Updapt is changing the ESG game for enterprises

With not much more than some seed funding, Updapt has developed an ESG management product that's being used by several large corporations

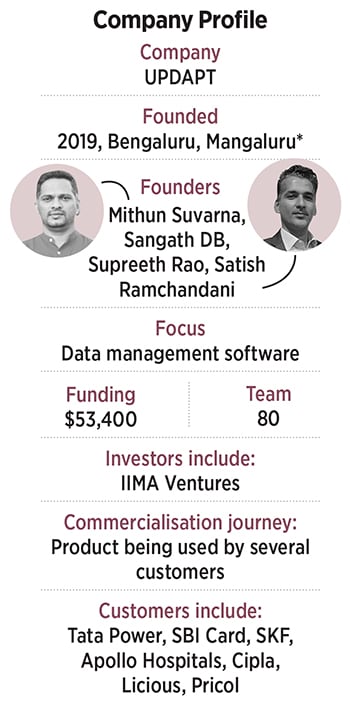

Mithun Suvarna, co-founder and CEO, Updapt

Mithun Suvarna, co-founder and CEO, Updapt

Mithun Suvarna spent about 15 years at Thomson Reuters, where he was an ESG [environment, social, governance] policy specialist when he left to start Updapt to offer customers a smart way to get a grip on their ESG related data, with co-founders Sangath D Babu and Supreeth Rao. Today they also offer a decarbonisation-specific module.

The product they developed has been in the market for less than three years, but already Updapt boasts names such as Tata Power, SBI Card, SKF, Cipla and Apollo Hospitals as customers, according to the company’s website. Suvarna himself was circumspect about naming customers in a recent interview with Forbes India.

“With the ESG dashboard provided by Updapt, we have a powerful tool at our fingertips, enabling us to monitor and visualise key environmental metrics in real-time,” says Ivaturi Nandikeswara Rao, head of environment and climate change at Tata Power, in a testimonial on Updapt’s website. “From tracking our carbon footprint to managing energy consumption and automating GHG accounting, this dashboard provides invaluable insights that drive our sustainability efforts forward,” Rao adds.

“With the ESG dashboard provided by Updapt, we have a powerful tool at our fingertips, enabling us to monitor and visualise key environmental metrics in real-time,” says Ivaturi Nandikeswara Rao, head of environment and climate change at Tata Power, in a testimonial on Updapt’s website. “From tracking our carbon footprint to managing energy consumption and automating GHG accounting, this dashboard provides invaluable insights that drive our sustainability efforts forward,” Rao adds.Updapt digitalises a customer’s sustainability journey from identifying and collecting data to analysing it to extract useful information. Gathering data involves everything, from even manual entry of data where needed to uploading spreadsheets and integrating with existing systems—IoT [internet of things] systems where they exist, smart electricity metres, and metres for water and waste water and so on.

Updapt can then automate greenhouse gas accounting, helping customers generate reports along some 15 different ESG reporting frameworks. Next, having measured where they are, customers can start to put in place the plans needed to meet their targets for the future, Suvarna says.

Updapt helps with this as well, with various modules, including one based on artificial intelligence and machine learning, for predictive analytics, and a net-zero module.

Also read: For businesses, sustainability should be a leadership challenge, not a cost problem: Rajeev Peshawaria

Customers can collect all their energy source data, convert those to emission numbers, which in turn are used to set targets and put in motion plans to reduce carbon footprints. Updapt helps customers track how well those plans are working and, finally, the startup also offers a marketplace to buy carbon offsets for the emissions that still remain.

“Our customers range from big listed companies to startups, from technology to manufacturing, and from America to Australia,” Suvarna says. “We are also used by real estate companies and private equity investors in real estate. And when new standards, guidelines or ratings are updated in any given industry, we can map Updapt to those within 48 hours,” he says.

An important aspect of Updapt is that it is “99 percent configurable”, Suvarna says. That means it can be adapted to their particular needs by the customers themselves, and not requiring separate, costly and time-consuming customisations as in the case large business management software packages, for example.

The company has “zero churn” and it’s going after several hundreds of prospects, he says. The existing business operation is almost at breakeven but Updapt’s ambitious business expansion plans will definitely need more money, Suvarna says, including, possibly more venture capital money.

(This story appears in the 23 August, 2024 issue of Forbes India. To visit our Archives, click here.)