RBI: The tough regulator

In the last two to three years, it has sent a clear signal that no financial institution will be spared in the case of governance lapses and non-compliance. A build-up in SME lending and fresh concerns in pockets of microfinance lending could be where the RBI is looking next

RBI Governor Shaktikanta Das—who, like previous governors YV Reddy and Duvvuri Subbarao, has an IAS background—has faced some backlash from the fintech community for his actions

Image: Getty Images

RBI Governor Shaktikanta Das—who, like previous governors YV Reddy and Duvvuri Subbarao, has an IAS background—has faced some backlash from the fintech community for his actions

Image: Getty Images

Dealing with an edgy or aggressive financial regulator is never a great thought. And one might be tempted to label the Reserve Bank of India (RBI) that, considering the rap on the knuckles it has been giving some of India’s largest banks, non-banking financial institutions (NBFCs) and fintechs in the past 12 to 36 months.

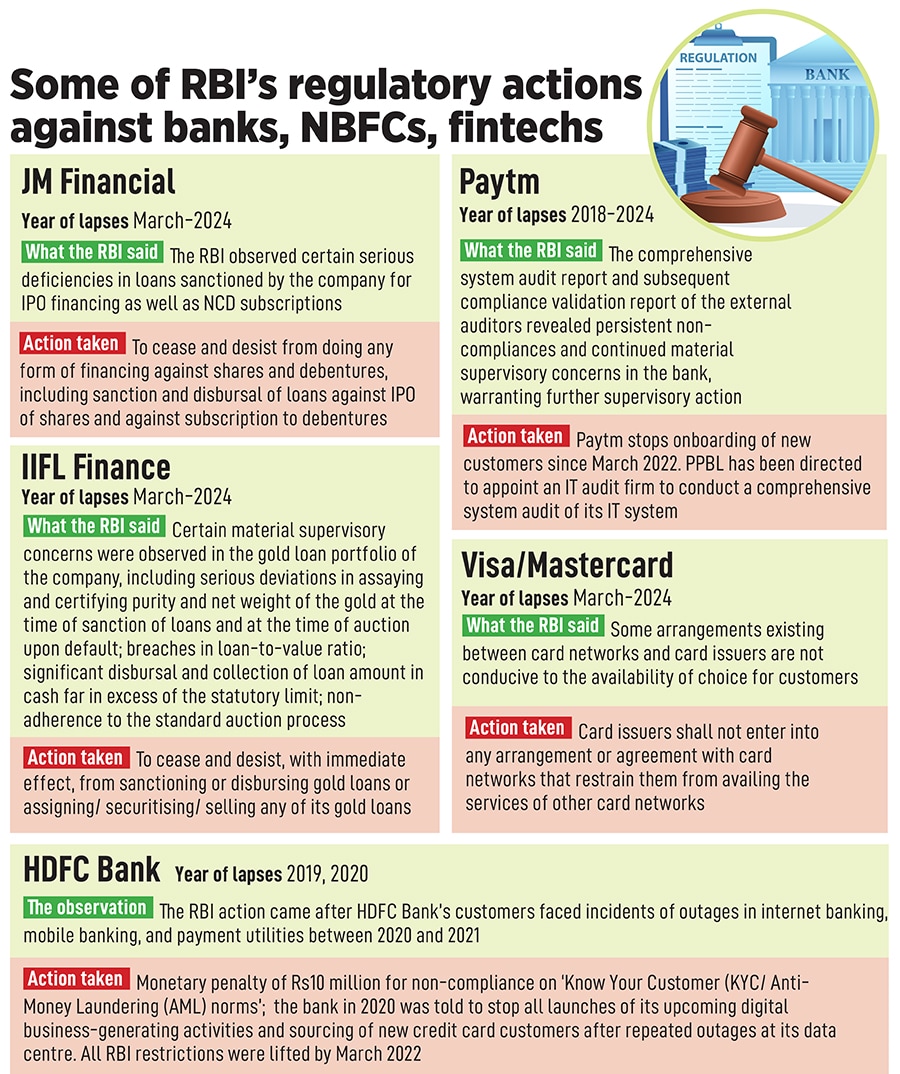

Not many have been spared: The list includes the largest private sector lender HDFC Bank to large NBFC lenders Bajaj Finance, IIFL Finance, JM Financial, payments bank Paytm Payments Bank (PPBL) and credit card issuers Visa and Mastercard (see table). At a broad level, the RBI has been concerned about nipping bad practices at the earliest instance—be it poor governance or risk management concerns; evergreening of loans, non-compliance and supervisory concerns, and even gaps in the functioning of technology platforms.

RBI Governor Shaktikanta Das—who, like previous governors YV Reddy and Duvvuri Subbarao, has an IAS background—has faced some backlash from the fintech community for his actions, fearing that all were under the scanner after the action against Paytm. Earlier this month, though, speaking to a television channel, Das was clear about why action was necessary against the payments bank.

Paytm’s concerns had started in 2018 and escalated two years ago in March 2022, when the RBI stopped it from onboarding new customers and asked it to carry out a comprehensive system audit. These restrictions continue to be in force, the RBI said in February. Last year, the RBI fined Paytm Payments Bank Rs5.4 crore for breach of KYC guidelines. India’s Financial Intelligence Unit has fined PPBL a further Rs5.49 crore for violating rules under money laundering norms.