Classic cars to art, watches and wines: What drives passion investments of India's rich?

More than a return on investments, it is the joy of ownership and the experience of a time capsule through the ownership of classic cars, art, wines, watches, and more, for India's super rich, especially in the post-pandemic world

Mumbai-based Kapil Kuwelker has bought and restored cars that he admired when he was growing up

Image: Neha Mithbawkar for Forbes India

Mumbai-based Kapil Kuwelker has bought and restored cars that he admired when he was growing up

Image: Neha Mithbawkar for Forbes India

In mid-2020, Kapil Kuwelker, founder and CEO of Cirrius Technologies, decided to buy a classic car. He was always interested in cars, but the pandemic—with its resultant work from home and respite from the two-and-a-half hour commute—gave the Mumbai resident time and space to pursue some of his old interests. “I was always passionate about cars, especially classics, so I decided to use my spare time and some surplus funds to buy and restore a classic Mercedes-Benz.” He took delivery of it in early 2021 and in the year-and-a-half since then, what started as a one-time experiment has turned into a series of classic car acquisitions—all Mercedes, from the 1960s to the early 90s—the purchases driven by a mix of nostalgia and passion.

“It’s a brand I admired as a kid, so there is nostalgia and an emotional connect,” he says. And even though he has no intention of selling them, (“I always say these will go with me to my grave,” he says), the other motivation is, of course, that these cars hold and often appreciate in value. “You can’t compare it to an investment per se, but you can definitely look at it as something where your money will remain safe. Though more than the notional appreciation, it’s the time capsule experience that brings a smile to my face.”

Classic cars have for long been a part of passion investments among the rich and among collectors, but social media awareness, the formation of car clubs and communities, and increasing opportunities to get the cars out regularly are driving further interest in them. According to an attitude survey conducted by Knight Frank’s The Wealth Report 2022, 11 percent of the investable wealth of Indian ultra-high net worth individuals (UHNWIs, whose net worth is $30 million or more) is allocated towards passion-led investments against the global average of 16 percent, and about 29 percent of Indian UHNWIs spent more on passion investments during 2021. Joy of ownership scored above investment returns, and was marked as the driving factor to collect investments of passion by the Indian ultra-rich.

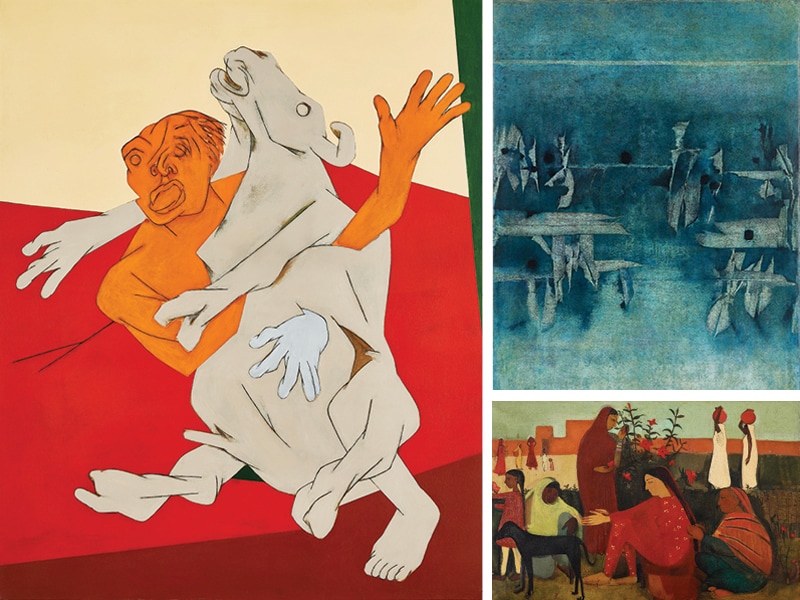

The report adds that art was the most preferred investment by Indian UHNWIs, followed by jewellery and classic cars while luxury handbags and wines slipped from their earlier first positions to 5th and 7th respectively in 2021 (see table).

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)