Jindal's Steely Resolve

Sajjan Jindal’s Ispat deal is the biggest consolidation move in the Indian steel industry. His next challenge: Make the company profitable in a year

There was no sign of a sleepless night on Sajjan Jindal’s face as he strode in for the 3 p.m. press conference on December 21. Just 10 hours earlier, at 5 a.m., he and his company JSW Steel’s board members had finished a five-hour meeting at Jindal Mansion, the Mumbai headquarters of the JSW Group. Before that, they had been in another marathon meeting with the lenders to Ispat Industries. But Jindal was his usual alert, smiling self. After all, it is not often that one makes the biggest consolidation move in the Indian steel industry and emerges successful.

JSW Steel had acquired a 41.29 percent stake for Rs. 2,157 crore in Ispat, a company promoted by brothers Pramod and Vinod Mittal. Now, with Vinod sitting beside him at the press meet, Jindal was quick to note that the deal had taken only eight days to complete. “It is a record time,” he said.

Jindal had moved quickly and decisively when it became apparent that Ispat was up for grabs.

JSW Steel wasn’t the only suitor. Vinod’s eldest brother, Lakshmi Niwas Mittal, owner of the world’s largest steel maker ArcelorMittal had been interested too. In November and early December, a high-level team from the London-based company visited plants of the beleaguered Ispat, which needed urgent infusion of money. Due diligence was done and the Mumbai-based firm was valued at $3 billion. But, when time came for a decision, Lakshmi Mittal decided not to go ahead.

“There were issues relating to corporate governance. The deal would have been seen as an older brother bailing out his sibling. It would have been highly sensitive for ArcelorMittal’s board and shareholders in Europe,” says an industry executive who worked closely with the Mittal family. Another big hurdle, of course, was Ispat’s $2 billion-plus debt that would add to ArcelorMittal’s $20 billion burden.

When the older Mittal withdrew, “it was an open field for others”, says a senior official at JSW Steel. But for Sajjan Jinadal to make the decisive move, he needed to clear confusion within his own family. Jindal Steel and Power (JSPL), headed by his younger brother Naveen, was also interested in buying a stake in Ispat. “We had taken a look at Ispat. But once JSW was interested, we withdrew. We don’t compete within the family,” says a senior official at JSPL.

With family matters taken care of at both ends, Jindal gave a glimpse of why he is known as a quick and able executioner of projects. Aware that at least five other suitors, including the Welspun Group and British trading giant Stemcor, were in the fray, Jindal personally called Vinod Mittal and made his interest in Ispat official. Personal ties between the two families (Jindal’s sister and Mittal’s wife are close) helped. So, while teams from both companies prepared and shared reports, Jindal visited Ispat’s Dolvi plant in Mumbai’s suburbs and realised the asset was good; only some “raw material management” and “financial discipline” was needed. Over the next two days, the two promoters met several times, mostly at Jindal Mansion, accompanied by their sons, Parth Jindal and Atulya Mittal.

Apart from family ties, one more factor helped Jindal close the deal quickly. Ispat’s lenders, including IDBI, ICICI and IFCI, were trying to save the Rs. 9,500 crore they had lent over the last 10 years. “Since the middle of 2010, monthly interest payments of at least Rs. 70 crore had stopped coming from Ispat. Had the defaults carried on, lenders were worried the loan could be bracketed as a non performing asset,” says a retired senior official of one of the lenders. Sources said December 31 was the deadline that the lenders had for Ispat to find an investor.

When Jindal sat with Ispat’s bankers a day before the deal was announced, they were not ready to let go easily. Only hours earlier, IDBI had won a hard bargaining position by sending a notice to the Ispat management. The bank wanted to convert part of the pledged shares into equity as Ispat had failed to make interest payments. “If the conversion had happened, it would have made the deal much more expensive for JSW,” says a senior official. Jindal cajoled the bankers. IDBI relented and Jindal agreed to their terms, the main one being that the lenders can convert the shares into equity at a rate of Rs. 14.74 a share, not more. By midnight, action shifted to Jindal Mansion, where JSW’s board discussed the deal. When the meeting got over five hours later, Jindal knew that within six months he was going to be the largest steelmaker in India (adding JSW Steel’s to-be added capacity and Ispat’s 3.3 million tonnes of annual production).

“The deal is unique because each party — the company, the investor and the lenders — had its own terms, and they were met. The Mittals get to remain in the company as co-promoters, JSW becomes the largest steel maker of India and the lenders are sure of their debt being repaid,” says Suhail Nathani, partner, Economic Laws Practice, which advised Ispat on the deal. Even while the finer details of the deal were being sorted, other suitors continued their due diligence of Ispat, in case talks with JSW fell through.

Two Families, Two Results

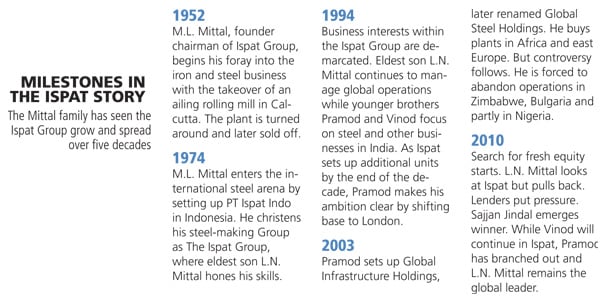

In 16 years, this is the third time that management at Ispat, which was incorporated in 1974 by M.L. Mittal, has changed. In 1994, the international business of the company was handed over to Lakshmi Mittal and the two younger brothers took charge of domestic operations. In 2003, Pramod set up Global Infrastructure Holdings; renamed Global Steel Holdings two years later, it became the vehicle for his Lakshmi Mittal-like global expansion. While, officially, he remained chairman of Ispat, youngest brother Vinod has been in charge of daily operations.

That things were going to change were evident by June 2010. “With steel prices not keeping up and raw material prices increasing, we realised the need for equity infusion,” says Vinod’s son Atulya. Ispat entered into talks with Stemcor, which would infuse capital to take care of interest payments and supply raw materials. “But markets were not moving up and raw material prices rose further. We were forced to start looking for a higher capital infusion and a partner,” says Atulya. He didn’t confirm or deny if ArcelorMittal was one of the parties, but added that “corporate governance” would not allow investment from the global leader.

But what has surprised observers is the absence of Pramod, both at the press meet on December 21 and at Ispat’s Annual General Body Meeting held the same day in Kolkata. Was London’s bad weather the only reason Pramod didn’t board the flight?

Insiders point at “an understanding” earlier this year within the family that saw Vinod take charge at Ispat. But Ispat subsidiaries Balasore Alloys and Gontermann-Peipers remain with Pramod. This was evident when post-deal press announcements only detailed Vinod’s role in the company. He will continue as executive vice chairman of the renamed JSW Ispat Steel for the 18-month transition period and will later have the choice to continue as non executive vice chairman.

“My uncle [Pramod] was involved in the deal through video conferences from London,” says Atulya, vice president at Ispat. When asked about Pramod’s role after the deal, he said, “We have not thought that far.” Balasore Alloys and Gontermann-Peipers, Atulya said, “remain within the family,” but pleaded ignorance when asked about specific ownership of the two companies. In a sign that the Mittal family might eventually sign out from the renamed entity, Atulya said, “I have not thought about my role. It depends upon the new management. There are many opportunities outside, I might pursue something independent.”

The Road Ahead

While JSW Steel’s investment in Ispat has further demarcated businesses within the Mittal family, it has also changed the dynamics of the Indian steel industry. Sajjan Jindal and Vinod Mittal are sons of industrialists who pioneered steelmaking in India. When M.L. Mittal’s eldest son was scorching the global steel market, O.P. Jindal’s family was making a much quieter progress back home. When the steel industry collapsed in the early part of the decade, both JSW Steel and Ispat came under corporate debt restructuring. JSW Steel was among the first to pay off debts.

At the December 21 press meet, Jindal mentioned Lakshmi Mittal as he talked about consolidation and it is not surprising that industry veterans see a similarity between the two. “Both are charismatic, aggressive, ambitious and know their steel. But surely, Jindal is not in the same league as of now,” says a former senior executive at ArcelorMittal. But if Jindal is able to turn around Ispat’s operations within a year, as he has promised, his chips will increase.

“We are restarting the Dolvi plant. We expect the operations to turn profitable on EBITDA [earnings before interest, tax, depreciation and amortisation] basis in a month,” says Seshagiri Rao, joint managing director and group chief financial officer, JSW Steel.

But the tougher task, say analysts, would be to turn Ispat profitable after tax within a year. “JSW’s plan to leverage on Ispat’s geographical advantage [it is close to the western coast and near a major manufacturing belt] and lowering its freight costs will help. But what will be integral to making Ispat profitable will be ensuring raw material and fuel supply to the Dolvi plant. But pellets, a raw material, will not come from JSW Steel’s Karnataka operations before the first quarter of 2011. Also, it remains to be seen how cheap will be the power from the Ratnagiri plant of JSW Energy,” says Ravindra Deshpande, analyst, Elara Capital.

Plans are on to build a captive power plant and coke oven battery at Dolvi but that might take two years, say observers. “Even Ispat’s mining leases for iron in Maharashtra and coal in Madhya Pradesh will take at least two years to start operations,” adds Deshpande.

To JSW Steel’s advantage, Ispat produces flat steel products that will add to its portfolio. “Because of the technology used in the plant, Ispat makes niche products that are used in cold rolling, auto and galvanised industry. We can now use our own distribution network to market these,” says Jayant Acharya, executive director, JSW Steel. But the main focus right now, stresses Acharya, would be to turn Ispat profitable.

Dealing with the debt is of course crucial for that. JSW Steel plans to refinance Ispat’s Rs. 9,500 crore debt by September 2011. While this will benefit Ispat and cut its interest rate costs below the present 10 percent, JSW Steel’s debt-equity ratio will increase to 0.93 from 0.8. This partially negates the improved financial position after Japanese steelmaker JFE infused Rs. 4,800 crore equity into JSW Steel earlier this year. The burden might increase further next year as JSW Steel goes ahead with its expansion plans in Bengal.

(Additional reporting by Cuckoo Paul)

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)