability to groom professional CEOs, a breed almost missing at Infosys now because all along it has had one of the original promoters at the helm. Add to all of these the fact that Kamath is a Kannadiga — which can be handy when managing tricky political winds in Bangalore — and it’s pretty obvious why the board is rooting for him.

But Kamath isn’t the kind of man given to lobbying for a job and is said to have remained quiet through all the noise around him. Sources close to him say he wouldn’t mind taking on the challenge at Infosys. His legacy at ICICI bank is at the crossroads. Chanda Kochhar, his successor as chief executive, is now driving her own agenda. Besides, many of Kamath’s carefully nurtured CEOs have chosen to move out of the bank. It is a very different place now from what he had built.

Kamath declined to comment. Lehman says, “The board and founders have been thinking about it for quite some time. It’s a matter of great importance to this company. Murthy is a truly remarkable person and not easy to replace. The process of finding his successor is well on track.”

In the normal course of things, the appointment of a new non-executive chairman wouldn’t be such a life-altering decision for a company. But then, Infosys isn’t just another company. And neither is Murthy just another chairman. He was the best CEO and CFO rolled into one that the company ever had since the time it was founded in 1981. He’d figured how to manage the complex interplay among the co-founders.

In the normal course of things, the appointment of a new non-executive chairman wouldn’t be such a life-altering decision for a company. But then, Infosys isn’t just another company. And neither is Murthy just another chairman. He was the best CEO and CFO rolled into one that the company ever had since the time it was founded in 1981. He’d figured how to manage the complex interplay among the co-founders.

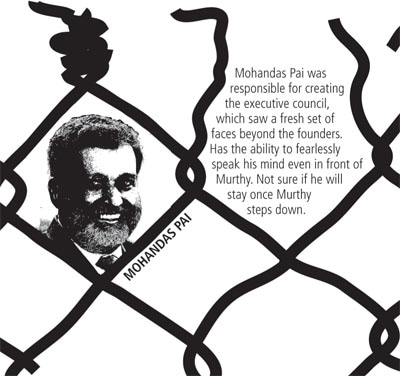

He also attracted fierce loyalties. Last year, for instance, Mohandas Pai, the head of human resources at the firm, told Murthy he’d throw in the towel the day Murthy hung his boots up. Murthy didn’t take too kindly to that. He promptly spoke to the Nominations Committee and asked them to counsel Pai why it isn’t such a good idea.

Even as he did all of this, he built an amazingly predictable cash machine that delivered consistent margins. There was one other thing about Murthy: As CEO, he was always willing to put his neck on the line and take tough decisions. In 1995, when GE held a gun to his head to drop its rates, Murthy decided to pull the plug, well aware that he was sacrificing a quarter of his existing business. Not only did Infosys recover all the lost ground in less than a year, it went on to post double-digit growth next year.

The outcome today is a $4.8 billion company with operating margins of 33 percent, a market cap of $39 billion, which makes it bigger than Accenture and cash reserves of $3.9 billion, making it the bellwether for the Indian IT services business.

But the model he built (delivering offshore services for application development and maintenance) is aging now. “Whatever decisions he took — building campuses, training, processes and quality — were good in a different time. Now we need a new thought process,” says a senior executive at Infosys.

Infosys under Murthy was all about predictability, sustainability, profitability and de-risking — the PSPD model as it is famously called. That is now under threat from a new phenomenon — cloud computing — a moniker for delivery of services over the Web on demand.

In the past, hardware companies like HP and IBM sold the hardware story while software companies like Oracle and Microsoft sold the software story. “Then there was us, services companies, who did the services number,” says a senior executive at Infosys who did not wish to be named. The clients don’t care anymore he explains. All they need is a solution and the only thing that matters to them is who delivers. “It is a whole new opportunity for Infosys to build a company that can dominate the future,” he says.

The big shift has already begun to play out: The integrated solution model. The big boys are already off the blocks. Oracle bought Sun, HP bought EDS and Dell acquired Perot Systems. Oracle’s Larry Ellison has bought 200 companies in the last few years. Soon enough, he’ll look at services companies as well.

The big shift has already begun to play out: The integrated solution model. The big boys are already off the blocks. Oracle bought Sun, HP bought EDS and Dell acquired Perot Systems. Oracle’s Larry Ellison has bought 200 companies in the last few years. Soon enough, he’ll look at services companies as well.

To live through these changes though, Murthy’s model will first have to be changed. The top team at the company has agonised over what the fallouts could be — including the much dreaded possibility of a decline in margins. Problem is, all the agonising hasn’t led to a consensus. Insiders say the team is split down the middle with one school of thought refusing to entertain even a single percentage point drop. Balancing these priorities will need nerves of steel. “Which is why, Kamath taking over may be a good thing for the company,” says the executive. “He can change the framework we operate in.”

Facing Change

There is nothing to suggest Infosys is on a slippery slope. Revenues are still growing at over 20 percent with net margins at 27 percent. By any yardstick, it’s been a phenomenal run.

But there are concerns the model is too linear. By the end of 2010-11, Infosys will have a workforce of about 125,000. While salaries and visa costs have gone up, what Infosys makes from its clients hasn’t kept pace. Just look at the revenue per employee. Accenture earns $128,624 per employee while Infosys makes only $44,288. (But Infosys’ profit per employee is $11,652, while Accenture’s is $10,487.)

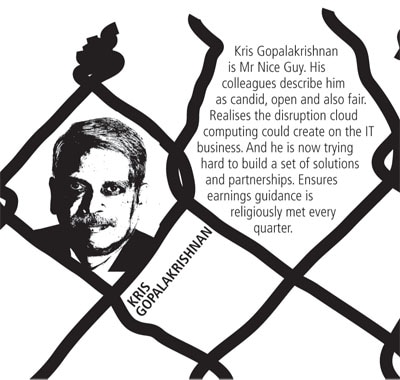

To address this issue, CEO S. ‘Kris’ Gopalakrishnan is pushing hard for more consulting-led work which brings in better quality of revenue. Over time, Gopalakrishnan says this will be 30 percent of the company’s revenue. Right now, it is in the region of 20-22 percent. But that is an easier problem to handle. The bigger challenge for Gopalakrishnan is to break linearity through new pricing models (where clients pay by the outcome rather than number of hours people work on an application); or new delivery models (where the same team works for different clients); or by creating IP (a combination of software, services, hardware); or even new software products (like Finacle, its core banking product).

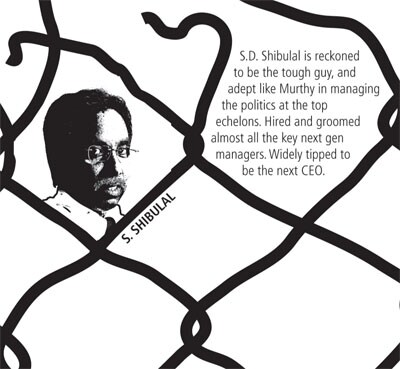

Each of these new models calls for taking higher risks, making upfront investments in technology, software and people, which yield results much later. Today non-linear work, including Finacle, brings in 10 percent of revenue. Gopalakrishnan wants to take that percentage to 30 percent of revenue in the next few years. “It is a high stretch target,” admits S.D. Shibulal, the COO.

This is where Murthy’s original paradigm needs to change. He believes the true measure of success is how much net profit can be generated per employee. The trouble with non-linear models is they are lumpy and unpredictable. Though it may generate more profits in the longer term, in the short term estimating demand and higher upfront investments could have an impact on revenues and profits.

Last year, Infosys won an order from the Indian government to process income tax returns in four states. The government of India has promised to pay Infosys a fixed sum of money for every tax return the company prepares. The initial investment in building this platform (hardware and software) — which can process up to 50 lakh forms — came from Infosys. The company is yet to make money. It lost Rs. 60 crore in the first year and is estimated to lose Rs. 100 crore next year.

Last year, Infosys won an order from the Indian government to process income tax returns in four states. The government of India has promised to pay Infosys a fixed sum of money for every tax return the company prepares. The initial investment in building this platform (hardware and software) — which can process up to 50 lakh forms — came from Infosys. The company is yet to make money. It lost Rs. 60 crore in the first year and is estimated to lose Rs. 100 crore next year.

Just how does Gopalakrishnan handle this conundrum? If he takes on too much of this kind of work, it threatens his margins. If he stays away from this, he risks losing the opportunity to a more aggressive rival. It’s a tough call. There is another difference in the way these models will impact operations. Apart from capital investment in these models, they also call for a shift in sales and marketing dollars.

In the past, when Infosys was selling offshore services, it always had a compelling story to tell its clients. It didn’t need to invest too much into building a brand. But in a world veering towards the cloud, clients have to be educated all over again. “To adapt to the new environment, Indian IT firms will have to invest in sales and marketing. They need to find people who can talk to a client how healthcare works or how a bank operates,” says Partha Iyengar, VP, Gartner, a consulting firm.

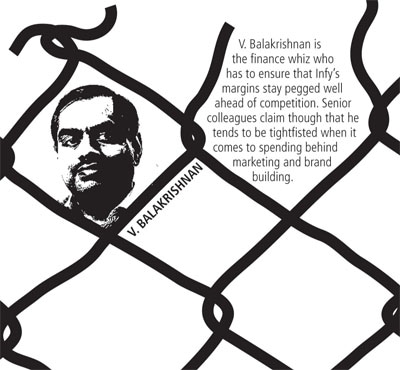

But for the most part, that conviction hasn’t always been forthcoming, say insiders. Inside Infosys, the allocation of budgets is still decided by a few people like its current CFO V. Balakrishnan, Mohandas Pai who heads HR, CEO Kris Gopalakrishnan and the COO S.D. Shibulal. A senior functionary at the company says, between Shibulal and Gopalakrishnan, they meet the earnings guidance quarter on quarter. Balakrishnan makes sure he maintains margins, while Pai keeps his flock happy through salary increments. “So, everyone is playing their parts well. But no one is taking tough calls,” he rues.

What it means is that if there is a deal that can be picked up at an initial margin of 15 percent, the financial model Infosys uses will reject the deal because it wouldn’t meet the criteria. Now, it is entirely possible to push up margins during delivery to 27 percent. But accepting such a deal upfront requires taking a tough call.

It isn’t as if Murthy’s obsession with margins is to blame. After all, higher margins are better in the longer run. Technology is a very fickle industry and more money simply means more investment dollars. In Murthy’s book, he’d like his CEO to take bottom-line responsibility and put his neck on the line for it.

It isn’t as if Murthy’s obsession with margins is to blame. After all, higher margins are better in the longer run. Technology is a very fickle industry and more money simply means more investment dollars. In Murthy’s book, he’d like his CEO to take bottom-line responsibility and put his neck on the line for it.

Now, taking a hit on operating margins isn’t easy. Missing an earning guidance runs the risk of adversely impacting the stock price. And therefore, no one is willing to quite risk that, at least not just yet.

Gopalakrishnan violently disagrees with the notion that margins are coming in the way of change. “If somebody says Infosys is not changing, I don’t think they know what is happening,” he says. “You don’t sacrifice today’s margins for some unknown tomorrow. We are taking risks. We are changing our business. We have our own way of doing it. That’s it”At a systemic level, the current generation of senior leaders across the Indian IT industry has grown up selling their wares to chief information officers. “You could ride on the coat tails of the CIO — who would change jobs every few years and we would move with him to new companies,” says an industry veteran. Today, the selling has to be done to business heads. And the game is very different: Without understanding the client’s business, it isn’t possible to offer solutions. But that is the Achilles’ heel for most senior leaders.

This was Nandan Nilekani’s big strength during his stint as CEO at Infosys, now head of the Unique Identification Database (UID) project for the Government of India. He was pretty good at gauging the business problems of a client. He quickly grasped the big drivers of change affecting sectors like finance, retail, media and telecom. When Gopalakrishnan took over as CEO, it took time for him to figure out that the market had fundamentally changed. And he did the next best thing: Spend enough time on the field, directly interacting with customers.

The problem now is, unlike in the past, CIOs don’t have budgets to spend. “In the past, a CIO’s worth was measured by how many projects he was running or how many engineers were working with him. Now the CFO is telling him that he’s got to cut his budgets for existing work and find innovative ways to fund new projects,” says an old war horse.

Insiders say Gopalakrishnan is obsessed with the problem. Others in the executive council are coming around to see his point of view. The way things are, Infosys doesn’t make any capital investments for its clients, except in raising campuses, hiring and training people. Now, it needs to start investing its own capital by building new platforms. That means buying hardware, software licenses and hiring people. That means, it starts getting paid only when clients begin to use what’s on offer. “That’s pretty much the product company model. And which is why our investment model will need to be re-looked at,” says an executive at the company.

Last year, Infosys spent 1 percent of its revenues on research and development. It partly used that to build about 10 platforms, which offer a range of solutions to clients. Of these, four have found traction and have brought in revenues of $50 million. The others need to be built as well. But there is no way anybody at Infosys or any model it builds can predict whether there will be any takers for what is on offer.

Gopalakrishnan is aware it is important to have a cohesive marketing strategy and communicate clearly to clients. At every CEO forum or partner meet, he has begun projecting it externally. “Today I’d give Infosys 3 or 4 on a scale on 1-10 in that. In the next 12 months they have to move it to 8 in terms of a clear strategy and well articulated position. They may be thinking of it internally, but they have to present an external face to it. TCS at least has a strategy. What they do with it is another matter,” says Iyengar of Gartner.

Gopalakrishnan is aware it is important to have a cohesive marketing strategy and communicate clearly to clients. At every CEO forum or partner meet, he has begun projecting it externally. “Today I’d give Infosys 3 or 4 on a scale on 1-10 in that. In the next 12 months they have to move it to 8 in terms of a clear strategy and well articulated position. They may be thinking of it internally, but they have to present an external face to it. TCS at least has a strategy. What they do with it is another matter,” says Iyengar of Gartner.

Epilogue

For a few years now, Murthy had nurtured a powerful set of individuals on his board. But indications are, the board will assert itself on the succession issue. So when Lehman and his colleagues on the nominations committee sit down to decide on Murthy’s successor, they will seek the views of all the founders. But finally, they will do what is in the best interest of the company, says a board member. In this case, that could be K.V. Kamath — unless the committee thinks otherwise and picks a successor from the founding team.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)