Profit with purpose can be a viable pursuit: Hero Future Energies' Rahul Munjal

Munjal, 48, who started Hero Future Energies in 2012, foraying into wind turbines-based power generation with a small 20 MW project, has since expanded into solar, hybrid, and now green hydrogen

Rahul Munjal, chairman and managing director, Hero Future Energies. Image: Madhu Kapparath

Rahul Munjal, chairman and managing director, Hero Future Energies. Image: Madhu Kapparath

Even as this issue of Forbes India hits the stands, Rahul Munjal will be a tad closer to the inauguration of a small green hydrogen plant at an aluminium smelting factory, slated to go live before the year is out. Munjal, chairman and managing director of Hero Future Energies (HFE), declined to add specifics prior to the opening of the plant, but it’s the latest example of how the renewable energy business he’s built is expanding and pursuing the founder’s decarbonisation agenda.

Commercial and industrial projects, C&I as the sector is called, currently a nascent operation at HFE, represent a big opportunity for the company to expand into, Munjal tells Forbes India. This involves setting up renewable energy operations for large factories in sectors such as cement manufacturing or iron and steel. And green hydrogen is widely seen as a promising source of energy for such factories.

The wind solar hybrid project at Manvi, Karnataka, run by HFE

The wind solar hybrid project at Manvi, Karnataka, run by HFE

The one that HFE is opening shortly is a pilot plant, at a factory in South India, Munjal says. It will demonstrate that the technology works. The plan is to use industrial-grade electrolysers on site to generate hydrogen, which is then blended with PNG (piped natural gas) and LNG (liquified natural gas) as fuel to produce heat for a smelter, he says. “That’s how you will end up decarbonising the process to some extent. Obviously, it still uses PNG and LNG, but it’s at least a start in the right direction,” he adds.

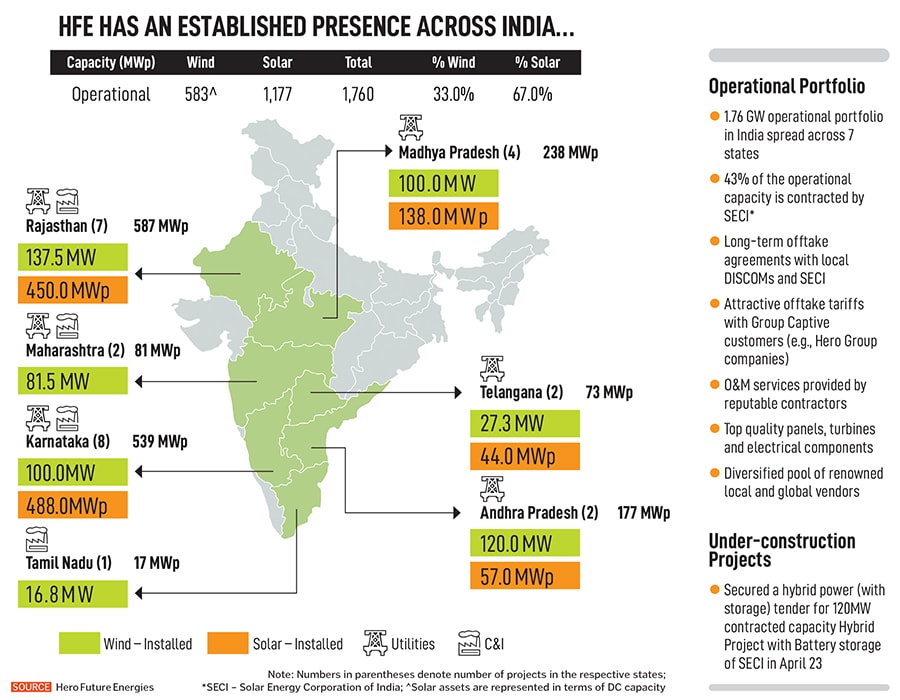

Munjal, 48, who started HFE in 2012, foraying into wind turbines-based power generation with a small 20 MW project, has since expanded into solar, hybrid and now green hydrogen. Overall, the Delhi-based company has about 1.9 GW of capacity today. Most of it is in India, where HFE operates wind, solar and hybrid facilities in states, including Rajasthan, Maharashtra, Madhya Pradesh, Karnataka, Tamil Nadu, Andhra Pradesh and Telangana.