The irony of being Adam Wyden: When you're a top hedge fund manager but your father is a tax-the-rich champion

In the last 10 years, hedge fund investor Adam Wyden made his investors 11 times richer, and made $100 million for himself, by uncovering hidden stock gems. His biggest worry? That his father, Oregon Senator Ron Wyden, will tax his gains to death

Adam Wyden’s hunt for hidden gems like Ferrari has given him a leg up on the S&P 500. In his Miami garage, however, he prefers Porsches. (He has no interest in the stock of Porsche’s parent, VW. It’s government-backed and made by a unionised workforce.)

Adam Wyden’s hunt for hidden gems like Ferrari has given him a leg up on the S&P 500. In his Miami garage, however, he prefers Porsches. (He has no interest in the stock of Porsche’s parent, VW. It’s government-backed and made by a unionised workforce.)

Image: Mary Beth Koeth for Forbes

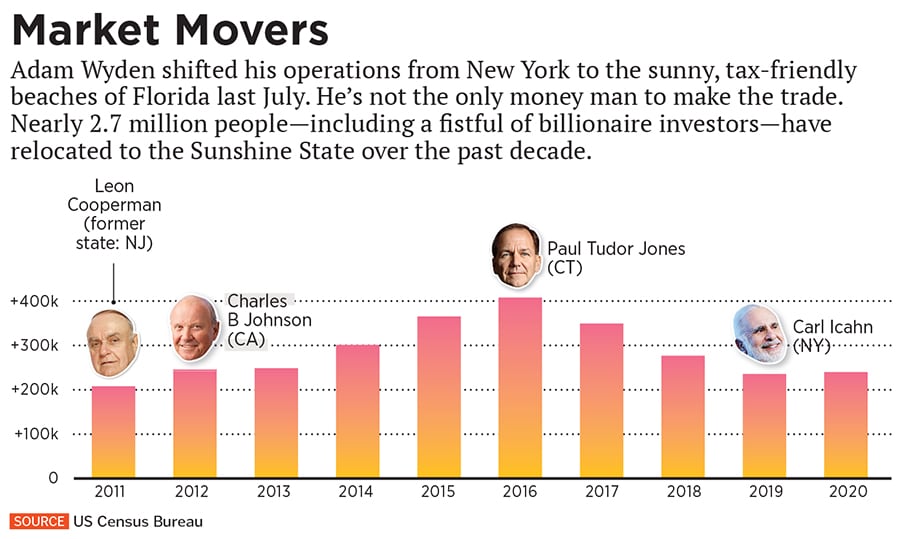

From the sun-drenched house he’s renting in the ritzy Miami enclave of Bay Harbor Island, Adam Wyden is livid at the news crossing his Bloomberg terminal. It’s April 22, and markets are sinking on a report that President Biden aims to raise capital-gains tax rates to 39.6 percent for high earners, effectively doubling the rate for rich investors.

“It’s anti-American!” Wyden bellows. “I’m very disappointed with American governance right now. Do you think any of these guys actually know what they’re doing?”

For an answer, Wyden could ask his father, Senator Ron Wyden, a Democrat from Oregon and chairman of the powerful Senate Finance Committee. The elder Wyden is a tax-the-rich champion who dubbed former President Trump’s corporate tax cuts a “partisan tax scam”. His son, by contrast, isn’t registered with either political party but is instead a card-carrying member of the Benjamin Graham party, with a dogged devotion to finding undervalued stocks. And his record to date has been nothing short of staggering.

Over the past decade, the younger Wyden, 37, has grown his bar mitzvah money and personal savings into a $350 million hedge fund in which his share is now worth $100 million. Through his Miami-based ADW Capital Partners, Wyden has proven his mettle as a deep value investor buying companies full of underappreciated assets. He hunts far from the picked-over S&P 500, preferring micro- and small-cap stocks mostly ignored by analysts and large hedge funds. Since inception in January 2011, Wyden’s ADW has returned nearly 28 percent annualised after fees, roughly double the S&P 500, making investors about 11 times their money in a decade.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)