The 'Goldilocks' budget for growth

In a masterful stroke, Finance Minister Nirmala Sitharaman has managed to walk the fiscal tightrope without faltering on fiscal targets despite an uptick in capital expenditure and social reforms

The government announced ambitious capex plans for building infrastructure which it hopes will trigger a multiplier effect to boost growth and development in the economy where investment and consumption have been in low gear.

Image: Sajjad Hussain / AFP

The government announced ambitious capex plans for building infrastructure which it hopes will trigger a multiplier effect to boost growth and development in the economy where investment and consumption have been in low gear.

Image: Sajjad Hussain / AFP

It is not uncommon for corporates to sugar coat their angst over disappointing Budget announcements. When corporates hail the finance minister for delivering a ‘super’ Budget, one takes it with a pinch of salt, as the tone isn’t hard to miss. But Budget 2023 is different. The mood is clearly upbeat.

Nilesh Shah, managing director, Kotak Mahindra AMC, says the Budget numbers are realistic, conservative and credible. “This Budget is a Baahubali budget. With one arrow, multiple targets are shot. Fiscal prudence is achieved with lower deficit and the path is set till FY26. Consumption is supported through tax cuts and the investment outlay has been enhanced,” he adds.

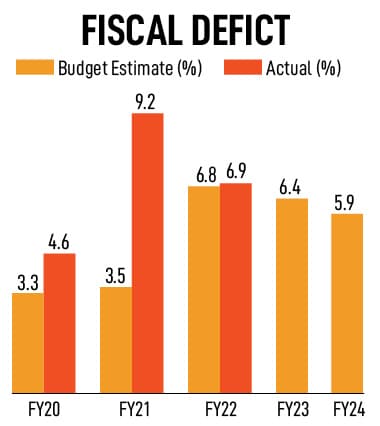

The BJP government—in its last full year Budget—checked all the boxes with measures and incentives to boost investments and consumption, without straying from its fiscal consolidation path, to fast-track economic growth. The government retained its FY23 fiscal deficit target of 6.4 percent and expects it to narrow to 5.9 percent in FY24, and eventually meet its goal of lowering it to 4.5 percent in FY26.

“Overall, this Budget’s push on capex will ensure that the private capex green shoots really sustain, help inclusive growth, and make the economy become more resilient in light of the global slowdown. Both equity and bond markets have reacted positively to the Budget, as the thrust to maintain the cyclical recovery and largely maintain fiscal prudence has helped lift sentiments,” says Chirag Mehta, CIO, Quantum AMC.

The S&P BSE Sensex ended the trading session 158 points higher at 59,708 and the bond market closed 0.9 percent lower at 7.27.

To address this, this year, Finance Minister Nirmala Sitharaman announced a sharp increase of 33 percent in capital expenditure to Rs10 lakh crore. In addition, the outlay for railways is at its highest of Rs2.4 lakh crore. Effectively, the government’s total outlay for capital investment is equal to 4.5 percent of the GDP.

To address this, this year, Finance Minister Nirmala Sitharaman announced a sharp increase of 33 percent in capital expenditure to Rs10 lakh crore. In addition, the outlay for railways is at its highest of Rs2.4 lakh crore. Effectively, the government’s total outlay for capital investment is equal to 4.5 percent of the GDP.