Auto industry preps for a long journey to recovery

Even as auto industry players prepare to get back to factory floors, they don't expect the sector to recover before 2021

A lone car drives through a Noida underpass during the lockdown. Demand is not expected to recover even after lockdown norms are relaxed

A lone car drives through a Noida underpass during the lockdown. Demand is not expected to recover even after lockdown norms are relaxedImage: Virendra Singh Gosain / Hindustan Times via Getty Images

The rough ride for India’s automobile companies, which began with a two-year slowdown and will worsen with the Covid-19 outbreak and its aftermath, is unlikely to be over before 2021.

Once the pandemic hit the country, companies were asked to shut down manufacturing facilities, dealer showrooms, and service centres overnight. It led to the sales of passenger vehicles crashing by 51 percent, and of two-wheelers by almost 40 percent, in March. In April, the fall could be even steeper: The Society of Automobile Manufacturers (Siam) expects the country’s auto industry, the world’s fourth-largest, to lose `2,300 crore in production turnover for every day of closure.

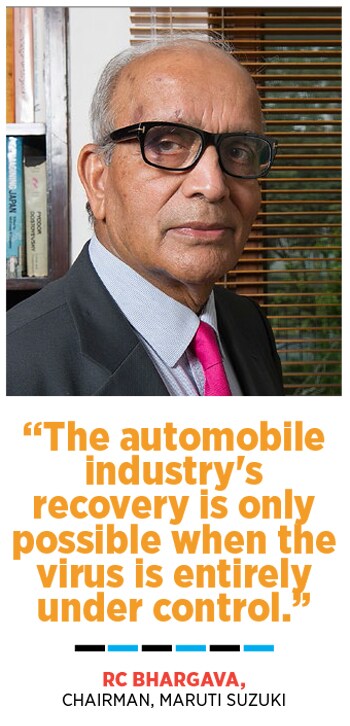

Now, into over 40 days of the lockdown, there is still no clarity on when companies could restart operations. Maruti Suzuki and Hyundai India, the country’s largest and second-largest carmakers, who control nearly 70 percent of the passenger vehicle market, have confirmed the uncertainty. “Production cannot start until the entire supply chain needed for manufacturing a vehicle is assured,” says RC Bhargava, chairman, Maruti Suzuki. “Manufacturing cannot be on a stop-go basis. It has to be continuous and, at the moment, factories belonging to suppliers are in containment zones. While it is possible that some models could be produced, it is not possible to produce all the models until things are settled completely.”

Hyundai Motors, which manufactures vehicles at its facility in Chennai, too will wait for more clarity on the lockdown. “We will review the situation after May 3 based on the new guidelines,” says a spokesperson. Others such as Toyota, Tata Motors, and Honda Motors have not resumed operations either.

Uncertainty looms over the two-wheeler sector as well as the country’s largest manufacturer, Hero MotoCorp, is yet to start working, while others such Honda Motorcycle and Scooter India, and Yamaha are contemplating the road ahead post-lockdown.

Only Bajaj Motors has, so far, begun operations since the government announced a relaxation of lockdown norms from April 20; as have a few auto component manufacturers, including Uno Minda, Setco, Timken, Varroc, and Sebros. “These plants shall be resuming at a lower scale and would gradually ramp up to align with the off-take from our customers, subject to compliance with standard operating procedures [SOPs] for social distancing,” Varroc Engineering said in a statement while reopening its factories.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

An employee at a Maruti Suzuki showroom in Chennai. With disruption in demand and supply the auto sector is looking at an uncertain future

An employee at a Maruti Suzuki showroom in Chennai. With disruption in demand and supply the auto sector is looking at an uncertain future