5G expansion: Sluggish and silent

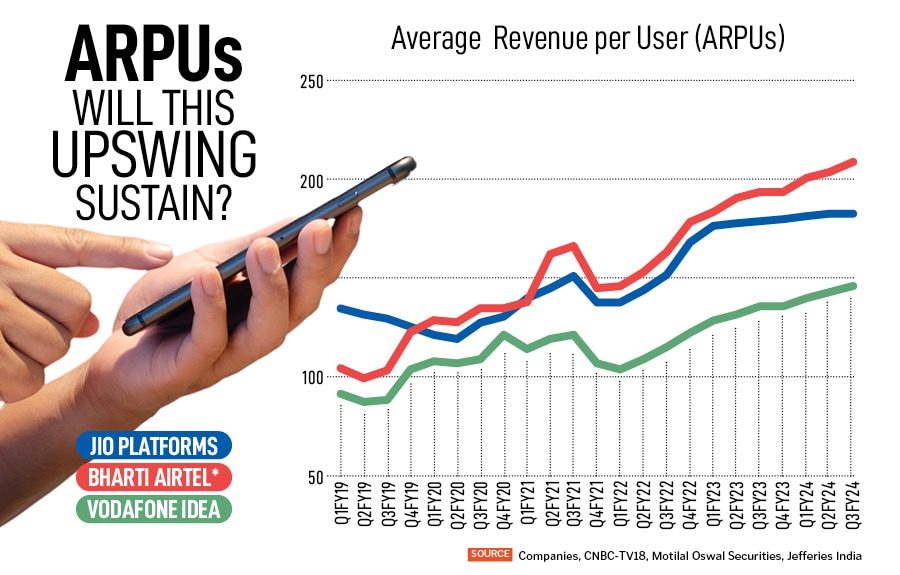

Lack of compelling use cases for 5G from consumers is a reality telecom companies need to deal with. Even as a fresh tariff hike is on the cards, the monetisation of 5G is becoming a real concern for them

For customers, there is no clear differentiator between 4G and 5G technology is what makes the 5G story—not just for telecom companies, but also for individuals—less compelling to tell with each passing day.

Image: Shutterstock

For customers, there is no clear differentiator between 4G and 5G technology is what makes the 5G story—not just for telecom companies, but also for individuals—less compelling to tell with each passing day.

Image: Shutterstock

By end-November 2022, a month after 5G services were launched in India, Shrenik Kanodia, a day trader (name changed) in Ahmedabad, recharged and opted for the ‘true’ 5G network plan on a Reliance Jio plan for his iPhone 12. It was, and still is, a free feature on his Rs2,545 package for 336 days, where 5G is unlimited with 1.5 GB 4G per day. “The biggest benefit of a 5G service is that data does not get exhausted while using the phone or while streaming,” Kanodia tells Forbes India.

5G’s most persuasive factor for consumers has always been the low latency and high speeds. But Kanodia has not seen much of a difference between 4G and 5G when it comes to video buffering. “It’s been equally fast in both networks.”

While largely working out-of-home, Kanodia does not actively check whether his mobile is on a 4G or 5G network. “Even while not using Wi-Fi, very often, the network switches back to 4G from 5G, even while I continue to work from my work desk. But it is not making a difference to my life,” he adds.

5G, no differentiator yet

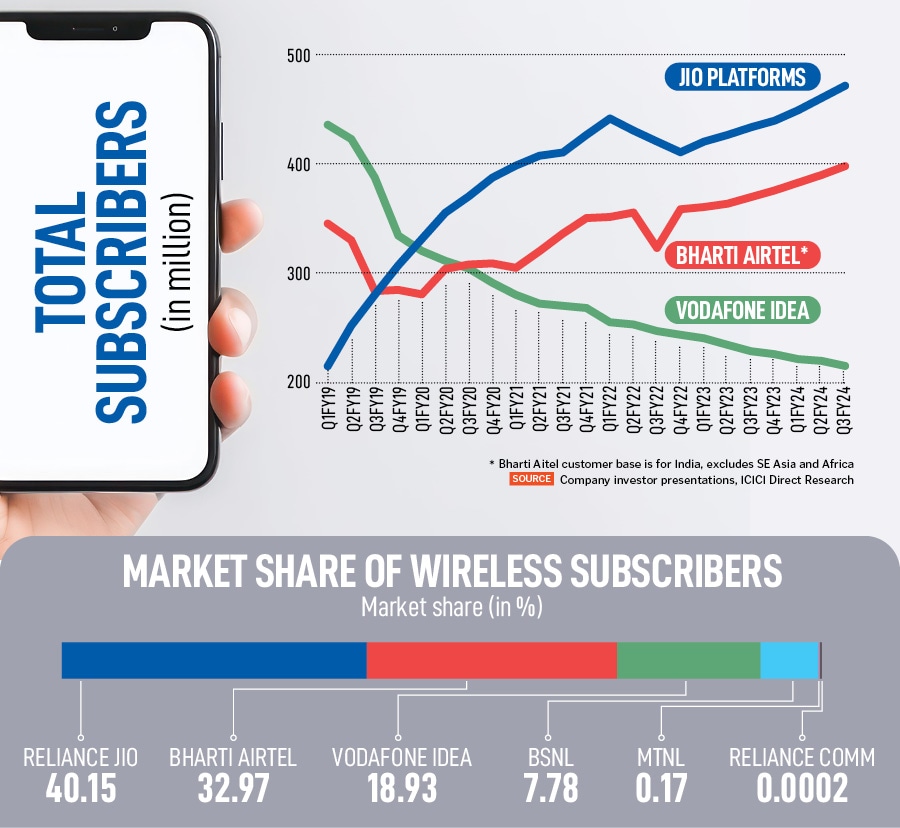

The fact that for customers like Kanodia there is no clear differentiator between 4G and 5G technology is what makes the 5G story—not just for telecom companies, but also for individuals—less compelling to tell with each passing day. “The fact that 5G is free makes things easier. If I have to pay for it, I would not use it. The problem is that 5G drains my mobile battery. Even when I am on a 5G network, I keep my phone on data saver mode, so it moves back to a 4G service, but my life continues as normal,” Kanodia says.Consumer subscribers’ data by end-2023 showed that 5G users with Reliance Jio rose to 70 million (out of around 460 million total wireless subscribers) and 55 million for Bharti Airtel (of 345 million total subscribers). Assuming a 30 percent rise in 5G customers in the first quarter of 2024, we would still be looking at approximately 175 million pure 5G subscribers, of a total of 1,164 million total subscribers, which works out to an approximate 15 percent market share.