Wine: Getting High

An investment in fine wine could roll in the good times in more ways than one

Indians don’t drink a lot of wine. As of June 2010, per capita consumption of wine in India was just 7 ml per person. But that should not stop Indians from investing in it.

At an annual traded value of $4 billion (year-on-year), wine is emerging as a very good investment option. The London-based Liv-ex Fine Wine 100 Index, the wine investment industry benchmark, has been giving a compounded annual return of 13.7 percent since 1988. As of November 2010, the Liv-ex gave a return of 38.7 percent year-on-year.

Before you go buying wine off the racks, keep this in mind: Not every wine is worth investing in. “In practice, this is a narrow group of wines and includes the very top wines of the Bordeaux region in France and a smattering of wines from Burgundy, the Rhone, Italy, Champagne and the New World [California],” says Jack Hibberd, research manager, Liv-ex.

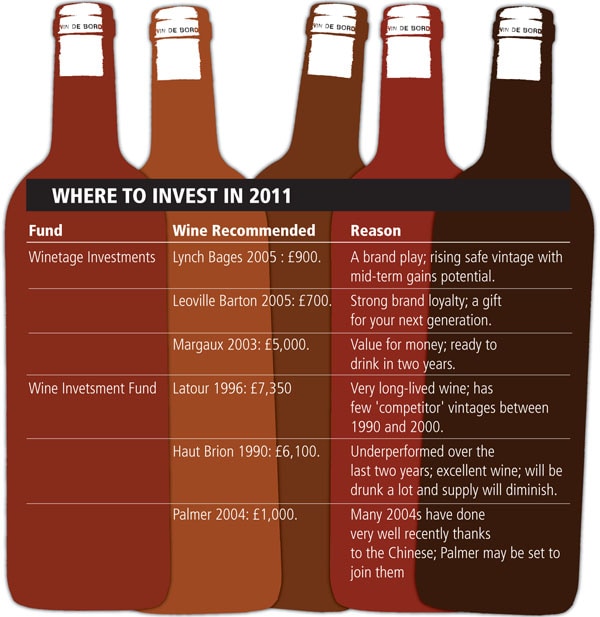

The five best fine wines in the world, all from the Bordeaux region in France, are called First Growths: Lafite Rothschild, Margaux Medoc, Latour Medoc, Haut-Brion and Mouton-Rothschild. Most professionally managed investment portfolios have between 80-90 percent by value invested in just eight brands or vineyards — the First Growths, plus Cheval Blanc, Petrus and Ausone.

The weather too limits the range of good wines available. Good wine comes from grapes that have seen a cold winter; it kills pests. Spring has to set in at the right time and summer needs to be hot and stable. It should rain before it gets too dry and the weather should be stable at harvest time. If all these conditions are fulfilled, it qualifies as a good year. In a good year most vineyards produce a good crop. Good years this decade have been 2000, 2005 and 2009. “In fact, 2009 has been stated by some to be the best vintage in 32 years,” says Ishaan Ahuja, founder, Mumbai-based wine advisory firm Drayton Capital.

So what do you need to watch out for in the New Year? For one, keep a lookout for Chinese buyers. Over 30 percent of the fine wine bought in the last two years has gone down Chinese throats. “The Chinese like to open wines at important events. It’s a matter of corporate prestige,” says William Grey, investment manager at the London-based Wine Investment Fund. That is one of the main reasons why wine prices have soared in recent years.

Investing in the Exchange

The high-risk investor can go through a broker at the Liv-ex at a commission of 1 to 2 percent.

If you know your wine, futures are a great way to make fast money. Here’s how that market works: The 2010 vintage, for instance was harvested and stored in barrels (en primeur) in Autumn 2010. It will get tasted in barrel during the spring of 2011. It will be sold as a “future” while still in thebarrel, in very limited quantities during that spring. If you know that the wine is good, you can make a killing on the exchanges.

The best way to get that knowledge is to read what prominent wine critics have to say about the year’s harvest. Wine is perhaps the only asset class where critics’ views make prices oscillate. Robert Parker is the world’s foremost wine critic and his Web site erobertparker.com has a pool of immensely powerful critics.

Prices of the 2009 Lafite vintage futures shot through the roof. “Lafite prices have more than doubled,” says Meenu Kohli, director, Winetage Investments, a wine fund with offices in London and Paris.

Infographic: Smaeer Pawar

However, Ahuja cautions against reading too much into the 2009 futures as it was an exceptionally good year. “Given the hype around 2009, futures themselves started trading hands before the wine was bottled. It was very unusual for this to happen on the scale it did. So far most wines have appreciated in nominal value but many wines have also fallen in value since their release price,” he says.

Going through a Wine Merchant

Do this only if you are a seasoned investor. Wine merchants buy wine en primeur and there are chances that they have made bad calls. “Wine merchants will typically invest your money in wines they already own,” says Ayesha Chenoy, co-founder, Drayton Capital. They charge in excess of 15 percent a transaction. If you have to, opt for established names like Berry Bros and Rudd, Britain’s oldest wine and spirit merchant, which has been trading in wines for over 300 years.

The Investment Fund Route

Bottled wine takes time to hit the market. If you want to buy cases of the 2009 vintage, you have to wait till early 2012. That’s when wine funds usually get in.

Minimum investments in overseas funds are usually around 5,000 pounds (Rs. 3.5 lakh). They charge an initial management fee of 5 percent and a performance fee of 20 percent on profits. Funds usually have a holding period of five years. Drayton Capital requires a minimum investment of Rs. 2 lakh. The company refused to reveal its transaction costs but said that it does not charge a performance fee.

Forbes India wrote to Robert Parker for his opinion. His office replied back, Mr. Parker believes wine is for drinking, not investing. Well, you know what to do if your investments go kaput!

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)