Airtable: Move slow and make things

Airtable's Howie Liu has quietly built a software giant by emphasising substance over speed. But can a tech tortoise win the data race?

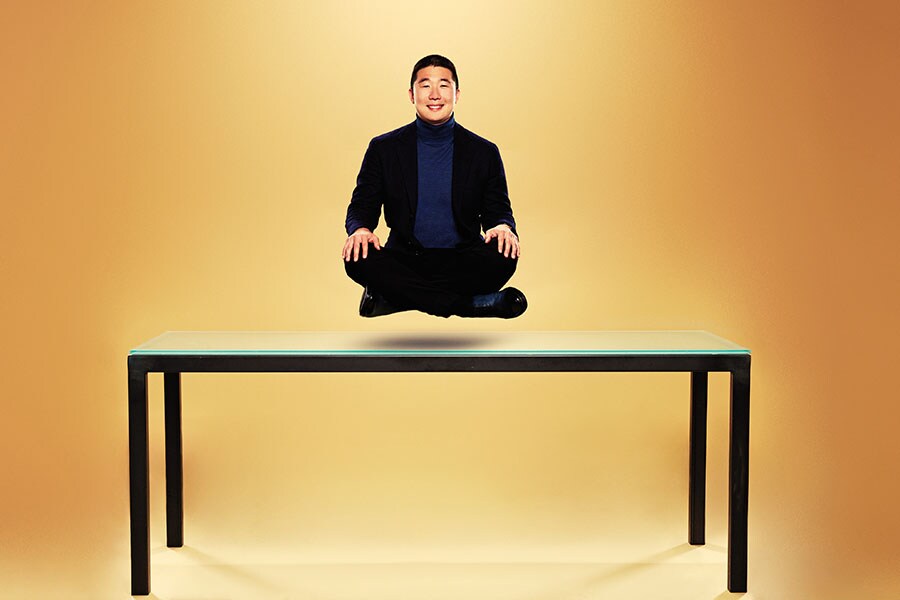

On the rise: Airtable CEO Howie Liu

On the rise: Airtable CEO Howie Liu

Image: Jamel Toppin for Forbes

In the frenetic world of tech, where the ruling ethos is to move fast and break things, Howie Liu moves at a glacial pace. With Andrew Ofstad and Emmett Nicholas, he launched Airtable in 2013. They wanted to create a spreadsheet with the power of a database. Then they spent three years building a prototype.

The trio pored over academic papers on collaborative software theory, agonised about the Node.js architecture and obsessed over the speed at which windows popped open. After reading Kenya Hara’s design book White, Liu spent months focusing on the interplay of colour and empty space.

Liu, 30, is sitting in his San Francisco headquarters dressed in a black leather jacket and black shirt, slacks and shoes. It’s a minimalist uniform à la Steve Jobs, the guy who would fuss forever over the shade of white of an iPod: “Instead of trying to rush a new product out the door, we introduce a period of forced delay, so people have a chance to sleep on an idea,” he says. “It’s a concept we call the simmer.”

Now Airtable is coming to a boil. Liu’s cloud-based software has taken hold in 80,000 organisations, from Netflix to small non-profits. Revenue is on track to jump 400 percent to $20 million in 2018, mostly on word of mouth.

Investors have noticed. In March 2018, Airtable raised $59 million from CRV, Caffeinated Capital and Slow Ventures. Later in the year, it snagged another $100 million from Benchmark, Thrive Capital and Coatue Management at a post-money valuation of $1.1 billion.

Airtable has attached an approachable drag-and-drop experience to a powerful database, much as Windows replaced tedious text-based commands with a graphic interface or AOL offered a welcoming portal to the web. “It’s an intuitive and fun way to build on data in a way you can’t with clunky products like Microsoft Access and Excel,” says Ray Tonsing of Caffeinated Capital. “It’s a joyful product to use.”

Airtable has taken hold in 80,000 organisations, from Netflix to small non-profits. Revenue is on track to jump 400%

At first glance, Airtable looks like a souped-up Google Sheet. It’s a collaborative spreadsheet that can store images, documents, videos and URLs. All of these can be dragged into cells and opened with a click. And while Google Sheets is fine for projects with a team of ten or so, Airtable has the relational database underneath to run businesses with thousands of far-flung employees simultaneously accessing the system via computers, smartphones and tablets. The several million of lines of code, written in open-source Node.js, encrypt the data and back it up with restorable snapshots.

Pricing is on the usual freemium model. You get basic services gratis. Subscriptions, which cost $10 or $20 for a month per user, offer advanced features and generous storage space. Enterprise packages start at $60 a head. One in six users is a paying customer.

Airtable’s defining feature is a buffet of apps and functions, called “blocks”. With these you can overlay data sets on a Google map, apply rules and formulas, send alerts and messages to colleagues, share files via SMS messages or emails, integrate with services like Slack and Dropbox, aggregate surveys and forms, and push content onto a live website.

It adds up to a powerful tool kit that lets anyone create custom applications (sales pipelines, client reports, project management flows, editorial calendars, inventory management) that previously required code writers or pricey consultants.

Airtable isn’t the only software vendor to talk about code-free programming; Quick Base, a spin-off of Intuit, makes a similar pitch. That doesn’t stop Liu from imagining how his firm can capture a wide swath of the world’s data processing. “People think we’re building an Excel or Google Sheets replacement, but we’re out to build the next Microsoft or Apple,” he says. “This is a $100 billion-plus revenue opportunity.”

That’s an ambitious statement—even in an industry that ploughs millions into immortality research and launches electric cars into orbit. After all, the opportunity to expand from a narrow product line into the full suite of business software doesn’t belong only to Airtable. Liu might find a way to snatch some of Microsoft’s $110 billion in sales; Microsoft might snatch some of his.

But Liu is convinced Airtable can win by being software’s version of Lego, providing blocks to let any business build do-it-yourself custom software cheaply and quickly. “America’s most valuable data is still stored in people’s heads and on Excel sheets,” says Sam Lessin of Slow Ventures, which joined in Airtable’s fundraising in March. “If you can become the place where all the data that operates most businesses goes, the opportunity to build an ecosystem and be the next great platform becomes obvious.”

Liu is betting he’ll get more traction once outside entrepreneurs build programs for Airtable as they do now for the App Store and Google Play. “The software serves as a blank canvas for whatever a company needs,” says Thrive Capital founder Joshua Kushner. “That’s extremely powerful.”

Airtable has illustrious acolytes. Netflix uses it to run its post-production pipeline. Atlantic Records built an Airtable program to manage communication between producers, songwriters and performers. WeWork, an early adopter, has thousands of employees on the software to manage and plan construction projects.

For Calvin Klein, an Airtable database ironed out its fabric-sourcing operations—once a complex juggle of thousands of emails and offline spreadsheets between designers, project managers and overseas textile mills. Now there’s a central application that manages calendars, images, production costs, manufacturing lead time and shipping schedules. PVH, the parent company of Calvin Klein, has since deployed Airtable to its other brands.

During Hurricane Harvey, the non-profit Austin Pets Alive created an Airtable app to track missing animals. Cattle farmers in Idaho use it to chart the health history and vaccination records of cows.

“It’s such a counterpoint to Silicon Valley hubris,” Liu says. His Market Street office is filled with Silicon Valley totems: Soundproof meeting pods, remote networking robots and rows of motorised stand-up desks. “There is a mindset that people in the middle of the country don’t have the desire or the intelligence to use technology—it’s so patronising.”

The son of Korean parents who were raised in China, Liu grew up in College Station, Texas, where his father earned a biochemistry PhD at Texas A&M. His mom, an engineer in China, worked minimum-wage jobs at McDonald’s and as a seamstress. “She’d come home with bloodied hands,” Liu says, “but still have the energy to teach me math, reading, arts and crafts.” She gave him books on Steve Jobs and Bill Gates. “At that time Microsoft was the company, and Bill Gates was the richest person in the world. I probably read four biographies about him.”

At 13 Liu taught himself to code C++ after finding an unread training book in his dad’s office. At 16 he went to Duke and in 2009 got a degree in mechanical engineering and public policy.

Liu landed a software development job in San Jose at Accenture. The salary was higher than his parents’ combined income. But the night before his start date, he got cold feet and never showed. “It was a tough decision. I didn’t have any financial resources to fall back on,” Liu says. “But ultimately I chose to try to do a startup.”

He launched a four-person company called Etacts that aggregated messages from email, Facebook and Twitter. In 2010 Liu got a spot in Y Combinator, the Mountain View, California, nursery for new ventures. Later that year he sold Etacts to Salesforce, netting a million-dollar payday and a gig building a chat product.

At Salesforce, Liu liked the people and the salary but again felt the pull to start something new. He left in 2012, travelled to Japan and Uganda and read books on philosophy and design theory. He visited museums, conducted colour-theory experiments through painting and tried his hand at sculpture.

At that point Andrew Ofstad, a classmate from Duke, was on sabbatical from his project manager job at Google. Soon the two were lugging oversize computer monitors to each other’s apartments to toy with programs. They wrote one for organising photos and built a word processor for creative writing.

Airtable took shape in 2012. It raised $3 million from Caffeinated Capital and Freestyle Capital in March 2013. With fewer than ten employees, it launched the first database in the winter of 2015 and collected another $8 million in funding a few months later. “We’ve always raised an abundance of money,” says Liu, whose equity stake is down to 10 percent. “We see the dilution as a form of buying insurance.”

Liu will need the $100 million from the latest dose of venture capital. In addition to Quick Base, Coda, another well-funded startup, is targeting his market. Tech giants are a threat too. “There’s an Amazon team, run by someone I know, building a direct competitor to us,” Liu says. Amazon did not respond to requests for comment.

Liu will use some of the new cash to launch an aggressive marketing campaign, educating potential customers about Airtable’s features. He will also invest in companies that want to build apps. As always, Liu is in no rush: “Having the capital in the bank lets us continue to prioritise things that might not pan out for years.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)