How Ramkrishna Forgings became an automotive powerhouse

Ramkrishna Forgings is today India's second largest forging company supplying parts to and components to sectors from automobile to railways, farm equipment to oil and gas and power

Naresh Jalan (right), managing director of Ramkrishna Forgings, with Chaitanya Jalan, who is whole-time director

Image: Mexy Xavier

Naresh Jalan (right), managing director of Ramkrishna Forgings, with Chaitanya Jalan, who is whole-time director

Image: Mexy XavierIn hindsight, Naresh Jalan reckons the move was silly, perhaps led by ignorance.

Why else would a company, he says, with ₹30 crore in revenues, with profits of around ₹60 lakh and not prompted by any private equity exits decide to go public, long before the IPO boom? It was 2004, and Jalan’s company, Ramkrishna Forgings, listed on the bourses at ₹20 when its net worth was around ₹12 crore.

“It was a silly decision,” Jalan, who was then in his late 20s and serving as managing director of the company that his father had founded two decades before, tells Forbes India. “We were ignorant. Everybody around us told us that if we go public we can grow faster. Because we are a first-generation enterprise, we did not have the skills or background. It’s been 20 years, but we don’t regret that.”

That’s also because the markets have been kind to Ramkrishna Forgings, particularly in the past few years. From a market capitalisation of ₹550 crore in March 2020, the Kolkata-headquartered maker of automotive components has grown by some 30 times to ₹17,288 crore in four years. It is the second-largest forging company in India and supplies components and parts to sectors such as automotive, railways, farm equipment, oil and gas, and power. Its client base includes Tata Motors, Ashok Leyland, Volvo, and Ford, among others, and operates industrial plants in Jamshedpur and Dugni in Jharkhand and Liluah in West Bengal.

“We have gone from a one-man shop to 4,000 people working directly with us,” Jalan says. “Indirectly, that number is much more. Ramkrishna Forgings is one of the most significant parts of the Make in India initiative, especially when it comes to global companies looking at sourcing from India.”

The company makes everything from crankshaft, pistons, axles and transmission gears for commercial and passenger vehicles to bogie frames for the railways. About 42 percent of its revenues come from exports, with clients spread across the US and Europe. Early this year, the group announced that the largest electric vehicle maker in the US had chosen the company to supply powertrain components.

The company makes everything from crankshaft, pistons, axles and transmission gears for commercial and passenger vehicles to bogie frames for the railways. About 42 percent of its revenues come from exports, with clients spread across the US and Europe. Early this year, the group announced that the largest electric vehicle maker in the US had chosen the company to supply powertrain components.“The group is one of the largest manufacturers of forged automotive components in India,” ratings agency Crisil said in a recent report. “Revenue growth has been healthy in the past few years, driven by steady offtake and sustained focus on exports. The group has entered non-automotive segments such as energy—oil & gas, power, off-road applications—earthmoving, mining, construction, railways and farm equipment, and has strategically acquired entities to augment its capacities in these segments and foray into passenger vehicles and tractor segments.”

One-stop shop

Ramkrishna Forgings was founded by Jalan’s father, Mahabir Prasad Jalan, in 1981. Mahabir had graduated in engineering from the Birla Institute of Technology and Science Pilani, and had worked in companies, including Orient Paper Mills Ltd and Shalimar Wires Limited, before starting out on his own. He set up Ramkrishna Forgings with a loan of ₹50,000 from Punjab National Bank, to make components for wagon builders based in Kolkata.Over the next 20 years, much of the company’s focus remained on the railway sector, making everything from hangers for coaches to forging items. In 1997, on the back of the growing focus around the automotive sector, it raised its forging and die-making capacity at its Jamshedpur plant, in addition to developing machining and heat treatment facilities, including isothermal annealing to help manufacture auto forgings. Isothermal annealing is a type of heat treatment that helps homogenise the structure.

The 1990s were witness to a fast-changing automobile sector when foreign multinationals began lining up in the country. From the likes of Hyundai to Ford and Honda to Mercedes, everybody wanted a pie of the market.

The decision to ramp up on automotive forgings brought the company closer to Tata Motors, its earliest clients in the sector. It began by supplying axle components for commercial vehicles. “Tata Motors was our first client in automotive, and today also it is the biggest client for us in terms of our domestic automotive journey,” Jalan says. “Tata Motors is the anchor of what Ramkrishna is. It has anchored the boat.”

Also read: How Jupiter Wagons became India's largest railway engineer behemoth

By 2004, when the company went public, it had pivoted from railway components to focus almost entirely on the fast-growing automotive sector. Over the next few years, it began ramping up on its product portfolio for the automobile industry, including ready-to-use forgings such as crown wheels, gears, shafts, hubs, spindle axle beams, brackets and pinion drives.

Today, as much as 70 percent of the company’s revenue comes from the automobile sector, with the remaining coming from railways, oil & gas, highways and tractors, among others. Back in 2000, 50 percent of the revenues came from railways.

“I think domestically, every second truck in India is on our manufactured components,” Jalan says. Among others, the company’s clients include the likes of Eicher, Tata Motors and Ashok Leyland. “No automotive player in the world can survive without us in their supplier base. We have all marquee customers,” Jalan adds.

“The acceptance of the company’s products is established by the long relationship that it has with some of the leading auto manufacturers in the country and overseas, particularly in the M&HCV segments,” rating agency ICRA says in a recent report.

Going big

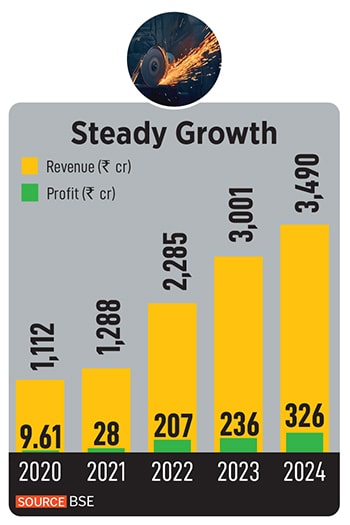

Over the past few years, the 43-year-old company has also embarked on a strategy to derisk and diversify its offerings from an unwavering focus on automotive parts. These new verticals now contribute 30 percent of the total business. Additionally, Ramkrishna has expanded its reach, increasing its presence in Europe, Southeast Asia, South America and Turkey, offering some 2,000 products across auto and non-auto segments.“Our industrial product segment and highway segment alongside railways is going to grow,” Jalan says. “With the growth in the top line, we are looking at 60 percent in automotive and 40 percent coming from non-automotive segments.” The company is now targeting ₹10,000 crore in top line, more than double its current number, in four years. For the fiscal ended March 2024, Ramkrishna Forgings’ revenues stood at ₹3,489.61 crore with profits of ₹326.07 crore.

Much of the recent diversification that the company has laid out since Covid is also a result of the growing change underway in the automotive world, with the focus quickly shifting towards electric vehicles. Electric vehicles use relatively fewer parts and don’t quite need an engine, unlike internal combustion engines which use up many forging parts.

Much of the recent diversification that the company has laid out since Covid is also a result of the growing change underway in the automotive world, with the focus quickly shifting towards electric vehicles. Electric vehicles use relatively fewer parts and don’t quite need an engine, unlike internal combustion engines which use up many forging parts. Among others, global automaker GM had in 2021 said the company would switch to an all-electric fleet by 2035, while Ford had announced plans to go all-electric in Europe by 2030. By 2030, about 40 to 45 percent of all two-wheelers and 15 to 20 percent of all four-wheelers (passenger vehicles) sold in India will be electric, according to a report by Bain & Co.

That’s also why, from two verticals in 2019, Ramkrishna Forgings now has five verticals under it with as many as 69 product categories in 2024 compared to 35 in 2019. The company has also gone on to add nearly 100 new customers in five years across 22 geographies, to reduce its focus on North America. Its offerings for the farm equipment sector include forged crank shifts and transmission shafts, while in the mining and construction sector, it manufactures shovels, buckets and backhoe buckets among others.

“India has been emerging as a leading supply chain destination for global mobility, especially with the China plus one strategy adopted by companies,” Puneet Gupta, director for automotive forecasting at market research firm S&P Global Mobility, says. “Even with the transition into electric vehicles, parts such as axles, and suspension will be needed with suspension systems undergoing a sea change with digital technology. That means the opportunity for companies like Ramkrishna Forgings is considerable.”

In 2022, the company acquired a majority stake in Tsuyo Manufacturing, a startup working on electric powertrains to ramp up its portfolio of motors, controllers, e-axles and differentials. Last year, the company, as part of its diversification strategy, also acquired Jamshedpur-based Multitech Auto and Mal Metalliks for ₹205 crore.

Multitech makes parts such as assembly top covers, shift cylinders, assembly gear, differential cases, and differential covers for commercial vehicles and railways. The company also acquired Amtek Group’s listed subsidiary JMT Auto through the corporate insolvency resolution process in 2023 for ₹125 crore.

“Last year, we have done three large acquisitions,” Jalan says. “Two were through NCLT and one outright. One is complementary to what we are doing on a standalone basis. The other two are in the casting space. From forging, we have diversified into castings also to offer a bouquet of opportunities for our customers.”

To do all that, the company had raised ₹1,000 crore through a qualified institutional placement. It is also consolidating its subsidiaries to streamline operations, improve synergies, and enhance cross-selling opportunities and in March, began manufacturing and supplying from its Mexico unit, with plans to establish a facility for passenger vehicle components.

Then, there is also a growing focus on the railway sector, where the government has been pushing for more participation from the private sector in manufacturing, especially wagons, brakes and wheels. That’s why in 2023, the company formed a joint venture with Kolkata-based Titagarh Rail Systems Limited to bid for manufacturing components for the railways. The company was awarded a contract worth ₹12,227 crore from the railways ministry to supply 15.4 lakh forged wheels over 20 years, with the delivery of 40,000 forged wheels in the first year, 60,000 in the second, and 80,000 wheels annually thereafter.

“In railways, we were practically negligible,” Jalan adds. “Now railways are almost 6 percent of our sales... we are now looking at almost 10 percent plus.”

All that means, Jalan, who attributes Ramkrishna Forgings’ success to hard work and team building, says the company is now on a steady path of growth, and that the best days are yet to come. “Our ability to grow and fund new projects, and tap new opportunities mean that we are looking at almost 20 percent plus growth every year.”

If anything, the last few years have proven that Jalan walks the talk. On to the next few years.

(This story appears in the 20 September, 2024 issue of Forbes India. To visit our Archives, click here.)