Joe Biden's Presidential Exit Leads To $67 Million Crypto Liquidation in 30 Minutes

Biden family memecoins dropped to 60 percent after Joe Biden exited the 2024 presidential race, and Kamala Harris' memecoin surged 133 percent before stabilising

US President Joe Biden’s announcement regarding his withdrawal from the 2024 presidential elections stunned the entire crypto market

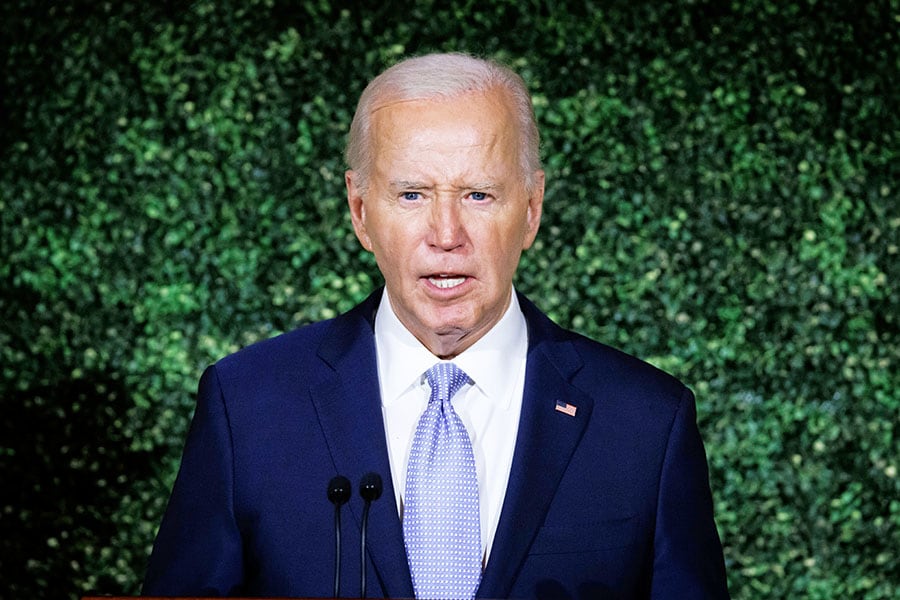

Image: Ting Shen/Bloomberg via Getty Images

US President Joe Biden’s announcement regarding his withdrawal from the 2024 presidential elections stunned the entire crypto market

Image: Ting Shen/Bloomberg via Getty Images

In a surprising political turn, US President Joe Biden’s announcement regarding his withdrawal from the 2024 presidential elections stunned the entire crypto market, liquidating approximately $67 million (₹5 billion) in long positions within thirty minutes. The unexpected news has raised concerns among investors and crypto traders, highlighting the market's volatility to major political shifts.

On July 21, substantial liquidations occurred between 5:30 p.m. and 6 p.m. UTC, resulting in a sharp 2.3 percent drop in Bitcoin’s (BTC) price, which stood at around $65,880. However, BTC quickly bounced back and reached a 24-hour high of around $68,400, leading to significant losses for the traders with leveraged short positions. Due to political uncertainty, the rapid selling-off of long positions indicates a bearish market ahead.

Markus Thielen, founder of the crypto firm 10x Research, stated that Biden’s incredibility to beat Trump, increased his chances of winning and led to the surge in Bitcoin’s price rapidly. He also mentioned that significant purchases, following the announcement contributed to its recovery within 24 hours. Trump holds over 60 percent winning chances in the 2024 elections, followed by Harris at around 30 percent.

Over 12 hours, from 10 a.m. to 10 p.m. UTC, more than $81 million and $53 million were liquidated in long and short positions, respectively, across various cryptocurrencies. Bitcoin witnessed around $44 million in liquidations, while Ethereum (ETH) and Solana (SOL) lost approximately $31 million and $8.6 million each. Most of these liquidations took place on Binance and OKX.

Currently, BTC is trading at around $67,300, indicating a 0.4 percent increase, and ETH is priced at about $3470, showcasing a dip of 0.7 percent over the last 24 hours.

The impact of Biden’s sudden candidature withdrawal on the crypto market implies the market's sensitivity to global political and economic events. As the industry tries to adjust to these unexpected changes, it is crucial for investors and traders to stay informed about such political risks influencing trade conditions.

Shashank is the founder of yMedia. He ventured into crypto in 2013 and is an ETH maximalist.

Twitter: @bhardwajshash