The global importance of the Bank of Japan and Japanese politics

While investors keenly monitor the Fed, the Bank of Japan's actions can send shockwaves through global markets

View of the headquarters of the Bank of Japan in Tokyo.

Image: Stanislav Kogiku/SOPA Images/LightRocket via Getty Images

View of the headquarters of the Bank of Japan in Tokyo.

Image: Stanislav Kogiku/SOPA Images/LightRocket via Getty Images

In the modern world, where investors and traders are focused on the Fed, the Bank of Japan's (BOJ) influence is often overlooked. However, even a 25-basis point hike by the BOJ caused turmoil in global markets. If the BOJ were to adopt aggressive rate hikes like the Fed, the resulting chaos could dwarf the financial crises of 2008 and 1929.

The importance of the Bank of Japan

The Bank of Japan's importance lies in its pioneering Zero Interest Rate policy (ZIRP) in 1999 and the Negative Interest Rate Policy (NIRP) in 2016. For nearly three decades, the BOJ has maintained ultra-low or negative interest rates to stimulate its economy, with significant global consequences.By providing zero-cost capital, the BOJ has inadvertently fuelled worldwide free capital flow, known as the Yen Carry trade, where investors borrowed in yen at zero cost and invested globally. This inflated asset prices worldwide for over two decades. Post-December 2008, the US Fed and other central banks adopted similar policies, causing asset prices to soar—from stocks to Bitcoin.

This era of free capital and global profits faced complications with the Fed's rate hikes since March 2022.

Post-2022 complications

Following the Fed's rate hikes since 2022, the BOJ remained the last bastion of zero (or negative) cost capital globally. As long as the BOJ kept rates low, free capital flowed, making it one of the most important central banks. This presence of BOJ's negative rates arguably blunted the Fed's impact on the US and global economy.A shallow Fed rate hike would have been manageable, but the Fed raised rates to over 5 percent. These hikes acted like steroids for Yen Carry trades. With US Treasuries yielding over 5 percent and the BOJ maintaining negative rates, Yen Carry traders could profit by borrowing in yen and investing in US Treasuries, the world's safest asset. There was no need to seek yields in risky emerging markets.

Consequently, Yen Carry trades have more than doubled since the end of 2021.

This trade involved borrowing in yen and selling it for USD to invest in US Treasuries or elsewhere. While traders enjoyed easy capital and yield profits, massive yen selling for these trades caused its value to drop significantly against the USD, from 115 in January 2022 to 160 in June this year—a 40 percent decline.

Despite the massive devaluation of the yen, the BOJ refrained from rate hikes for nearly two years. One reason is Japan's staggering national debt, which is 220 percent of its GDP and totals $9 trillion. Higher interest rates could force the government to allocate most, if not all, of its revenue to debt servicing. Another reason is the potential havoc this might cause in Japanese and global markets due to the unwinding of Yen Carry trades.

However, not raising rates and letting the yen fall also has consequences. Economically, it leads to increased import costs and inflation. Politically, it makes the Prime Minister very unpopular.

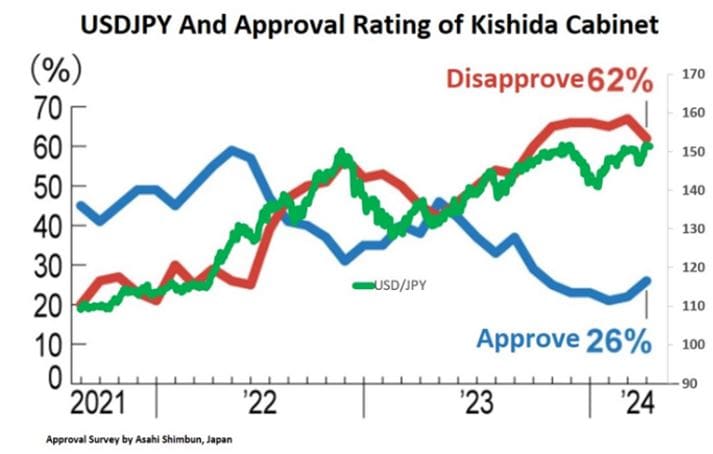

Recently, the USD-JPY rate has been a good indicator of approval ratings in Japan (see figure below). Japanese households, being net importers, face significantly higher prices due to the weaker yen. This erodes their purchasing power, reduces real consumption, and increases the political cost of the massive yen devaluation.

Prime Minister Fumio Kishida has recently become the most unpopular leader since his party's return to power in 2012. September 2024 is crucial for Kishida, as the Liberal Democratic Party will elect its next president, effectively choosing Japan's next PM.

This likely prompted the BOJ to act. In March 2024, it abandoned the NIRP. In August, it ended its ZIRP, raising rates to 0.25 percent. This led to higher borrowing costs, significant margin calls, and a market crash, leading to the new 'Black Monday' on August 7.

Also read: Lessons and reforms for a fragile financial system

What next?

A 25-basis point rate increase by the BOJ triggered a global Black Monday. A further percentage point increase could lead to a market crash worse than 2008 or 1929. The tentacles of free money are deep, and the BOJ is (still) the last bastion of low-cost capital.Will the BOJ increase rates further? It depends on several factors. Politically, 2025 is crucial for Japan with general elections. At 25 bps, the BOJ's rate is still too low to stop the yen's long-term slide. However, every rate increase also adds to the interest burden, requiring careful balancing.

All this will be in the shadow of Fed actions. The large gap between the BOJ and Fed rates fuels the yen's fall and subsequent political and economic issues in Japan. A further BOJ rate increase could crash US markets decisively. The BOJ's latest hike might push the Fed to consider a rate cut, as the BOJ may be forced to hike again without it.

The Fed might need to substantially reduce the rate difference between the BOJ (0.25 percent) and Fed (5 percent) by continuous cuts, risking inflation in the US. However, closing the gap by increasing BOJ rates could trigger a massive market crash.

How long the BOJ can hold out is a key global macroeconomic question.

Vidhu Shekhar is Assistant Professor, Finance and Economics at SPJIMR.

[This article has been reproduced with permission from SP Jain Institute of Management & Research, Mumbai. Views expressed by authors are personal.]