These numbers show Mumbai's residential market is still in a coma

Developers in India's most expensive realty market, have resigned themselves to slow sales

Image: Joshua Navalkar

With their steadfast refusal to reduce prices, real estate developers in Mumbai, India’s largest and most expensive market, have resigned themselves to slow sales.

Gone are the days when prices would steadily appreciate every year and projects got sold out soon after their launch. Data by Anarock Property Consultants shows a 32 percent decline in sales in the Mumbai Metropolitan region from 77,300 units in 2014 to 52,600 units in 2017.

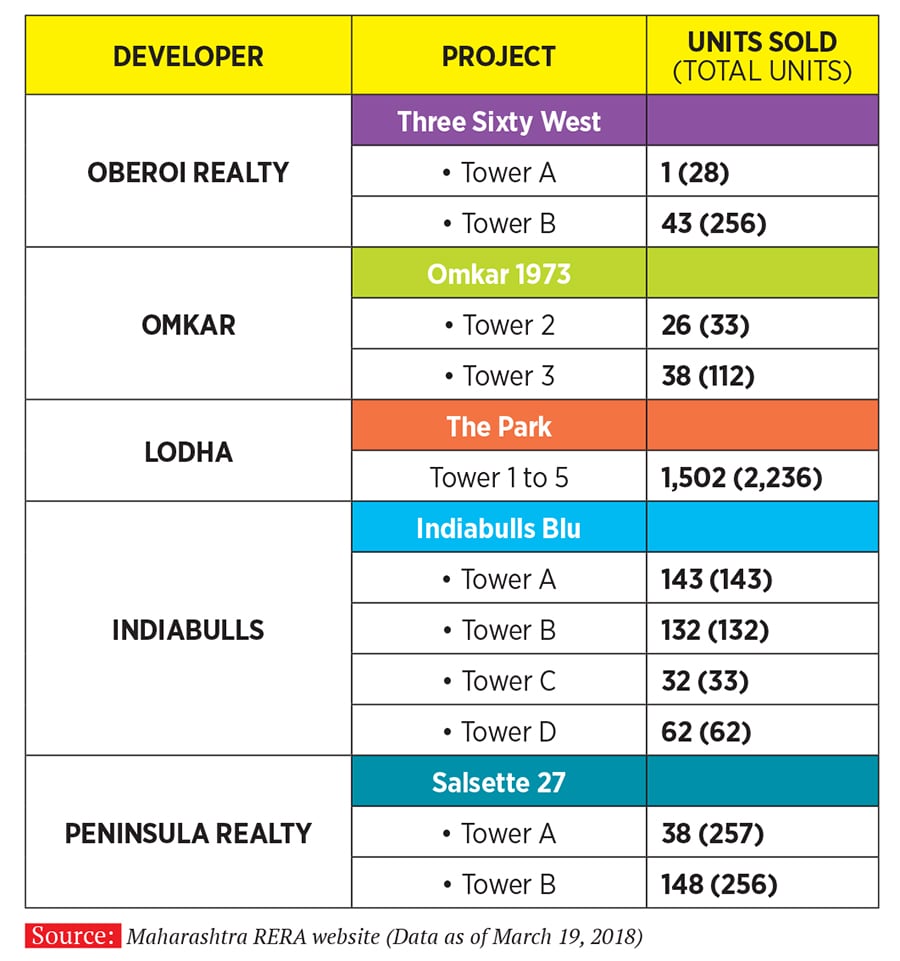

Thanks to the Real Estate (Regulation and Development) Act, buyers are now able to access precise sales data. Forbes India takes a look at five marquee projects in Mumbai to see how many units they’ve sold. While developers may not have launched all units for sale, it still gives a clear picture of how much there is left to sell over, say, the next 3-4 years.

Analysts who declined to be named say they are sceptical about how many units priced between ₹5 crore and ₹15 crore the market can absorb. Almost on cue, developers have begun to cut back on inventory. Omkar 1973, a property in Worli, for insta nce, is moving to convert one of its three towers to an office.

X