Nandan Nilekani is overhauling the way the world sees India

It's not just evangelising a vision of inclusive India, but personally developing large chunks of the digital building blocks of that future

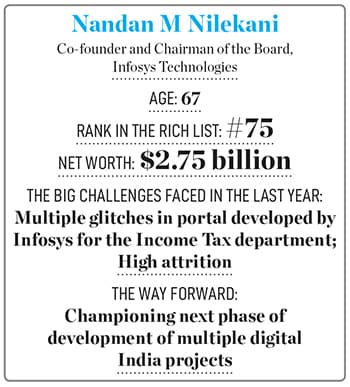

Nandan Nilekani, co-founder and chairman of the board, Infosys Technologies

Image: Samyukta Lakshmi / Bloomberg via Getty Images

Nandan Nilekani, co-founder and chairman of the board, Infosys Technologies

Image: Samyukta Lakshmi / Bloomberg via Getty Images

The stage was set in Mumbai, India’s financial capital, at the Jio World Centre, the city’s business district. People from world over were meeting to celebrate India’s fintech revolution and talk about what’s next. A senior official from the National Payments Corporation of India made a simple, almost cursory, announcement that Nandan Nilekani would speak for a bit. Nilekani, chairman of Infosys Technologies, but in the day’s context, chief evangelist of tech for an inclusive India, didn’t disappoint.

India, and specifically the Reserve Bank of India (RBI), “is showing the world how to combine regulation and innovation,” he said at the beginning of his brief 10-minute speech. He spoke of how the world is marvelling at India’s fintech revolution, with Aadhaar and the Unified Payments Interface (UPI), but ever looking ahead, added “this is just a part of the journey, there are a few things that are coming.”

In particular, the Account Aggregators system that the RBI is putting in place holds out the promise of making credit and lending as simple as sending a payment today, and will touch off its own set of revolutions, he said. Another big initiative is the Open Network for Digital Commerce (ONDC), which will allow India to disaggregate ecommerce with participation from literally everyone—retailers, supply chain businesses, payments companies, and so on—with a big impact on hyperlocal commerce. “This combination of credit with UPI, enabled by the Account Aggregator system and ONDC, will fundamentally reorder the supply chain of India,” making it more efficient and easier to get products and services to everyone, he outlined.

The day’s events included the launch of additional features on the UPI platform, including the ability to make payments via an “offline UPI” feature. And ever dreaming big, “today we have about 260 million people using UPI, and with the launch of offline UPI, I think we can add another 500 million users to the payments system,” Nilekani said.

Today’s young, who communicate via memes, would relate to pictures of rope tricks, elephants, cows and snake charmers that were commonly used to parody India. In the last 30 years, those images have become obsolete, starting with the country’s economic liberalisation. And Nilekani has risen to become the best-known figure among a small elite who straddled private enterprise and public service to wow the world with what was possible in India—Sam Pitroda and Ashok Jhunjhunwala are others in that set, for example.

Today’s young, who communicate via memes, would relate to pictures of rope tricks, elephants, cows and snake charmers that were commonly used to parody India. In the last 30 years, those images have become obsolete, starting with the country’s economic liberalisation. And Nilekani has risen to become the best-known figure among a small elite who straddled private enterprise and public service to wow the world with what was possible in India—Sam Pitroda and Ashok Jhunjhunwala are others in that set, for example.