India's bioeconomy crosses $150-billion mark: Report

Sector is being fuelled by investments, government policies, and collaborations; bioindustry and biopharma are leading the way

Image: Shutterstock

Image: Shutterstock

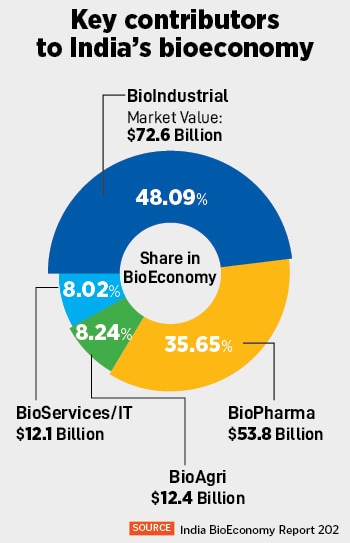

The four key sectors of India’s bioeconomy—biopharma, bioindustrial, bioagri, and bioservices/IT—have shown promising growth. Bioservices/IT has registered a 30 percent year-on-year (y-o-y) growth, while bioindustrial, which includes alcoholic beverages and biofuels, is the biggest contributing sector, with a market value of $72 billion by the end of 2023. Biopharma, with a market value of $53 billion, is the second-highest contributor to the sector. The total value of bioagri and bioservices/IT reached $12.4 billion and $12.1 billion, respectively, by the end of 2023.

“The success of the biotech innovation ecosystem hinges on the active involvement of diverse stakeholders, including research institutes, universities, companies, investors, and government. These entities should and must collaborate to foster a sustainable environment through networks, regulatory and policy support, and promoting innovation with intellectual property rights protection,” said Ajay Kumar Sood, principal scientific advisor, Government of India, at the launch of the report in New Delhi on September 12.

The two-decade growth

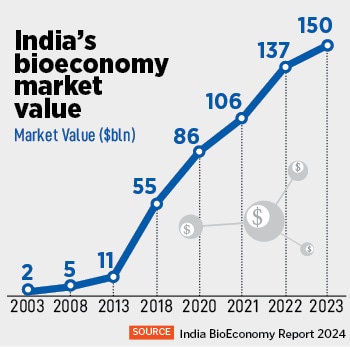

In the past two decades, India’s bioeconomy sector has witnessed exponential growth. In 2003, its market value was modest at $2 billion. Initial growth in the first decade took its market value to $5 billion by 2008 and $11 billion by 2013. From 2013 to 2018, the bioeconomy witnessed an exponential surge in market value and registered a growth of 400 percent, touching $55 billion by the end of 2018. The primary drivers of this growth are the investment in human capital and infrastructure, an innovative ecosystem built by collaborations between institutions and industry, government incentives and other policies, and better product commercialisation. This growth momentum continued in 2020, 2021 and 2022, with the market value touching $86 billion, $106 billion and $137 billion respectively.Also read: To improve quality standards, we need to build a robust culture: Sun Pharma's Dilip ShanghviSpeaking on future growth, Rajesh S Gokhale, secretary to the Government of India, Department of Biotechnology, said, “Indian government has introduced the BioE3 Policy [Biotechnology for Economy, Environment, and Employment], a strategic framework designed to propel India into the next era of industrialisation through high-performance biomanufacturing. This framework is designed to empower Indian institutions, startups, and industries to engage in transformative innovations that address the intertwined challenges of climate change, resource efficiency, and economic development.”

From 2013 to 2018, the bioeconomy witnessed an exponential surge in market value and registered a growth of 400 percent, touching $55 billion by the end of 2018. The primary drivers of this growth are the investment in human capital and infrastructure, an innovative ecosystem built by collaborations between institutions and industry, government incentives and other policies, and better product commercialisation. This growth momentum continued in 2020, 2021 and 2022, with the market value touching $86 billion, $106 billion and $137 billion respectively.Also read: To improve quality standards, we need to build a robust culture: Sun Pharma's Dilip ShanghviSpeaking on future growth, Rajesh S Gokhale, secretary to the Government of India, Department of Biotechnology, said, “Indian government has introduced the BioE3 Policy [Biotechnology for Economy, Environment, and Employment], a strategic framework designed to propel India into the next era of industrialisation through high-performance biomanufacturing. This framework is designed to empower Indian institutions, startups, and industries to engage in transformative innovations that address the intertwined challenges of climate change, resource efficiency, and economic development.”Sector-wise breakup

The bioindustry sector, which is valued at $72.6 billion, contributes 48 percent to the bioeconomy. It registered a 23 percent y-o-y growth in 2023. The surge in the demand for biofuels such as ethanol, steady growth in the alcoholic beverage sector, and enzymatic applicants have contributed to its growth. The beverage industry alone accounts for $22 billion of the bioindustry sector. The biofuels segment, led by ethanol blending, is valued at $7.9 billion. Enzyme applicants, primarily used in textile and detergent sectors, reached a market value of $8.2 billion. The biopharma sector, which is the cornerstone of India’s bioeconomy, grew at 8 percent in 2023 and reached a market value of $53.8 billion, from $49.9 billion in 2022. Its contribution to India’s bioeconomy remains at 35 percent. The production and export of generic medicines and vaccines are the two biggest contributors to the biopharma segment. While India’s share in the global supply of generic medicines stood at 20 percent, India’s vaccine industry accounted for 60 percent of global vaccine production. The vaccine segment alone has a market value of $15.5 billion. Also read: Ground Report: From Gujarat's Botad to Maharashtra's Junnar—impact of agri-tech firms on farmers

The biopharma sector, which is the cornerstone of India’s bioeconomy, grew at 8 percent in 2023 and reached a market value of $53.8 billion, from $49.9 billion in 2022. Its contribution to India’s bioeconomy remains at 35 percent. The production and export of generic medicines and vaccines are the two biggest contributors to the biopharma segment. While India’s share in the global supply of generic medicines stood at 20 percent, India’s vaccine industry accounted for 60 percent of global vaccine production. The vaccine segment alone has a market value of $15.5 billion. Also read: Ground Report: From Gujarat's Botad to Maharashtra's Junnar—impact of agri-tech firms on farmersThe bioagri sector registered a growth of $0.9 billion, from $11.5 billion market value in 2022 to $12.4 billion in 2023. The global push for sustainable agricultural practices is increasing the demand for genetically modified crop seeds, biofertilisers, and biopesticides. The biofertiliser market stood at a value of $1.4 billion, which is expected to grow at a compound annual growth rate (CAGR) of 12 percent in the coming five years. Bioservices/IT sector registered at 30 percent y-o-y growth as its market value increased from $9.3 billion in 2022 to $12.1 billion in 2023. Advancements in the fields of bioinformatics, gene editing and artificial intelligence are driving the growth in the segment. While bioeducation contributes about $1 billion to the segment, BPO/software services account for about $7 billion.

The advent of startups

There has been a surge in the number of biotechnology startups in recent years, particularly after the Covid-19 pandemic. While the number stood at 3,397 in 2019, in 2023 it touched 8,531. This growth is driven by the demand for innovation in health care, favourable shifts in policies, and increased investments.Indian biotech startups have developed over 800 health care products in the past years. Funding for biotech startups peaked in 2022, when $938 million was invested over 31 deals. However, the total funding dipped to $199 million through 16 deals in 2023. Maharashtra tops the list of states with biotech startups, with 1,421, followed by Karnataka with 1,054.