How StepChange is helping companies decarbonise and model climate risk

StepChange has customers ranging from financial services to FMCG, and boasts a suite of products covering carbon reduction, ESG compliance management, and supply chain-related carbon tracking2

Ankit Jain (right), co-founder & CEO, with Sidhant Pai, co-founder & CSO of StepChange

Image: Neha Mithbawkar for Forbes India

Ankit Jain (right), co-founder & CEO, with Sidhant Pai, co-founder & CSO of StepChange

Image: Neha Mithbawkar for Forbes India

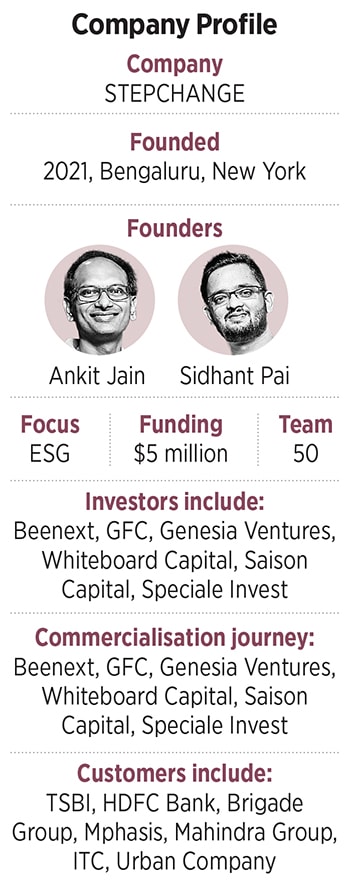

In a matter of about three years, Ankit Jain and Sidhant Pai have built their environmental, social, governance (ESG) solutions venture StepChange to where they can boast of customers such as the State Bank of India (SBI), Mahindra Group, Brigade Group, ICICI Bank and HDFC Bank.

Today, StepChange has a suite of products covering carbon reduction, ESG compliance management, and supply chain related carbon tracking. The company also offers a dedicated set of solutions that financial companies such as banks and private equity investors can use to track the climate change impact of their loans and investments.

On the ESG and supply chain reporting front, “we’ve now been working with quite a few sectors including automotive, real estate, agriculture, FMCG, and electronics manufacturing,” Jain says.

On the ESG and supply chain reporting front, “we’ve now been working with quite a few sectors including automotive, real estate, agriculture, FMCG, and electronics manufacturing,” Jain says.With large services companies, for example, the decarbonisation focus revolves around their real estate assets, he says.

Therefore, it boils down to tracking electricity and diesel consumption, which helps companies figure out how energy efficient they are. This constitutes the “operational sustainability” part of StepChange’s solutions.

On the portfolio sustainability front, “we work today with eight out of the top 20 banks in the country,” Jain says. Similarly, StepChange’s solutions are used by mutual funds and private equity companies. The solutions help asset managers in any of these finance companies to get a sense of the environmental impact of the loans or portfolio of investments they manage.

The startup helps finance companies raise the share of their green lending, which constitutes the “portfolio sustainability” aspect of how its products are being used by customers today.

StepChange also offers climate risk assessments, so companies can model the risk to their investments from climate change events likely in the future. And finally, the company offers software tools that customers can use to move closer towards net zero, and decarbonize their portfolios.

“One thing that we’re proud of is the depth we’ve built in what’s called Scope 3 emissions, which is the largest part of any company’s carbon footprint,” Jain says. So far, “we’ve measured 600 million tons of CO2e (carbon dioxide equivalent) through our platform. To put that number in perspective, that’s almost 20 percent higher than the all the CO2e of the UK.”

Also read: Updapt is changing the ESG game for enterprises

The “scope” definition of emissions come from the Greenhouse Gas Protocol, the most widely used green accounting standards, worldwide. Scope 1 covers emissions an organisation is directly responsible for. Scope 2 are emissions it causes indirectly such as emissions from its power supplier. And Scope 3 includes emissions that result from every part of the supply chain a company relies on that aren’t covered in Scope 1 and 2. This is also often referred to as emissions from the “value chain” of a company.

“Increasingly, value chain sustainability has been an emerging theme,” Jain says.

In India, for example, “value chain reporting has become a big part of every large company’s requirements,” Jain says. This has become more urgent over the last six months or so after the capital markets regulator, Securities and Exchange Board of India (SEBI), mandated that all listed entities must report at least 75 percent of their value chain, he points out.

The company had said in a May 2023 press release, announcing a funding round, that its India-specific database helps customers track emissions across 75,000 emission factors related to various products and services. StepChange today has about 50 customers, Jain says.

“By end of this year, we want to get to a place that allows us to raise a Series A investment,” he says. So far, StepChange has raised about $5 million in seed funding from investors including GFC, Beenext and Speciale Invest.

“StepChange’s innovative approach to corporate sustainability focuses on region-specific carbon accounting models and platforms. We believe this approach will be a game-changer in the global effort towards tackling climate change,” Anirudh Garg, a partner at Beenext, said in a statement at the time of the May 2023 funding announcement.

“The sophistication of our offerings has been increasing, customers willingness to pay has also been increasing with that,” Jain adds.

As you move to applications like tracking Scope 3 emissions, and climate risk modelling, there’s a lot more value add.”

“We are in fact now looking to start expanding globally.” So far most of StepChange’s work has been in India, but it already has customers in Southeast Asia, Europe, and the Middle East. The company is looking at other geographies as well, he says.

(This story appears in the 06 September, 2024 issue of Forbes India. To visit our Archives, click here.)