Form 26AS tax credit statement: How to view and download

Tax season got you stressed? Learn how to download, view, and understand Form 26AS Tax Credit Statement to maximise your tax savings

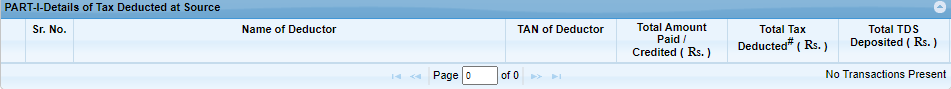

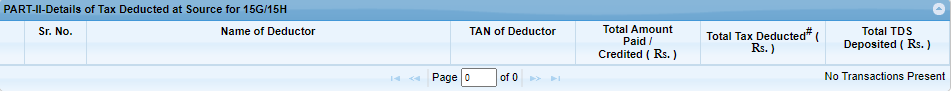

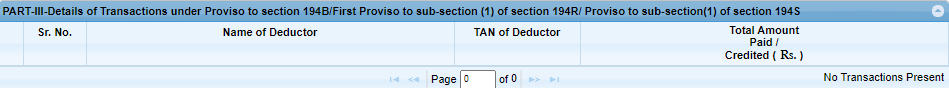

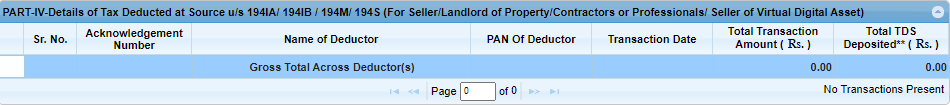

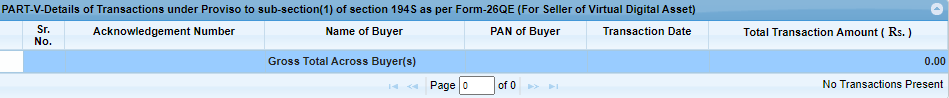

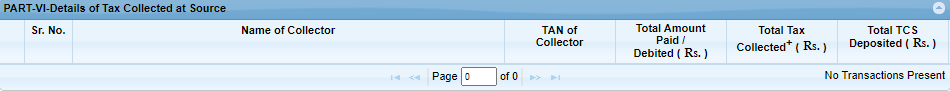

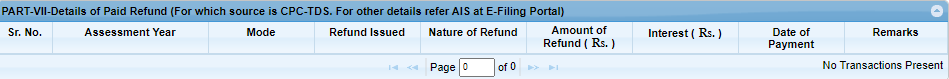

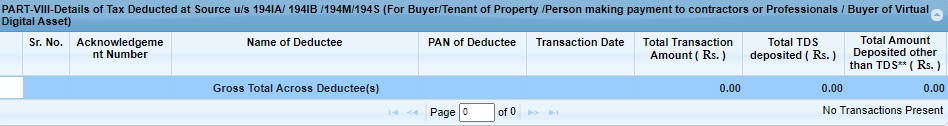

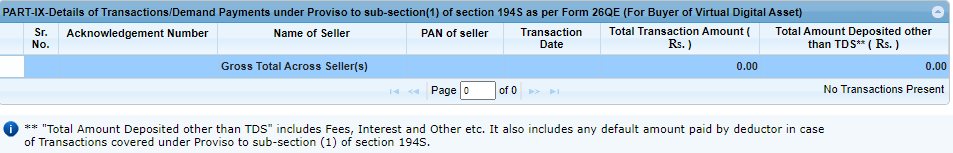

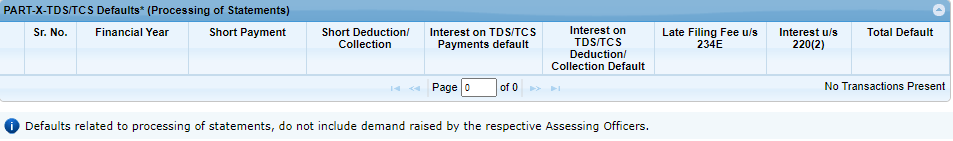

Form 26AS is a tax credit statement that provides a comprehensive view of all tax-related transactions linked to an individual's Permanent Account Number (PAN). It includes details such as tax deducted at source (TDS), tax collected at source (TCS), advance tax, self-assessment tax, and refunds.

This document is a consolidated record of all tax transactions between the taxpayer and the income tax department, making it essential for accurate income tax return (ITR) filing. It helps taxpayers verify tax deductions, claim tax credits, and ensure compliance with tax laws.

Form 26AS is crucial for accurate income tax return (ITR) filing. It helps you verify tax deductions, claim tax credits, and ensure compliance with tax laws. The Form 26AS credit statement is available online and can be downloaded by taxpayers on the official ITR e-filing website.

Also Read: ITR filing: Here are the documents required for income tax return filing

How to View and Download Form 26AS

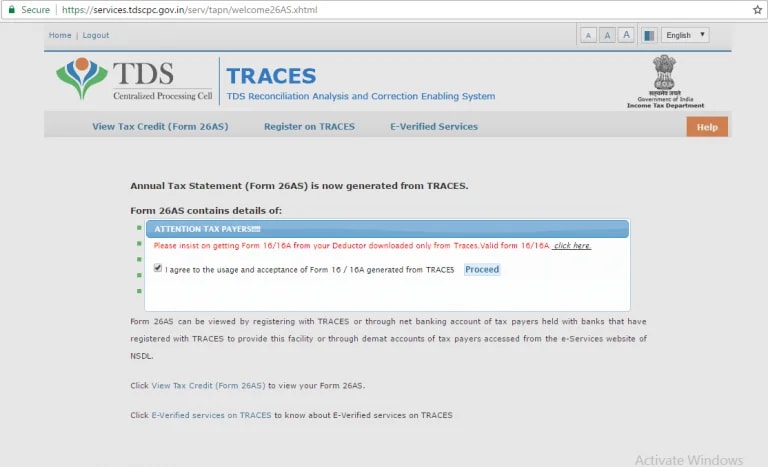

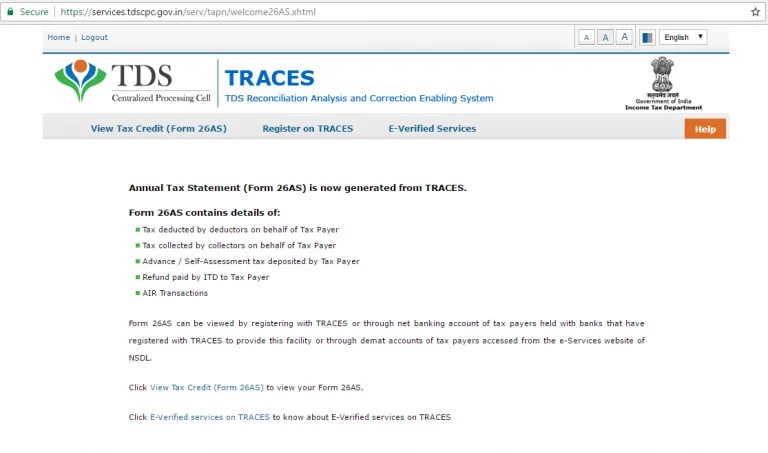

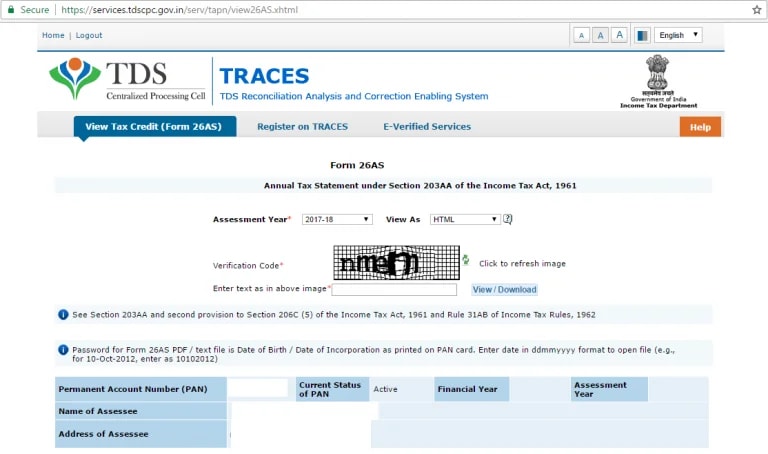

- TRACES Portal

- Net Banking

Option 1: Through the TRACES Portal

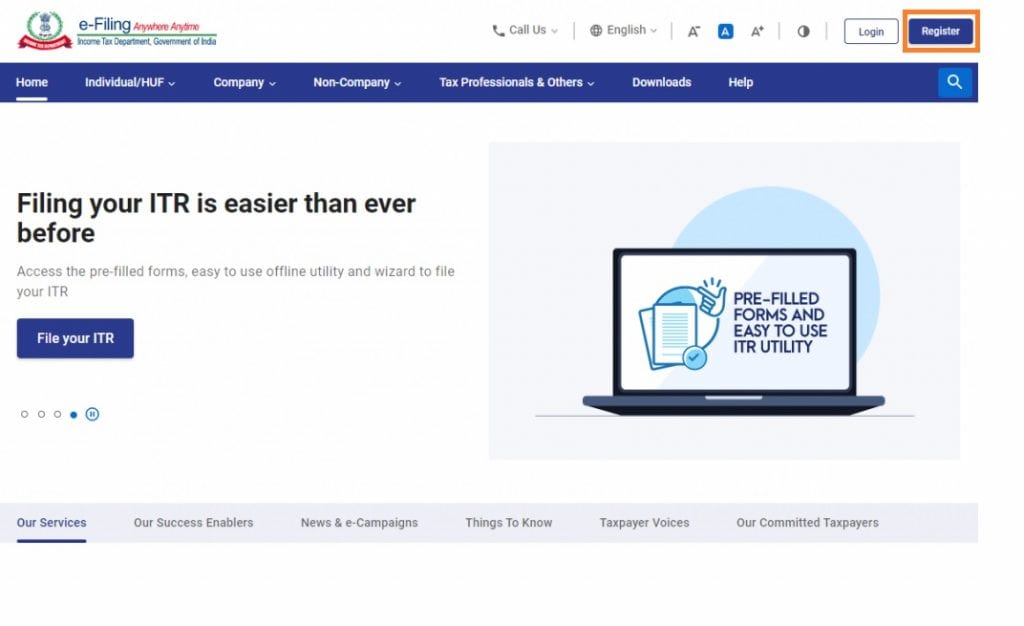

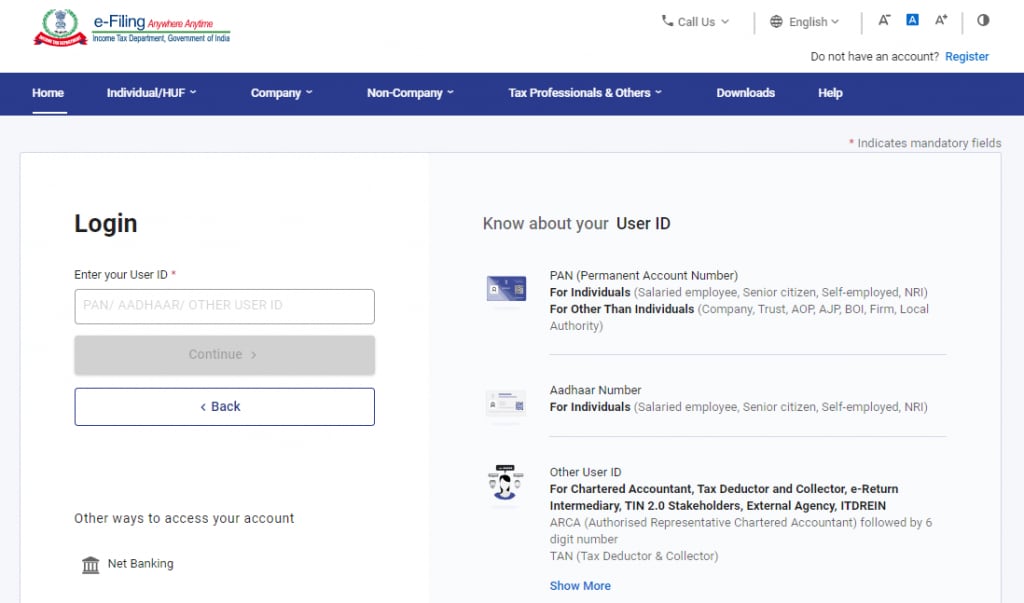

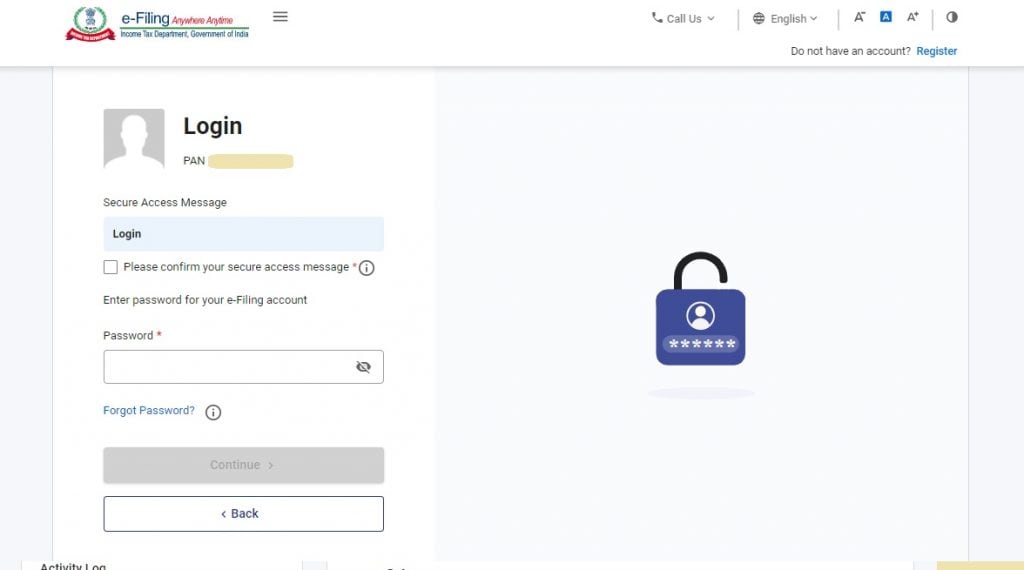

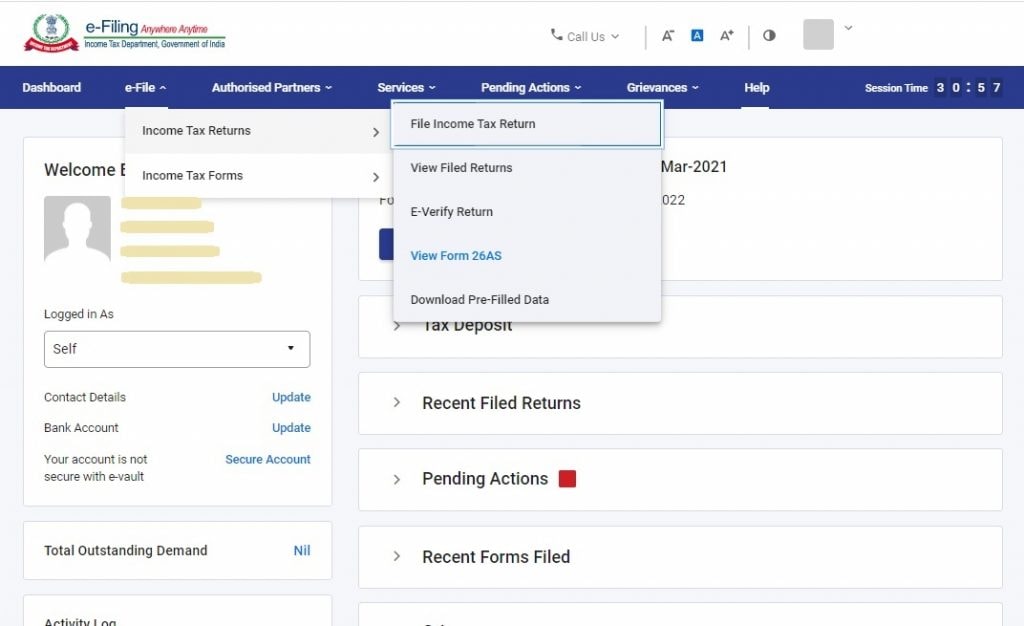

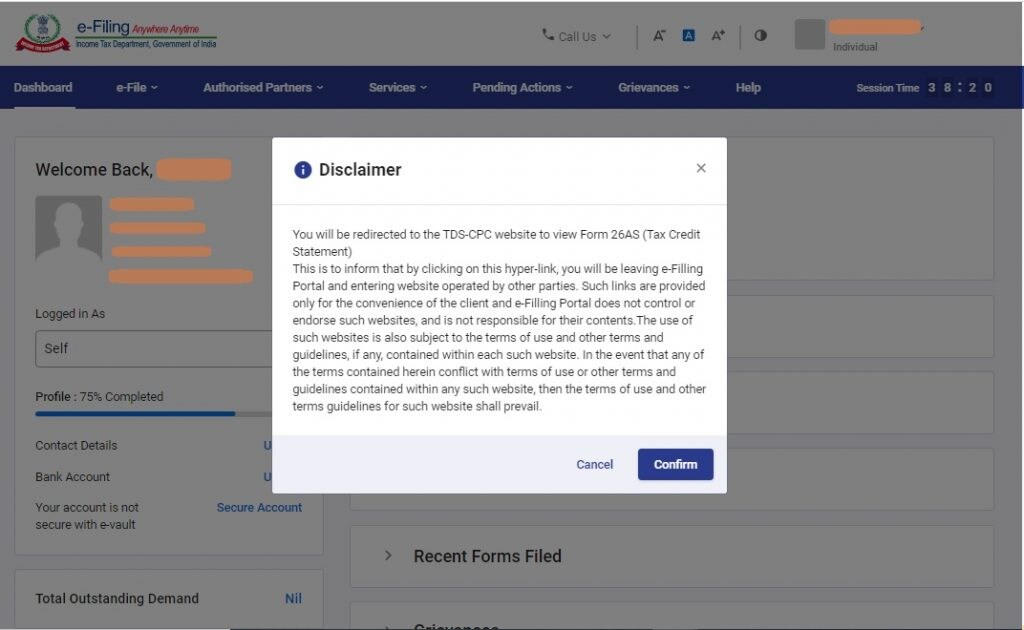

Step 01: Head to the official ITR e-filing website.