Motilal Oswal: Up to the challenge

Vijay Goel, who heads Motilal Oswal Private Wealth Management, has both an exciting and competitive market to operate in

Vijay Goel, managing director & CEO, Motilal Oswal Wealth Management

Image: Mexy Xavier

Image: Mexy Xavier

If pure statistics were all to go by, Vijay Goel, Motilal Oswal Private Wealth Management’s (MOPWM) managing director and CEO, would have been a worried man. Revenues for the wealth management firm edged up just 2 percent to ₹24.9 crore and profits fell 40 percent to ₹2.6 crore in the quarter ending December 31, 2018, from the previous (September-ended) quarter.

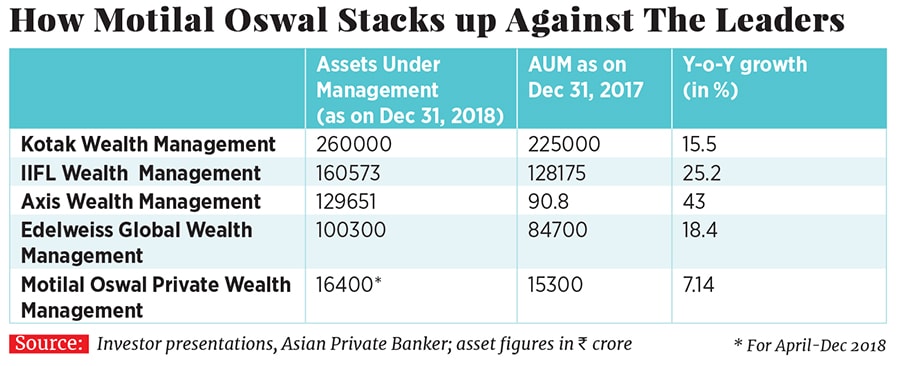

Assets under management (AUM), meanwhile, grew just 7 percent trailing behind giants such as Kotak Wealth Management, IIFL, Edelweiss Wealth Management and Axis (see table). At the same time, operating costs increased 17 percent as the group continued to hire relationship managers (RMs) to grow this business. This resulted in a lower Ebitda (-41 percent) for Q3FY19 and lower profits.

But Goel doesn’t seem to be worried. “The quarter gone by was tough for the industry as a whole,” says Goel, adding that investors were shy to put money in increasingly volatile equity markets and stayed away from even debt products. Also, for companies selling mutual fund schemes—and this includes wealth management companies—several regulatory changes were announced by Sebi, which would have a direct impact on costs and profitability of the company and also earnings packages for their talent pool—mainly RMs. These changes will come into effect from April 1, 2019.

For fund houses managing AUMs above ₹50,000 crore, Sebi has capped the total expense ratio (TER) for open-ended schemes at 1.05 percent, compared to an average 1.75 percent charged earlier. The regularor has allowed for a higher expense ratio for funds with smaller-sized AUMs, so that there is a level playing field for all mutual fund companies.

TER is the total cost of managing the mutual fund that investors pay while investing with an AMC for this service. Distributor commissions, fund management fees, promotional events are all expenses for an asset management company (AMC).

Smaller mutual fund companies are at an advantage here as their TER can be higher and agents will try and sell these schemes to investors, as they would earn more commission through these.

Moreover, in a move towards making investing in mutual funds more transparent, Sebi has mandated that AMCs will have to adopt a trail model of commission in all schemes. Payment of upfront commission to mutual fund distributors will not be allowed.

An upfront commission is paid to a mutual fund distributor in the same month that the investor made that purchase, while a trail commission is a recurring fee paid to the distributor until the investment is sold. Agents would often advise clients to churn their mutual fund portfolios to earn a higher commission. A trail commission, on the other hand, would ensure investors stay invested in a particular scheme longer and incentives will be given to the RM at the end of the year.

“We never took to upfronting and have followed the trail (commission) model. Over 80 percent of my costs are covered due to recurring revenues,” Goel claims.

Motilal Oswal’s core strategy, Goel explains, has been to ensure client longevity. “If he stays longer with you, his money will grow and my commission will grow; his surplus income/ business will grow and then he will park more with me.”

The wealth management firm now has 3,527 clients serviced by 134 RMs. Most of their clients—who are top corporate senior professionals or run mid to large family-led businesses—have a portfolio of ₹5 crore to ₹100 crore parked with them.

India has the third largest number of billionaires in the world, which has meant an obvious growth in the wealth management business, led by aggressive selling and hiring of RMs, and hefty bonuses to RMs in recent years.

According to the AfrAsia Bank Global Wealth Migration Review 2018, India had 119 billionaires, which would rise to 357 by 2027. It is data like this that keeps Goel cheerful.

As for RMs, he says, “We hire most of our RMs from the priority banking segment at banks.” He is also not perturbed that RMs have left them to join the larger wealth management companies such as Kotak, IIFL, Edelweiss or Axis. “Maybe only 10-15 percent of new joinees would have left. I have not checked this. For us, the mantra is: everyone works for the RM and the RM works for the client.”

The differentiator, according to Goel, is rigorous training for RMs, monthly or quarterly portfolio reviews with their clients and conservative investment advice. Talking about the AUM league tables, Goel says, “We want to grow at our own pace, not compared to others. Otherwise it will put unnecessary pressure on us.”

AUMs for their wealth business had surged by 140 percent between 2016 and 2017, Asian Private Banker data showed, albeit on a small base. Goel now hopes to grow their wealth management AUMs by over 35 percent, from ₹16,400 to between ₹20,000 and ₹25,000 crore by FY20. While the pie is large and continues to swell, Goel’s biggest challenge will be to retain and grow his talent pool.

Newer services continue to be launched for wealthy investors, including by State Bank of India, IndusInd Bank, Sanctum and Paytm. With the leaders already well-entrenched and as Sebi’s regulations kick in, the coming quarters will determine how well Motilal Oswal has managed its business.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X