Can mamaearth live up to its hype and create value for retail investors?

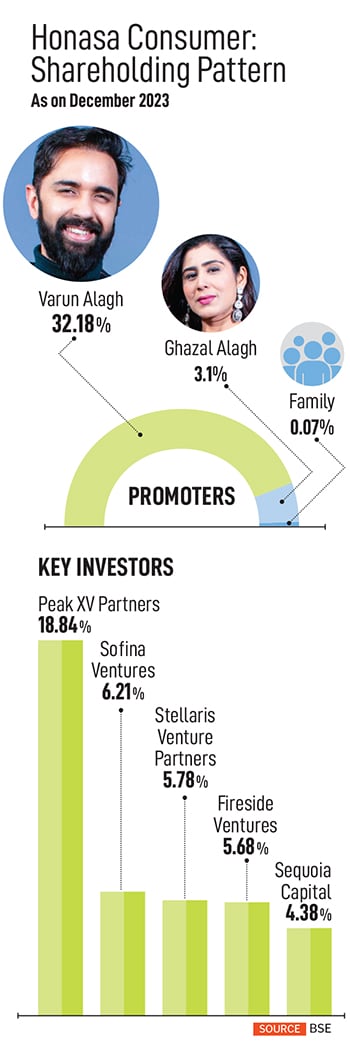

With buzzy digital marketing strategies backed by multiple rounds of fund infusion from venture capital investors such as Fireside Ventures, Sofina and Sequoia Capital, to name a few, the beauty and personal care firm, co-founded by husband-wife duo, Varun and Ghazal Alagh has generated multi-bagger returns for its early VC investors

Ghazal Alagh, Chief innovation officer & co-founder, Honasa Consumer and Varun Alagh(right), CEO & co-founder, Honasa Consumer

Image: Amit Verma

Ghazal Alagh, Chief innovation officer & co-founder, Honasa Consumer and Varun Alagh(right), CEO & co-founder, Honasa Consumer

Image: Amit Verma

Nearly eight years ago, Ghazal Alagh, a mother in her late-20s, burst onto social media with a woeful story of not being able to find safe skin care products for her toddler, and how the harrowing experience moved her husband and her to start a company to make toxin-free baby products.

The sales pitch struck a chord with some consumers. Besides, this was a time when awareness about “nasties”—such as parabens and sulphates—in creams and shampoos had caught on and the idea of a “made safe” brand caught attention across online platforms.

So much so that a year later, on the back of tactful influencer tie-ups and community-driven promotions, the brand went on to expand its portfolio to offer personal care products for mothers too, and then over the next five to six years, it changed course, and diversified into the thriving market of colour cosmetics and beauty products for millennials and Gen-Z.

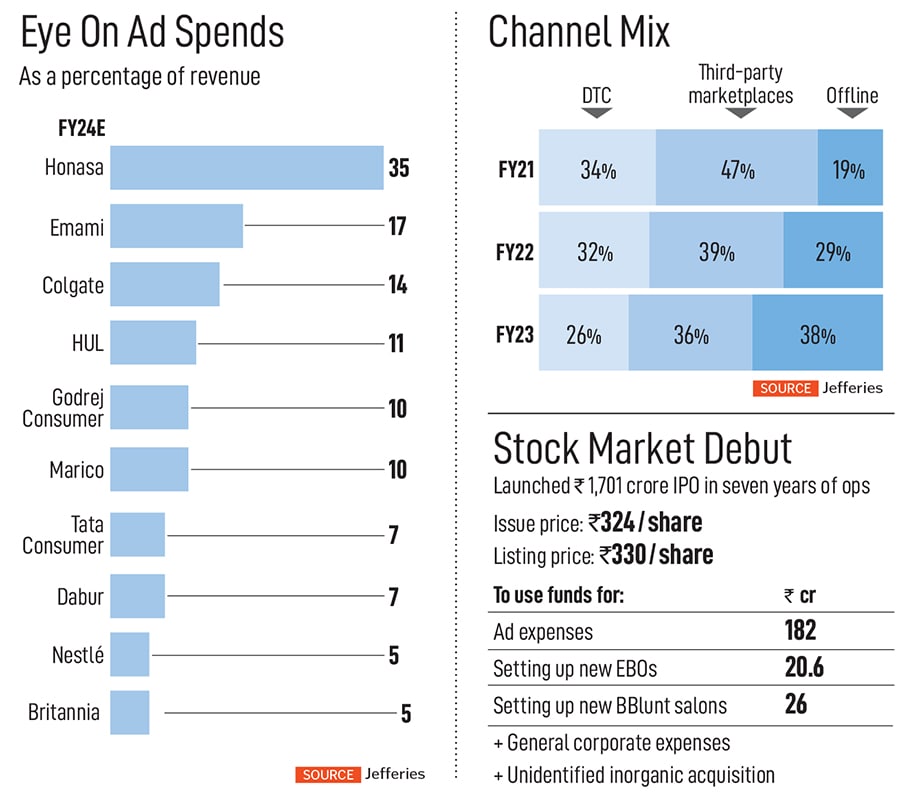

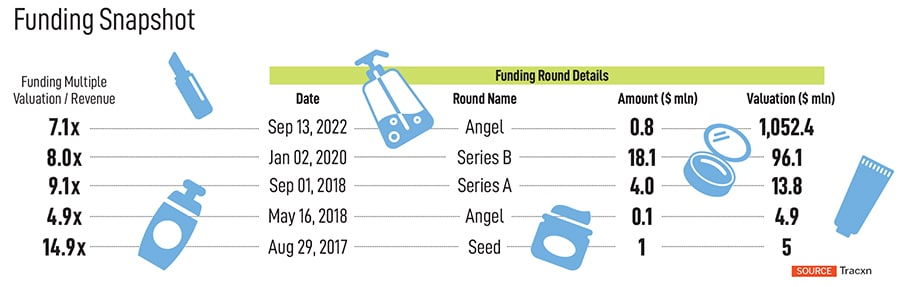

This is the story of Mamaearth, the flagship brand of Honasa Consumers. With buzzy digital marketing strategies backed by multiple rounds of fund infusion (see table) from venture capital (VC) investors such as Fireside Ventures, Sofina and Sequoia capital, to name a few, the beauty and personal care firm, co-founded by husband-wife duo, Varun Alagh, chairman and CEO, and Ghazal Alagh, chief innovation officer, set off on a high-speed growth path.

Though not a biochemist or pharmacist by training, Ghazal assures she can whip up cleansers and lotions in her kitchen as she claims to lead the firm to undertake safe innovations. As part of its growth plan, Honasa Consumer now houses five other brands: The Derma Co, Aqualogica, Ayuga, BBlunt and Dr Sheth, of which the last two were acquired in 2022, before the funding winter gripped the startup ecosystem.

Though not a biochemist or pharmacist by training, Ghazal assures she can whip up cleansers and lotions in her kitchen as she claims to lead the firm to undertake safe innovations. As part of its growth plan, Honasa Consumer now houses five other brands: The Derma Co, Aqualogica, Ayuga, BBlunt and Dr Sheth, of which the last two were acquired in 2022, before the funding winter gripped the startup ecosystem.

Although markets weren’t convinced, Honasa Consumer’s listing unlocked high returns for its angel and VC investors who sold shares in the OFS portion. For example, actor Shilpa Shetty Kundra earned over ₹39 crore on her investment of ₹5.83 crore in 2018. But this pales in contrast to returns earned by, for instance, actor Alia Bhatt, whose investment of ₹4.95 crore in Nykaa in July 2020 yielded a return of close to ₹54 crore when the company listed on the bourses in October 2021.

Although markets weren’t convinced, Honasa Consumer’s listing unlocked high returns for its angel and VC investors who sold shares in the OFS portion. For example, actor Shilpa Shetty Kundra earned over ₹39 crore on her investment of ₹5.83 crore in 2018. But this pales in contrast to returns earned by, for instance, actor Alia Bhatt, whose investment of ₹4.95 crore in Nykaa in July 2020 yielded a return of close to ₹54 crore when the company listed on the bourses in October 2021.  Runa Gupta, a marketing professional who worked in community marketing last year, says, “Mamaearth teamed up with mothers on Facebook communities who acted as advocates and created a strong WOM (word of mouth), visible in the brand SOV (share of voice) within the communities, which was supported by product trials and multiple other engagement approaches forming a well-connected network of nano influencers within these communities.”

Runa Gupta, a marketing professional who worked in community marketing last year, says, “Mamaearth teamed up with mothers on Facebook communities who acted as advocates and created a strong WOM (word of mouth), visible in the brand SOV (share of voice) within the communities, which was supported by product trials and multiple other engagement approaches forming a well-connected network of nano influencers within these communities.” To deliver industry-beating growth, the founders focus on leveraging data-capturing tools to discover consumer trends on the internet by tapping into, for example, key search words, to discover ‘trending’ ingredients. These insights, Varun says, drives the innovation process by helping the team to decide if, for instance, a shampoo should be called a lime or a lemon shampoo?

To deliver industry-beating growth, the founders focus on leveraging data-capturing tools to discover consumer trends on the internet by tapping into, for example, key search words, to discover ‘trending’ ingredients. These insights, Varun says, drives the innovation process by helping the team to decide if, for instance, a shampoo should be called a lime or a lemon shampoo?

Importantly, one of the most credible R&D scientists and an industry veteran, with decades of experience across leading FMCG companies, in an off-the-record chat, explains that the average production time for beauty and personal care products for traditional companies is at least eight to 10 months.

Importantly, one of the most credible R&D scientists and an industry veteran, with decades of experience across leading FMCG companies, in an off-the-record chat, explains that the average production time for beauty and personal care products for traditional companies is at least eight to 10 months.