We didn't build Naturals to sell it. IPO also not on our minds: Siddhant Kamath

When Raghunandan Kamath started Naturals in 1984, his heart didn't melt for an FMCG or QSR ice cream company. He wanted to build a differentiated, premium, artisanal, parlour brand. Forty years later, Naturals is the biggest brand in Mumbai and Maharashtra. Now the next-gen is taking it forward

Siddhant Kamath, Director, Natural Ice Cream

Image: Neha Mithbawkar for Forbes India

Siddhant Kamath, Director, Natural Ice Cream

Image: Neha Mithbawkar for Forbes India

2013, Mumbai. In 2013, the ‘hero’ was not churning out blockbusters. “When my father started Naturals in 1984 in Juhu, Mumbai, ice cream was not the hero. It was a supporting actor,” recalls Siddhant Kamath, the second-generation entrepreneur who joined the family business in 2013. Raghunandan Kamath, the founder of the artisanal and premium chain of ice cream parlour brand, brought ice creams into the limelight.

His son explains why the supporting act was not enough. “Forget premium and artisanal brands, there were no ice cream parlours in 1984,” he says, adding that ice creams got their due share only at restaurants, hotels, marriages, and obscure small shops. Siddhant’s father went against conventional wisdom, created a niche with high-quality products, and expanded across Maharashtra. Over the next three decades, ice cream was the undisputed hero. By 2013, Naturals had a turnover of around ₹65 crore, opened 105 outlets—except for the first store in Juhu, the rest were franchised—and the home state had a chunk of the outlets.

When Siddhant joined in 2013, the ‘hero’ was losing its charm. The primary reason for a lacklustre show was inconsistency in quality of service. With 99 percent of the outlets franchised, there was a vision mismatch between the owner and the franchisees. “They exhibited a typical dealer mindset and were not service-oriented,” says Siddhant. To stem the tide, the Kamaths decided to stop roping in new franchisees. “It was a bold step. Imagine, we had grown via franchisees, and suddenly in 2014, we pulled the plug,” he recalls. The founding family had to make a tough choice between growth and stability. “We opted for stability,” he says. For the first time, in 2014, the Kamaths rolled out a second company-owned store.

The idea was simple. Naturals needed to pause, streamline and consolidate. The only way to bring high-quality growth back on track, says Siddhant, was to undertake massive training of the existing franchisees, lay down structured SOPs (standard operating procedures), roll out more company-owned stores in metros that can set the quality benchmark and act as model outlets for franchisees, and set up procurement and processing mechanisms, which were not organised. “We use rare and indigenous fruits such as chikoo (sapota) and jackfruit, and you didn’t have an ecosystem to procure them,” he says, underlining the challenges faced by the brand from 2014 to 2017. “We sacrificed growth and focused on strengthening foundations which could support the brand in the future,” he says.

The idea was simple. Naturals needed to pause, streamline and consolidate. The only way to bring high-quality growth back on track, says Siddhant, was to undertake massive training of the existing franchisees, lay down structured SOPs (standard operating procedures), roll out more company-owned stores in metros that can set the quality benchmark and act as model outlets for franchisees, and set up procurement and processing mechanisms, which were not organised. “We use rare and indigenous fruits such as chikoo (sapota) and jackfruit, and you didn’t have an ecosystem to procure them,” he says, underlining the challenges faced by the brand from 2014 to 2017. “We sacrificed growth and focused on strengthening foundations which could support the brand in the future,” he says.

(This story appears in the 09 August, 2024 issue of Forbes India. To visit our Archives, click here.)

But even as the ‘5 percent versus 18 percent’ chaos was taking a toll, the pandemic wreaked havoc during the first half of 2020. While other ice cream players managed to run operations, Naturals was the odd one out. Reason? The biggest strength of the brand—a small shelf life of 15 days—became its biggest curse. The logistics nightmare during Covid, truncated shelf life, and the fact that their ice creams were sold only via parlours forced Naturals to shut operations for over three months. “The pandemic tested the resilience of the brand,” says Siddhant.

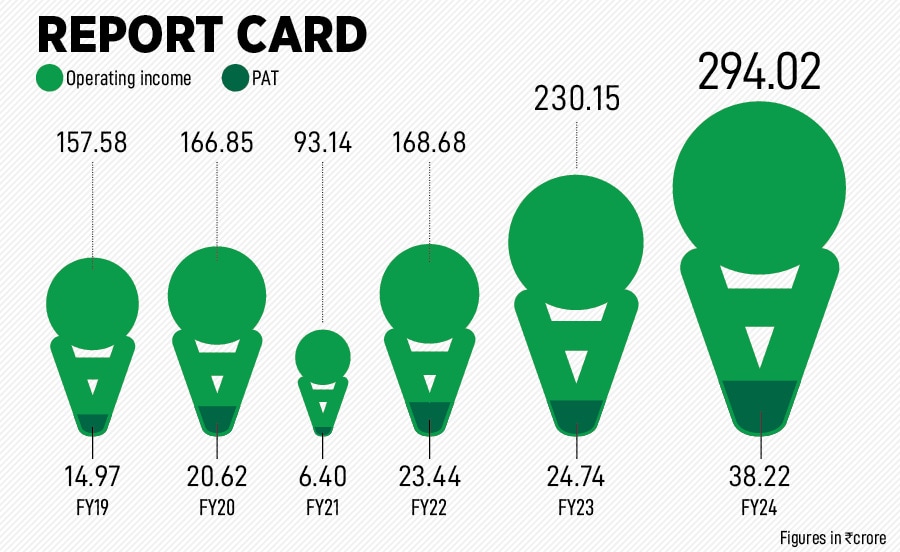

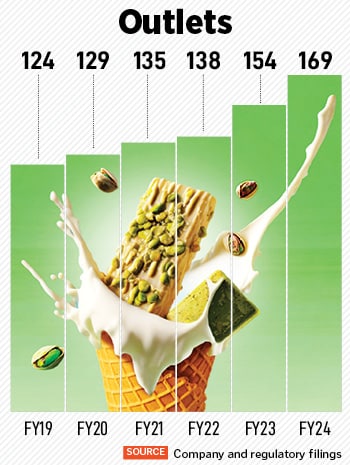

But even as the ‘5 percent versus 18 percent’ chaos was taking a toll, the pandemic wreaked havoc during the first half of 2020. While other ice cream players managed to run operations, Naturals was the odd one out. Reason? The biggest strength of the brand—a small shelf life of 15 days—became its biggest curse. The logistics nightmare during Covid, truncated shelf life, and the fact that their ice creams were sold only via parlours forced Naturals to shut operations for over three months. “The pandemic tested the resilience of the brand,” says Siddhant.  Cut to July 2024. Naturals has posted a strong rebound. The outlet count has increased from 129 in FY20 to 169 in FY24. In terms of production, the brand has enhanced its tally from 4,771 metric tonnes per annum in FY20 to 6,647 metric tonnes in FY24. Revenue too has leapfrogged: From ₹166.85 crore in FY20, which dipped to ₹93.14 crore in the subsequent fiscal, Naturals closed FY24 at ₹294.02 crore. Siddhant now wants to make Naturals a ₹500-crore brand in three years.

Cut to July 2024. Naturals has posted a strong rebound. The outlet count has increased from 129 in FY20 to 169 in FY24. In terms of production, the brand has enhanced its tally from 4,771 metric tonnes per annum in FY20 to 6,647 metric tonnes in FY24. Revenue too has leapfrogged: From ₹166.85 crore in FY20, which dipped to ₹93.14 crore in the subsequent fiscal, Naturals closed FY24 at ₹294.02 crore. Siddhant now wants to make Naturals a ₹500-crore brand in three years.