Adi Godrej: An entrepreneur and a gentleman

The Godrej Group patriarch Adi Godrej's five decade-long entrepreneurial journey is the story of Indian capitalism's evolution and all that is good about it

Image: Vikas Khot

Image: Vikas Khot

Forbes India Leadership Awards 2017: Lifetime Achievement

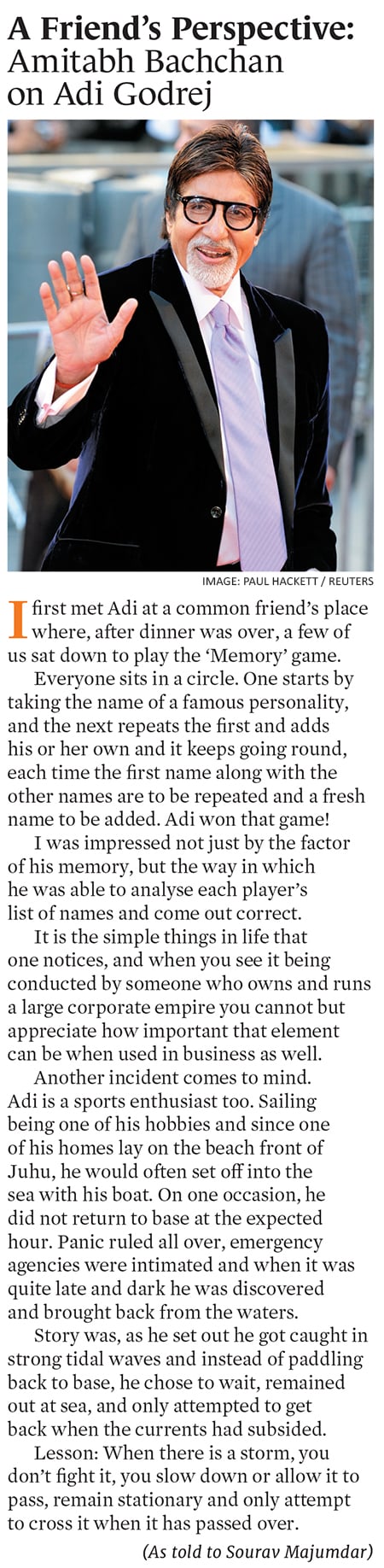

Many years ago, Adi Godrej, who is fond of sailing, took off with his boat into the sea alone, as he often did. On one occasion, Godrej didn’t return at the expected hour and was incommunicado, recalls his good friend and Bollywood legend Amitabh Bachchan. Panic spread, emergency services were alerted and it was not until dark that he was spotted at sea and brought back safely, Bachchan tells Forbes India in an email. It turned out that he had been caught in strong tidal waves and instead of navigating back to the shore, he had chosen to wait till the sea was calm again, recalls Bachchan.

But it is not Godrej’s entrepreneurial achievements alone that define him. Speak to anyone—family, friends, employees or peers in the industry—and you will find why the septuagenarian is a thorough gentleman with impeccable ethical standards: A role model, in the truest sense.

*******

The Godrej Group was already diversified when Godrej joined the business. It was making everything from locks and safes to wardrobes and soaps. But it was still a relatively small entity with a turnover of around ₹10 crore, nowhere close to being the $5 billion conglomerate (around ₹32,000 crore by turnover) that it is at present.

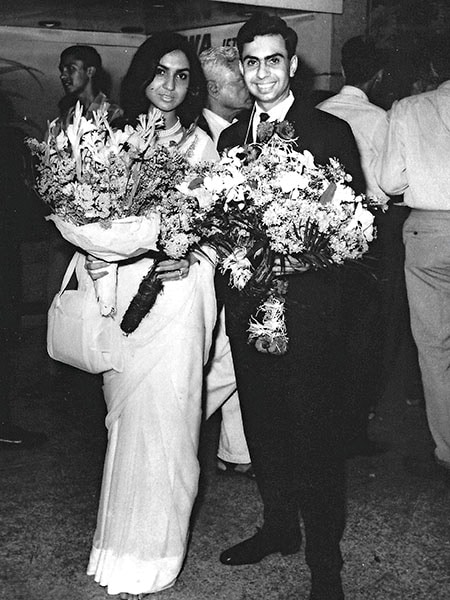

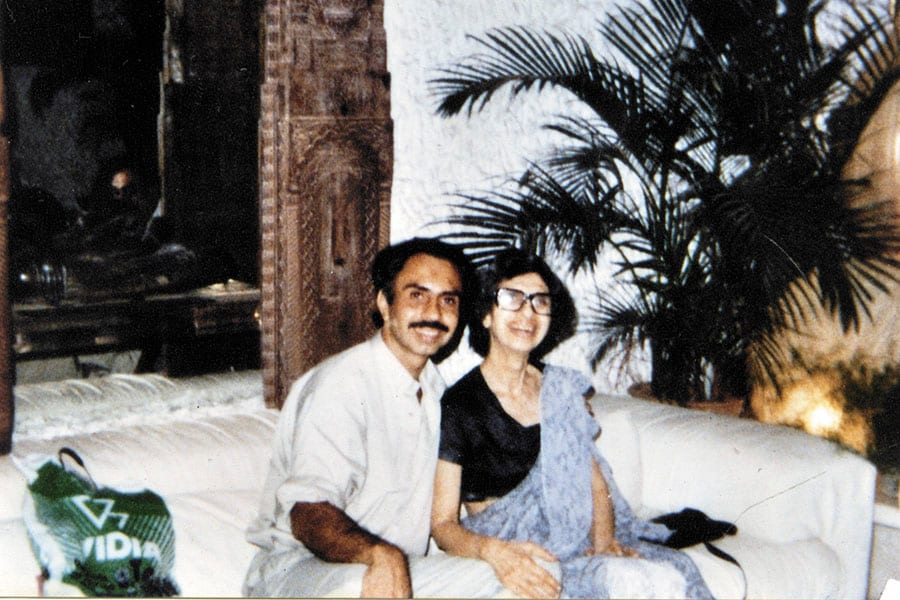

Adi Godrej with his late wife Parmeshwar Godrej

Adi Godrej with his late wife Parmeshwar GodrejWith businesses including consumer products, real estate, furniture, consumer durables, chemicals, aerospace and animal feed, the combined market value of the four listed firms of the group stands at ₹1.07 lakh crore as on October 27.

“The economy was closed at that time, GDP growth was slow, policies were all socialistic,” Godrej tells Forbes India, seated in a conference room on the seventh floor of Godrej One, the conglomerate’s new glass-and-steel headquarters in Mumbai’s eastern suburb of Vikhroli. “Expansion of the business was difficult as lots of permissions were needed and everything was controlled [by the state].”

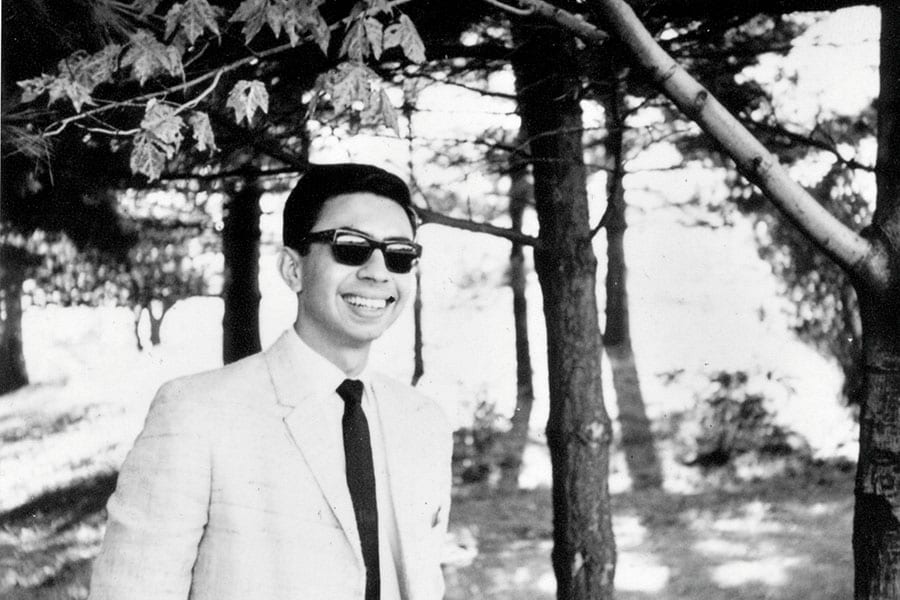

How does a business improve its performance in a market that isn’t expanding? By looking inwards and implementing the necessary change. And that is what Godrej did after returning to India upon the completion of his MBA from the Sloan School of Management, at the Massachusetts Institute of Technology, and joining the business alongside his father Burjorji Godrej. The group had two companies at that time—Godrej Soaps (famous for its Cinthol brand) and Godrej & Boyce (manufacturing furniture, safes and locks, among other products). Always up for a challenge, the young Godrej decided to join Godrej Soaps, a company that was incurring losses at the time.

Godrej, now India’s sixth richest billionaire with an estimated family wealth of $14.2 billion according to the 2017 Forbes India Rich List, was the first management graduate to join the family business and that too at a time when the concept of management education didn’t exist in India.

He immediately put his global education to good use by ushering in a slew of process improvements to turn the company around. He managed to do this within a year of joining.

“I brought in my management thinking, cut costs, introduced practices such as cost accounting and human resources management,” recalls Godrej, who was awarded the Padma Bhushan (India’s third highest civilian honour) in 2012. “Gradually, I hired a lot of management graduates and restructured the organisation to make it more efficient and marketing-oriented. Everyone was given a clear goalpost and the work culture was made more performance-linked.”

The business then started generating a healthy quantum of cash, which was used to fuel further expansion to the extent possible in a closed economy.

*******

The subsequent opening up of the Indian economy in 1991 was seen as a threat by several Indian companies due to increased competition from multinational companies (MNCs). But Godrej held a different view.

The new economic scenario allowed the conglomerate to attract foreign partnerships such as the ones with Procter & Gamble [P&G (for soaps)], set up in 1993, and with GE Appliances (for consumer durables like washing machines and refrigerators), set up in 1994. Not all of these partnerships lasted long—like many of the joint ventures between Indian and foreign companies that sprang up post liberalisation—but the Godrej Group made sure that it imbibed the best practices that these companies brought to the table for posterity.

Harsh Goenka, chairman of RPG Enterprises, describes Godrej, whom he has known for over three decades, as a “solid businessman who has very clear focus and clarity of purpose”. Goenka tells Forbes India that Godrej was very clear in his expectations from the joint ventures that the Godrej Group entered into.

“If it [the Godrej Group’s expectations] was marketing knowledge and treatment of brands in the case of P&G, it was the model of excellence and know-how of processes when it came to GE,” Goenka says. “Adi was always clear what the end-objectives of these partnerships were, and that when they had been achieved, it was time to move on.”

Goenka says that many times when he has found himself in a crisis or struggling for answers, especially when it came to business matters concerning joint ventures, he has turned to Godrej for “sane and practical advice”.

Godrej’s younger brother Nadir Godrej, 66, also admits that his willingness to take risks is something that he has learnt from his sibling. “But while he is willing to take risks, he also believes in cutting losses rapidly,” says Nadir, who is the managing director of Godrej Industries (the holding firm for businesses like consumer products, real estate and chemicals) and chairman of Godrej Agrovet (the group’s agri business).

One of the partnerships that lasted long and reaped rich dividends for the House of Godrej was its joint venture with US-based consumer products company Sara Lee.

Godrej Sara Lee, as the joint venture was called, sold products such as insecticides under brands like Good knight and Hit, and the Kiwi brand of shoe polish. That partnership lasted for 15 years, till 2010, when Sara Lee announced its intention of exiting the venture since it wanted to focus on its core food and beverages business.

*******

The story behind Sara Lee’s original investment in Godrej’s consumer products business sheds light on another key element of Adi Godrej’s style of leadership—quick decision making and foresight.

It was in 1994 that an insecticide manufacturing company, Transelektra Domestic Products, which sold mosquito repellents under the Good Knight brand and other insect repellents under the Hit brand, was up for sale.

Hindustan Lever (now known as Hindustan Unilever), was keen to acquire Transelektra but was struggling to secure permission from the global parent company to go ahead with the transaction.

It was at this stage that Godrej sensed an opportunity. He conducted a swift due diligence of the company and the sector in which it operated, and quickly closed the deal to acquire it for around ₹80 crore. To mitigate the group’s exposure to a new business, Godrej got Sara Lee on board soon thereafter and sold half of the newly acquired company to the US firm at the price that Godrej had paid for the whole of Transelektra.

“So we got a 50 percent stake in the company [Transelektra] effectively free of cost, and this acquisition set the consumer products company on a growth path,” says Nadir Godrej.

An inflection point in the group’s fortunes came in 2000 when it decided to split the erstwhile Godrej Soaps into two entities—its consumer products flagship company, Godrej Consumer Products Ltd (GCPL), and Godrej Industries. The restructuring came into effect in 2001.

Thereafter, GCPL has been on an acquisition spree. Its first international acquisition was UK’s Keyline Brands in 2005. Since 2010, it has bought as many as 11 companies across countries including India, Indonesia, Argentina, Chile, Kenya, Nigeria and South Africa. According to GCPL’s latest investor presentation, over half of its revenues come from outside India.

GCPL is a market leader in many countries around the world, including India, in categories like hair care and household insecticides. In establishing this position of market dominance, especially in the hair colour space, it has taken on the might of well-entrenched global players like L’Oreal. The French company is the leading seller of hair colour around the world (excluding Germany and Japan), except in India and 25 other countries, where GCPL is the leader, Godrej proudly states.

Opening up the economy helped the Godrej Group globalise, says Godrej. “Around 35 percent of our group income comes from international operations. And that was a very conscious call we took,” he points out.

While GCPL continued to grow from strength to strength, the conglomerate also made a strategic decision to diversify into adjacent areas like vegetable oil, palm oil plantations, chemicals and animal feed (that have a linkage with its soaps business). The group’s real estate business was also a logical extension of its vast land holding in Mumbai. They are developing around 34 acres of its land holding in Vikhroli (where it earlier had an office campus and a factory) for residential and commercial purposes.

*******

What is remarkable is that despite being in business for over a century and across various businesses, both Godrej and the group he helms have been drama-free.

In fact, points out Goenka, it is particularly significant that the Godrej Group has never been bogged down by a single controversy despite owning one of the largest land parcels in Mumbai.

It isn’t hard to understand why. Apart from the redevelopment of its existing industrial, commercial and residential township, another 1,750 acres of land that the group owns in Vikhroli has been preserved as a mangrove by the Godrej family for around seven decades.

This, at a time when ecologically sensitive coastal zones in other parts of Mumbai have been rapidly vanishing to make way for expensive real estate.

“In India, it was generally felt that ethics aren’t important and being corrupt pays,” says Godrej. “We don’t believe in that. We also intentionally stayed out of areas where involvement with the government was very high, like infrastructure, and where capital requirements were high.”

Even in some industries where there is a relatively high level of government intervention and where the group has a presence, it has devised ways of sticking to its philosophy.

For instance, in real estate, the strategy is to develop projects through joint ventures where the partner is responsible for obtaining regulatory clearances, while Godrej Properties lends its brand name and management expertise.

In aerospace and defence, the group is not a final assembler of defence equipment, but a supplier to other defence and aerospace companies.

“Adi is a tall industry leader with high integrity,” says Goenka. “The sobriquet of an elder statesman fits him well.”

*******

Also noteworthy is his ability to manage the expectations of a diverse set of stakeholders whose fortunes are linked to that of the business his family has pioneered. This includes family members, shareholders and employees.

With him as the patriarch, members of the Godrej family have well-defined roles of ownership and management. The family is clear that only those members who are qualified to run the business will be allowed to do so.

The Godrej Group has never been bogged down by a single controversy despite owning large land parcels in Mumbai

There is also the family council where all those who are shareholders and above 18 years of age are invited for periodic discussions. “We put forth to them the developments at the group and take their views on matters. This is a good way of discussing and arriving at common objectives. If there are differences of opinion, we discuss them in these meetings,” Godrej says.

Even then, family members who are a part of the business are strategically placed in positions that require collaboration across diverse arms of the group, and where the family’s interest needs to represented at the board level. Most large group companies have a managing director from outside the family to oversee day-to-day management.

Godrej’s younger daughter Nisa is the executive chairperson of GCPL, while elder daughter Tanya Dubash is executive director of Godrej Industries and chief brand officer of the group; son Pirojsha is the chairman of Godrej Properties. Godrej’s cousin Jamshyd Godrej is the chairman of the board of Godrej & Boyce (which is into the manufacturing of consumer durables, furniture and locks, and industrial equipment). It was only earlier this year that Godrej handed over the chairmanship of GCPL and Godrej Properties to Nisa and Pirojsha respectively.

On the other hand there are managing directors like Vivek Gambhir (GCPL), Balram Yadav (Godrej Agrovet) and Mohit Malhotra (Godrej Properties) who have been empowered by the family to steer their respective companies.

Gambhir, who joined Godrej Industries in 2009, took over as the MD and CEO of GCPL in 2013. In the work environment within the group, he has never felt any distinction between Godrej family and non-family professionals, Gambhir says. “It is a merit-based, results-oriented culture where the standards of accountability are the same for family members and other professionals,” he says. “If Mr Godrej disagrees with something, he respectfully differs in the same way with a family member, as he would with a non-family professional.”

Apart from this culture of democracy, a focus on conducting business in a ‘good and green’ way is also a major attraction that draws employees and business partners towards the Godrej Group.

The conglomerate’s good and green philosophy stands on three pillars: Ensuring employability by training a million young Indians in skills that will enhance their earning potential; protecting the environment; and generating a third of sales revenue from good and green products (like green-rated buildings) by 2020.

“He [Adi Godrej] is the creator and the mentor of the Godrej Group as it stands today,” says Dubash, of her father. “His evolved leadership style with his love for the group, unflinching values, fairness and humility at all times, constant desire to learn and to plan for an even better future for the group is what has brought us to where we are today.”

*******

Godrej may have handed over executive responsibilities to his children, but is in no way leading a sedentary lifestyle. He reaches office early morning every day, bearing a long commute from his residence in South Mumbai’s Walkeshwar area, and stays till evening.

“I am not as involved in day-to-day management as I earlier was. But I am still the chairman of Godrej Industries and am still working on some projects, including the recent listing of Godrej Agrovet,” says Godrej. “I also like to keep myself informed of what is going on in the economy and certain statistics.”

Also, adds Goenka, “At many [educational and knowledge-building] seminars and programmes, I used to find Adi was the only businessman apart from me. He used to always say: ‘You can never finish learning’.”

And work isn’t the only thing that keeps Godrej going. When he met up with Forbes India in October, before Diwali, the water sports enthusiast, who still loves to jet ski and sail, was excited at the prospect of an impending family vacation to New Zealand. “I have been to 93 countries, but I have never been to New Zealand,” Godrej says, with a smile. In December, the family has a trip planned from Cape Town to Antarctica. “That’s the only continent that I have never been on.”

Gambhir recalls an incident many years ago when Godrej and he were walking around the campus, headed from the factory to the office.

Godrej realised that he had forgotten his identity card when a guard, who was new on duty and didn’t recognise the boss, stopped them. “Instead of losing his cool or trying to throw his weight around, Godrej pleaded with the guard to let them pass,” Gambhir says. “He was just happy that the man was doing his job.”

Also, bad temper would have been uncharacteristic. After all, as Bachchan puts it, “Adi is a gentleman to the core… his etiquette never at fault.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)