Developer's Dilemma: How To Sell Luxury Properties

In a difficult market—think Gurgaon, Mumbai—developers are getting back to the drawing board to attract takers for their opulent projects

Sanjay Sharma, managing director of QuBrex, a Gurgaon-based real estate consultancy and brokerage firm, is struggling to sell luxury apartments in the city. “In the boom period of 2009-11, it was quite common to close eight to 10 deals in two months, but now, selling even one piece of property has become difficult,” he says. Last week, Sharma came close to sealing one such deal, but it fell through when the buyer failed to appear. “The seller turned up at my office but the buyer dropped out,” says Sharma.

The number of meetings between buyers and sellers is now 25 percent of what it used to be a few years ago. “Of this, only one in four meetings results in a sale,” he says. Queries about properties from potential buyers have fallen to 10 to 15 a month from the earlier 100. “We hardly do any sales now.”

The slump in the luxury real estate market is all too real in some key urban pockets. Samantak Das, director of research and advisory services at real estate consultancy firm Knight Frank India, says investors, who comprise at least 25 percent of luxury home buyers, have moved to the mid-income housing segment because of more pronounced exit options. The trend is an extension of a broader decline in the entire real estate market that began two years ago.

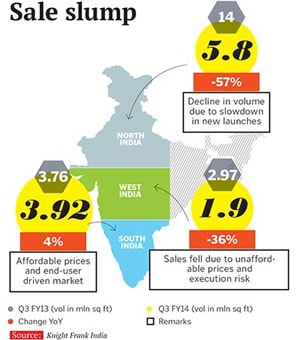

A March 2014 report by Knight Frank India shows that for Q3 FY14, sales volumes of 15 of the country’s top 25 developers have declined by 43 percent year-on-year to 118 lakh sq ft. The report was compiled from the data of companies that declare the information on a quarterly basis.

Gurgaon is one of India’s worst-affected markets. The loss of its lustre is reflected in the discounts offered on ready-to-move-in apartments that usually sell at a premium. Consider Caitriona, which has become a casualty of this slump. The luxury residential project is in Ambience Island, an integrated township on NH-8, a few metres beyond the Delhi-Gurgaon border. The smallest apartment is 6,750 sq ft; the more spacious ones go up to 11,500 sq ft. Prices range from Rs 13 crore to Rs 40 crore. Ambience Developers and Infrastructure is offering buyers an equated monthly installment (EMI) scheme, under which they can pay 30 percent of the price at the time of booking the apartment, and the rest in EMIs over the next five years. “The fact that the developer has to entice people to buy an apartment in a ready-to-move-in project through innovative EMI schemes is an indication of how tough it is to sell luxury homes,” says Sharma.

Gurgaon had seen a similar cooling off in sales during the 2008 economic meltdown, but the real estate market was resilient, and recovered after the 2009 national elections. After the elections, the National Capital Region (NCR) saw a record launch of 1.2 lakh units. “It was the highest number of launches in a year in the region. It never happened before and hasn’t happened after,” says Amit Oberoi, national director, Colliers International, a real estate consultancy firm.

Investors who buy properties for a short period of time and sell it later for a profit, are waiting for a price correction. “They are holding on to their money,” says Oberoi. “I know a lot of people in Gurgaon who are itching to buy apartments, but are waiting for a more conducive environment.”

Another tribe of buyers, called end-users, are staying away from the market because of high prices, high interest rates and uncertain job prospects. A word developers love to explain slow sales is ‘sentiment’. “Fundamentally, there is nothing wrong with the Indian real estate market,” says Brotin Banerjee, managing director and CEO at Tata Housing Development Company, which has several luxury projects in the NCR and Mumbai region. “Buyers are postponing decisions in the hope that interest rates will come down. Our sales in Mumbai/NCR have been affected as well, and we are hoping that once sentiments pick up, we will see more traction.”

A section of developers in the NCR believes this segment is immune to economic uncertainties. Nayan Raheja, executive director of Delhi-based Raheja Developers Pvt Ltd, insists the “slowdown is for the masses and not the classes”. Raheja had launched a luxury project Revanta in Gurgaon in 2012. “On the first day of the launch, we sold six penthouses,” says Raheja. “We haven’t experienced a slowdown.”

Amar Sinha, executive director, Wave Infratech, concedes that demand for houses has been affected but, like Raheja, he says the landscape of the luxury market remains unscathed. “This segment is more or less recession-proof. Buyers are typically celebrities or businessmen. Their appetite for homes is not governed by economic considerations. We haven’t seen any slowdown at Wave.”

Developers may deny the slump, but many have postponed the launch of luxury projects in the NCR and Mumbai. “In the north, developers with huge debt have changed their strategy,” says Knight Frank’s Das. Instead of a flurry of new launches, the trend is towards completion of projects, he adds, pointing out that “in Mumbai, launches are fewer because of delays in project approval”.

Being an end user-driven market, South India has held up well. Koshy Varghese, managing director of Bangalore-based Value Designbuild Pvt Ltd, says, “Bangalore has been a better market because investor participation is not as big as before.”

In Mumbai it is a mixed bag. “While there is pain in micro-markets such as central Mumbai, which has an oversupply of luxury homes, those in Bandra-Kurla Complex, eastern and western suburbs are doing well,” says Kamal Khetan, chairman and managing director, Sunteck Realty Ltd.

Prices haven’t dropped, at least not at first glance. In the NCR, developers haven’t reduced the base selling price, but are willing to offer discounts on properties.

Gautam Ahuja, managing director of Mumbai-based developer Ahuja Constructions, which has 30 percent of its projects in the luxury segment, says slow sales affect the builder’s cash flow, but there is no room to reduce prices. “Luxury properties in Mumbai have seen a 10 to 15 percent price correction in the form of discounts on floor rise, parking, and so on, but there is no reduction in sale price,” he says.

Ahuja doesn’t see prices dropping any time soon. “They have held up for 1.5 to 2 years despite a bad market because the cost of construction has gone up. Once demand returns, prices will rise,” he says.

Mumbai’s limited supply of land makes it difficult to reduce prices, says Khetan. “If you remember, Mumbai was the least-affected market even after the Lehman collapse. The city is like Manhattan, which saw a price correction of only 10 percent during the 2008 slowdown, as compared with Miami, which saw prices fall by as much as 70 percent.”

A report by Knight Frank says the financial stress of developers is at a five-year high. “The stress relates to debt and the repaying capacity of not only the principal amount but also the interest,” says Das.

Builders have been borrowing heavily to complete projects. A March 2014 Knight Frank study shows that the net profit of India’s top 15 developers has fallen by 41 percent over the last eight quarters. In Q3 FY14, the revenue of the top 25 realty companies increased by just 1 percent on a year-on-year basis. “Revenue numbers show progress in construction activity because builders report revenue on a project completion method. The meager rise in revenue tells you that construction activity has slowed down because of a cash crunch,” says Das.

The hope now is that sentiment will improve after elections. Colliers’ Oberoi doesn’t expect a repeat of the 2009 record launches in the NCR. “But the perception is that markets will bounce back. Demand is so low that it can only go up,” he says.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)